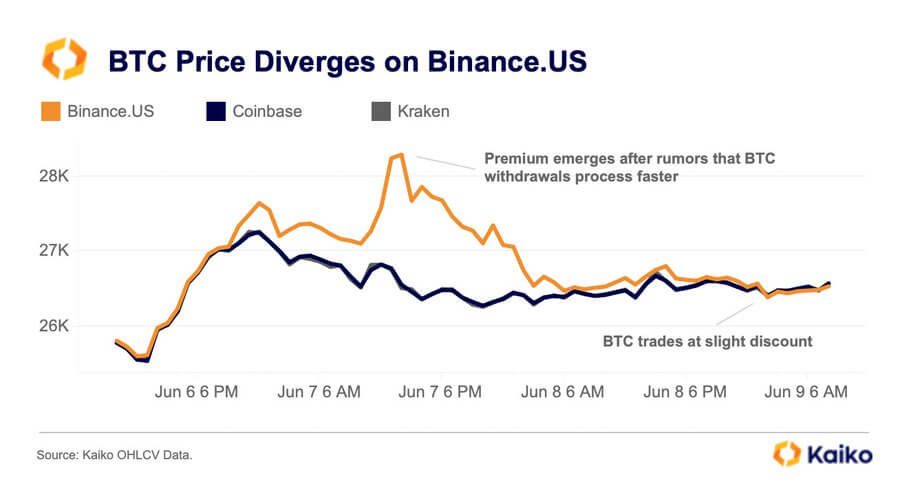

Bitcoin (BTC) is buying and selling at a slight low cost on Binance.US following the trade’s announcement of its banking companions’ choice to halt USD cost channels on June 13, amidst ongoing regulatory troubles, in line with Kaiko knowledge.

Kaiko said that BTC traded at a premium on Binance.US between June 6 and June 8 when rumors surfaced that it was processing sooner BTC withdrawals. Nevertheless, the premium trades quickly gave approach for low cost trades after the trade mentioned it was transitioning to a crypto-only platform as a result of its regulatory woes.

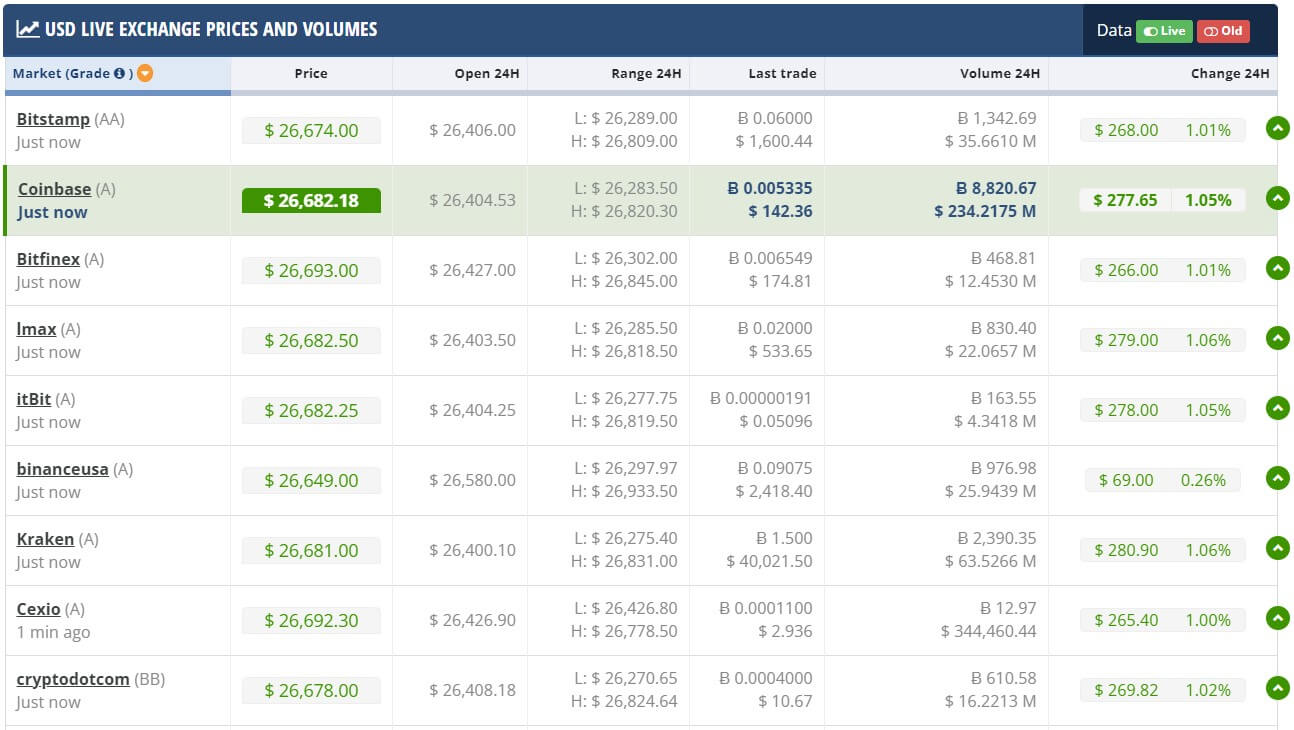

Information from CryptoCompare additional corroborate Kaiko’s report. In line with the information aggregator, the flagship digital asset was buying and selling at $26,649 on Binance US as of press time. That is barely decrease than what it sells on rival platforms like Bitfinex, Bitstamp, Coinbase, and Kraken, the place it’s exchanging palms for over $26,670.

This slight low cost additionally exists on different digital property like Ethereum, Solana, and Cardano, in line with CryptoCompare knowledge.

Binance regulatory struggles

Earlier at this time, Binance US mentioned it will droop USD deposits and recurring purchase orders, urging its shoppers to withdraw their {dollars} utilizing financial institution transfers. Moreover, it should begin delisting USD buying and selling pairs subsequent week.

The choice is coming amid the current regulatory troubles dealing with the agency and its father or mother firm, Binance.

On June 5, the U.S. Securities and Change Fee (SEC) sued Binance, claiming it acted as an unregistered trade, vendor, and dealer. The regulator additional claimed that the trade provided crypto securities tokens like BNB coin (BNB) and the Binance USD (BUSD) stablecoin to People – a cost Binance disputed.

Since then, the regulator has moved to freeze Binance’s U.S. property and summoned Changpeng “CZ” Zhao to look in a D.C. courtroom. Moreover, U.S. lawmakers urged the Division of Justice to analyze statements beforehand made by the trade.

Regardless of these challenges, Binance.US has assured its customers that their funds are protected and that the trade will proceed to function usually.

The put up Bitcoin trades at slight low cost on Binance.US as banking companions lower ties appeared first on StarCrypto.