- Bitcoin on-chain exercise reached $37.4 billion, the very best in seven months.

- The spike in on-chain transactions coincided with whale actions after months of dormancy.

- The whale accrued $681M in BTC over the previous couple of months at larger values.

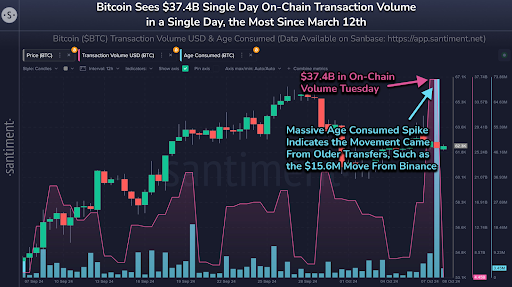

Although Bitcoin is dealing with bearish stress affecting its worth, latest whale actions counsel a promising outlook for the market. On Tuesday, Bitcoin’s community noticed a big surge in on-chain transaction quantity, reaching $37.4 billion—the very best stage in seven months, in line with blockchain analytics platform Santiment.

This spike occurred concurrently actions of dormant Bitcoin by whales. For instance, one whale took 250 BTC, price roughly $15.6 million, off the Binance trade on Tuesday.

This explicit whale had been inactive for six months, and the withdrawal was executed one hour earlier than Lookonchain’s report. The reactivation of those dormant cash has fueled hypothesis about Bitcoin’s near-term market conduct.

In response to Lookonchain, this whale had beforehand accrued a considerable sum—10,158 BTC, price $681 million—between March 14 and April 13 of this 12 months, at a mean worth of $67,026 per BTC. With Bitcoin presently priced at round $62,402, this whale is dealing with an unrealized lack of roughly $46 million on these holdings.

Historical past Suggests Stagnant Bitcoin Reactivation is a Constructive Signal

Market contributors watch whale actions carefully as a result of they will typically present shifts in market dynamics. The reactivation of dormant BTC might imply that enormous holders are preparing for future worth actions. Santiment’s evaluation says that previously, the motion of stagnant Bitcoin again into circulation has been a bullish signal for future worth will increase.

Regardless of the spectacular $37.4 billion in on-chain transactions pushed by whale exercise, Bitcoin’s worth fell from an intraday excessive of $63,174 to $61,843. This bearish efficiency additionally impacted the broader altcoin market, with many altcoins remaining within the crimson. As of the newest replace, Bitcoin’s worth has stabilized across the $62,000 vary, buying and selling at $62,396—a slight acquire of 0.05%.

Disclaimer: The data offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shouldn’t be chargeable for any losses incurred on account of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.