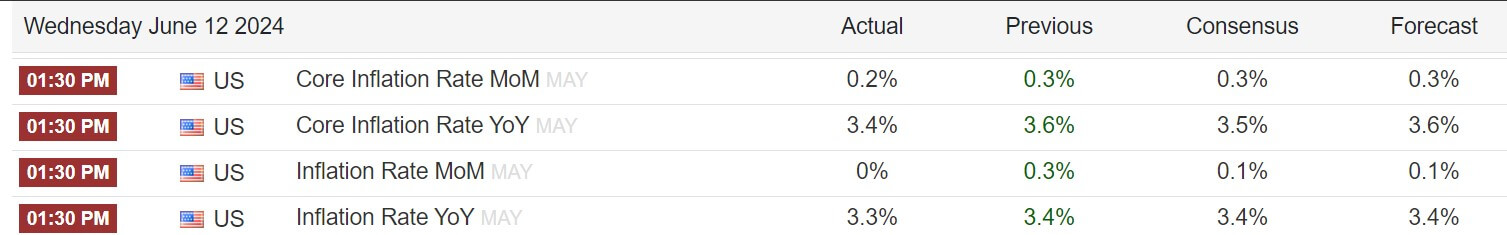

Bitcoin’s value has soared previous $69,000 after the most recent US Client Worth Index (CPI) for Might confirmed a slight decline.

Accessible information reveals that the much-anticipated US CPI inflation information was higher than a number of specialists’ predictions.

Charlie Bilello, the Chief Market Strategist at Inventive Planning, mentioned:

“General, US CPI moved down to three.27% year-on-year in Might from 3.36% in April. US inflation has now been above 3% for 38 straight months. US Core CPI (ex-Meals/Power) moved down to three.41% year-on-year from 3.62% final month. That is the bottom core inflation studying since April 2021.”

Bilello additional identified that the US Inflation fee has drastically decreased from the 9.1% peak of June 2022 to three.3% at present. He added that the decline in these numbers was attributable to the “decrease charges of inflation in used automobiles, fuel utilities, attire, meals at dwelling, gasoline, medical care, gas oil, meals away from dwelling, shelter, and electrical energy.”

Bitcoin rises on optimistic CPI

The higher-than-expected CPI numbers instantly had a constructive impression on Bitcoin’s value, with the BTC rising by greater than 2% on the 1-hour candle to as excessive as $69,377 as of press time.

Mike Alfred, a board member at IREN Power, identified that the motion confirmed that:

“Bitcoin already is aware of that CPI + Fed gained’t be main bearish catalysts. It’s a very smart international macro asset that costs in nearly every thing upfront.”

In the meantime, the market consideration has shifted to the US Federal Reserve, which can reveal its resolution on present rates of interest later at present. Jesse Cohen, a International Markets Analyst at Investing.com, mentioned:

“The Might CPI Inflation report might give the Fed the arrogance to start laying out the carpet for fee hikes within the months forward. It’s going to take a minimal of three or 4 tender inflation prints earlier than I believe they’re prepared to chop charges, however this may be a begin.”