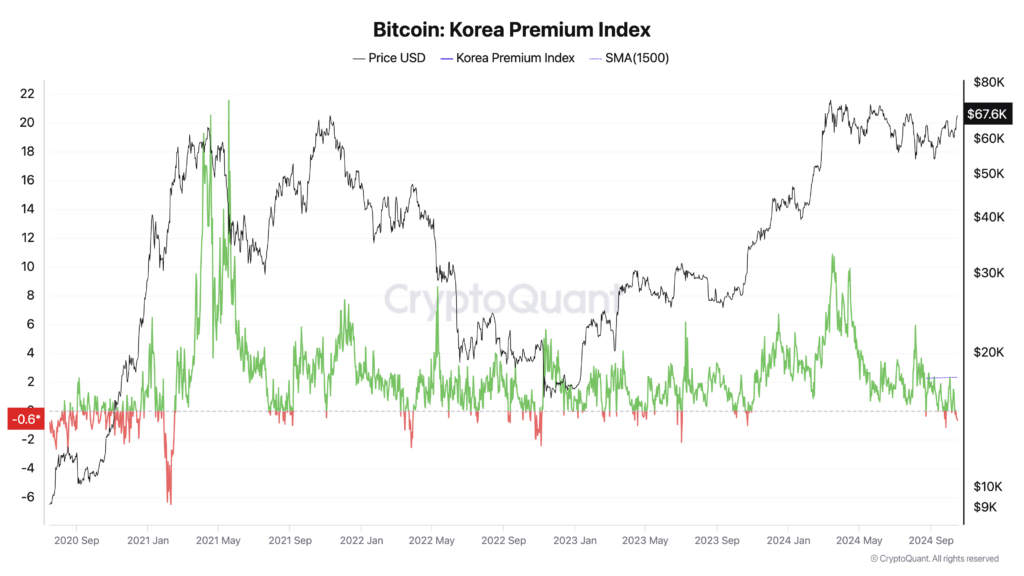

Bitcoin is buying and selling at a reduction on South Korean exchanges, reversing the normal “kimchi premium” that has traditionally signaled bullish market sentiment. Per The Korea Occasions, the cryptocurrency is priced roughly 700,000 received ($511.73) decrease domestically in comparison with international exchanges, leading to a destructive premium (low cost) of -0.74% as of Thursday afternoon.

This shift seems to recommend a bearish outlook amongst South Korean traders. Usually, a better kimchi premium signifies robust native demand and optimistic sentiment, usually resulting in Bitcoin costs exceeding international charges. In distinction, a decrease or destructive premium displays weakened enthusiasm and decreased shopping for strain, probably signaling a market correction or alignment with international valuations.

Analysts attribute this uncommon discrepancy to subdued investor sentiment in South Korea and better demand for digital belongings on overseas platforms. KP Jang, head of Xangle Analysis, advised the Korea Occasions that restrictions stop overseas and institutional traders from accessing home exchanges, amplifying the affect of declining retail investor demand.

A shift in dealer preferences towards altcoins can also be influencing the market. As Bitcoin surged globally, Korean merchants started accumulating undervalued various cryptocurrencies, anticipating a strong fourth-quarter rally, as reported by Enterprise Insider. These altcoins, together with Tao, Sei Community, Aptos, Sui, NEAR Protocol, and The Graph, are perceived as providing larger returns, probably diverting consideration away from Bitcoin.

Declan Kim, a analysis analyst at DeSpread, additionally advised the Korea Occasions that the altcoin market, which includes a good portion of home buying and selling, continues to wrestle amid transitional phases of recent laws. The implementation of the Digital Asset Person Safety Act is affecting market forces. Many altcoins stay unlisted on home exchanges in comparison with overseas ones, and the ban on market-making makes securing liquidity difficult.

The kimchi premium has traditionally been a trademark of South Korea’s crypto market. When Bitcoin surpassed the 100 million received mark domestically in March, the premium briefly spiked to as a lot as 10%. The next premium typically signifies robust native demand and bullish sentiment, usually coinciding with or previous Bitcoin value rallies. Conversely, a decrease or destructive premium suggests bearish sentiment and decreased shopping for strain.

Information signifies a notable decline in Bitcoin-Korean received (BTC/KRW) buying and selling quantity over the previous 40 days, reflecting a shift in investor focus.

Analysts anticipate the reverse kimchi premium to be non permanent. Jang anticipates that the discrepancy will resolve quickly, as such premiums have not often persevered for lengthy intervals. He talked about that ongoing discussions about laws to allow company investments in digital belongings may enhance liquidity on home exchanges and progressively cut back the value hole with overseas markets.

The present buying and selling situations replicate a fancy interaction of home laws, investor behaviors, and international market traits, signaling vital shifts inside South Korea’s crypto panorama. The destructive kimchi premium, although uncommon, could finally result in a extra balanced and mature market because it aligns extra carefully with international digital asset valuations.

The final time the Kimchi Premium fell destructive was in Oct. 2023, simply earlier than Bitcoin’s ETF-fueled bull run.