Bitcoin has plummeted to beneath $64,000, its lowest stage since mid-Could, pushed by heightened promoting stress out there.

BTC has largely traded downwards or sideways after exceeding the $70,000 mark in the beginning of the month. Since then, the flagship asset has shed greater than 10% of its acquire throughout this era.

Why is BTC falling?

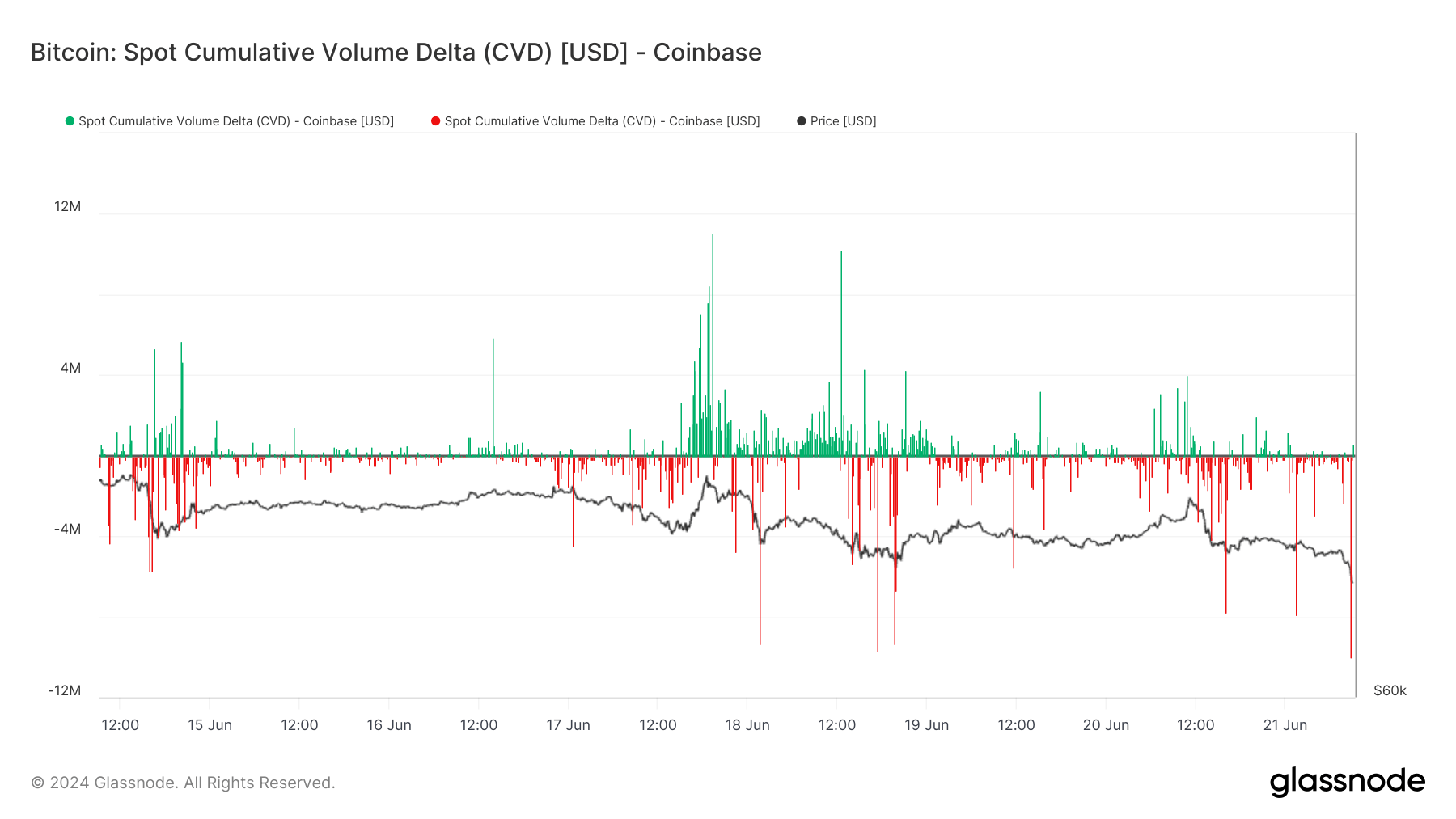

On-chain knowledge reveals that some current promoting stress originated from Coinbase, the biggest US-based crypto alternate. Glassnode knowledge exhibits that the platform skilled $10 million in spot-selling exercise, marking the very best quantity inside a 10-minute window in per week.

Notably, the German authorities can be contributing to the present promoting stress, shifting $600 million in BTC on June 19, with $195 million despatched to 4 alternate addresses, together with Kraken, Bitstamp, and Coinbase.

Market specialists have attributed BTC’s present value weak point to elevated outflows from the US-based spot Bitcoin exchange-traded funds (ETFs). Whereas curiosity in these ETFs surged after their approval in January, resulting in over $53 billion influx, the previous week has seen internet outflows exceeding $900 million.

Moreover, BTC miners have been offloading their holdings because of the monetary stress launched by the current halving occasion. Bitcoin analyst Willy Woo stated BTC’s value would solely get better “when weak miners die and hash price recovers.”

$20 million liquidation in 1 hour

Coinglass knowledge reveals that the market downturn liquidated round $20 million in crypto positions inside the previous hour, totaling $150 million within the final 24 hours.

A more in-depth have a look at the liquidations signifies that lengthy merchants who wager on value will increase confronted essentially the most important losses, dropping $106 million. In distinction, brief merchants, holding a extra bearish outlook, had been liquidated for $44 million.

Bitcoin merchants skilled the very best losses, totaling $42 million—$26 million from lengthy positions and $16 million from brief positions. Ethereum merchants adopted intently, with liquidations reaching roughly $28 million.

Essentially the most important single liquidation occurred on Bybit, involving a BTCUSD transaction valued at $8.09 million.