Bitcoin’s (BTC) dip under the $39,000 mark resulted in vital liquidations totaling roughly $115 million throughout the cryptocurrency market in the course of the previous hour.

Purple market

Within the final 24 hours, BTC skilled a 4% decline, buying and selling at $38,915 as of press time, in line with knowledge from StarCrypto. This downturn lowered its market capitalization by round $40 billion, settling at $767 billion.

BitMEX co-founder Arthur Hayes urged that Bitcoin’s present worth pattern might persist till the top of the month, influenced by the US Treasury’s quarterly refunding announcement.

Concurrently, Ethereum (ETH) witnessed a 6% drop, reaching $2,230. The decline in ETH’s worth may be attributed to substantial promoting stress from its Basis and fund actions associated to the distressed crypto entity Celsius.

Celsius transferred round 13,000 ETH (roughly $30.87 million) to Coinbase and a pair of,200 ETH (roughly $5.12 million) to FalconX, whereas the Ethereum Basis bought $1.6 million of the digital asset.

Lengthy merchants shocked

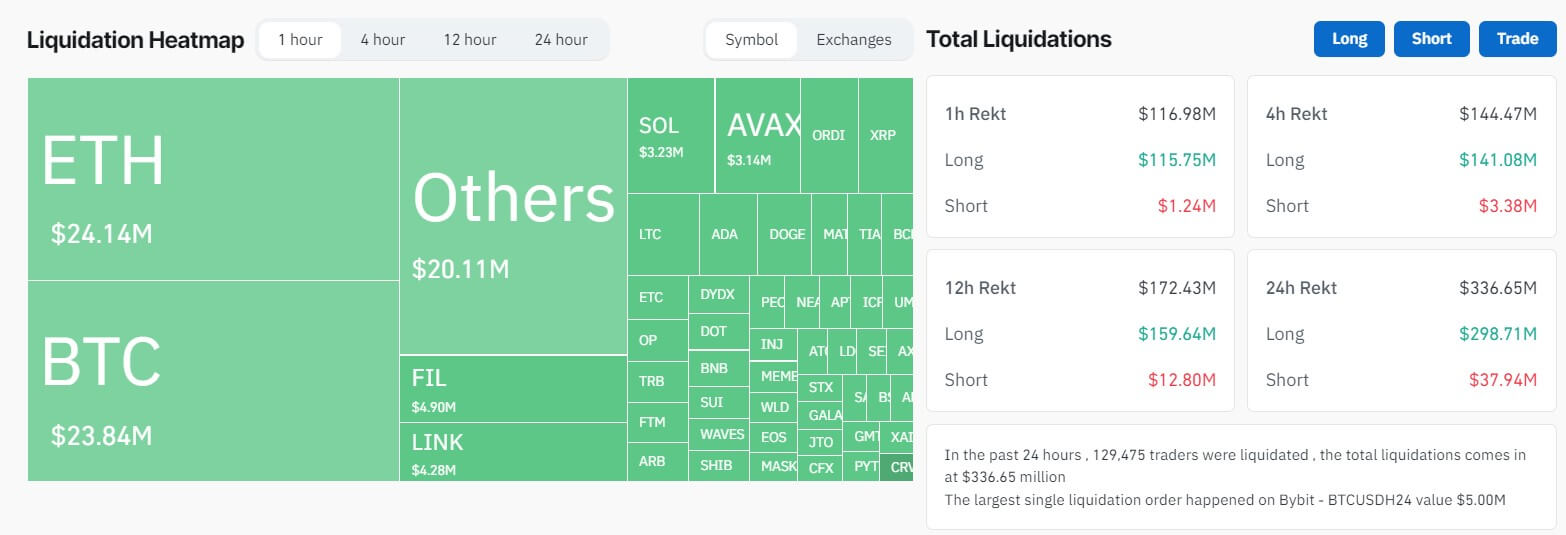

Knowledge from Coinglass reveals substantial losses for merchants anticipating additional market worth will increase. For context, lengthy merchants misplaced $115 million in the course of the previous hour alone.

When the timeframe is prolonged to 24 hours, lengthy merchants’ losses quantity to almost $300 million, whereas these with bearish market positions incurred a extra modest $38 million in losses throughout this reporting interval.

Bitcoin merchants bore the brunt of the downturn, dropping greater than $80 million, with greater than 60% of those losses attributed to lengthy positions. Probably the most vital particular person liquidation was a $5 million wager on BTC’s worth improve on Bybit.

Equally, Ethereum speculators confronted complete liquidations of round $70 million, with nearly all of losses—roughly $60 million—stemming from merchants betting on ETH worth will increase.

Merchants holding positions in different main digital currencies additionally skilled substantial losses, with Solana, XRP, Dogecoin, and Ordinal seeing liquidations of $16 million, $4 million, $5 million, and $6 million, respectively.

Analyzing exchanges, Binance, the biggest cryptocurrency change by buying and selling quantity, noticed merchants collectively lose $98 million, whereas OKX reported liquidations totaling $71 million. Different crypto platforms, together with ByBit and HTX, witnessed a mixed lack of $63.52 million amongst their merchants.