- SpaceX’s Bitcoin liquidation triggered an enormous drop in Bitcoin’s value

- A double high sample suggests extra weak point would possibly come

- The measured transfer hints at additional draw back into the $20k space

Bitcoin value failed on the $30k stage twice this yr. After rallying from $16k, it fashioned a potential double high sample that ought to fear buyers.

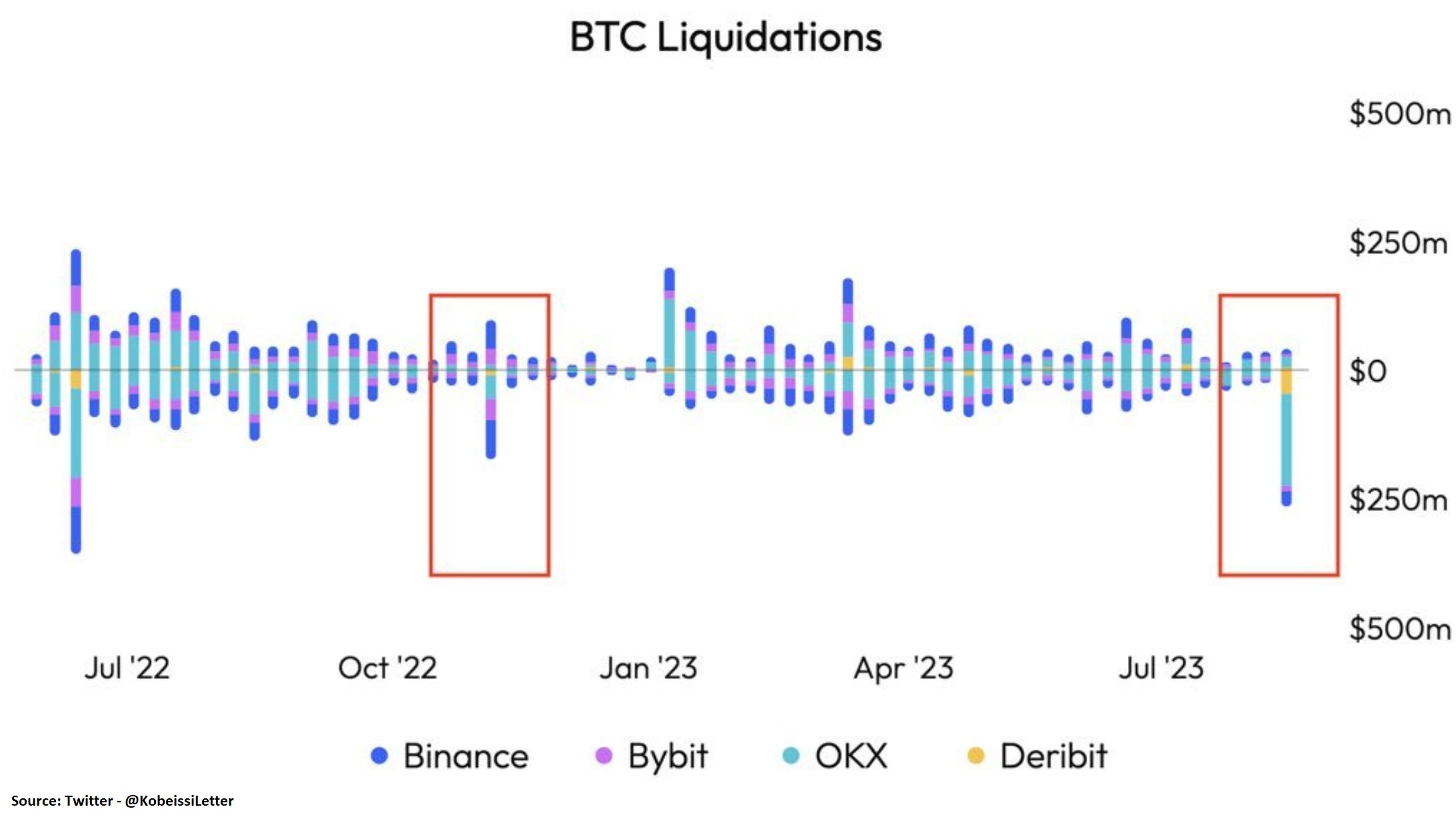

The most recent signal of weak point got here final week. Information that Elon Musk’s SpaceX liquidated its complete Bitcoin stash despatched the value decrease. Extra exactly, SpaceX offered Bitcoin price $373 million.

It was one of many largest day by day liquidations by quantity in historical past. In simply 20 minutes, Bitcoin value crashed by greater than 7% on outflows larger than through the FTX collapse.

SpaceX offered its Bitcoin holdings after Tesla did the identical final yr. Extra exactly, Tesla offered final yr 75% of its Bitcoin holdings.

So what does it imply for Bitcoin value, and might the market bounce again?

A double high sample may need fashioned at $30k

Because the begin of the yr, Bitcoin value have doubled. The rally was so highly effective that it triggered a wave of enthusiasm amongst cryptocurrency buyers.

However the failure to carry above $ 30k led to the formation of a potential double high sample.

Bitcoin chart by TradingView

A double high is a reversal sample with a measured transfer equal to the gap from the highest to the neckline, projected from the neckline. The chart above reveals the 2 tops fashioned on the $30k space and the neckline on the $25k space.

Subsequently, the measured transfer equals $5k and, if projected from the neckline, means that Bitcoin would possibly see $20k sooner quite than later.

The one approach for bulls to get again in management is for Bitcoin to interrupt above the double high space (i.e., $30k). For now, nonetheless, the bias is bearish, and the main target is on a possible bearish breakout beneath the neckline.