The function of Bitcoin miners goes past block validation — they’re elementary in shaping the market by means of their BTC balances. Traditionally, these balances have been intently tied to Bitcoin’s worth actions, making them a key metric for market evaluation.

Bitcoin’s latest surge previous the $40,000 mark was met with vital motion from miners. Originally of December, Bitcoin was priced at $38,680. By Dec. 8, it climbed to a peak of $44,200 earlier than consolidating at round $41,200 on Dec. 11. Regardless of this consolidation, the practically 8% improve over ten days indicators a bullish market section.

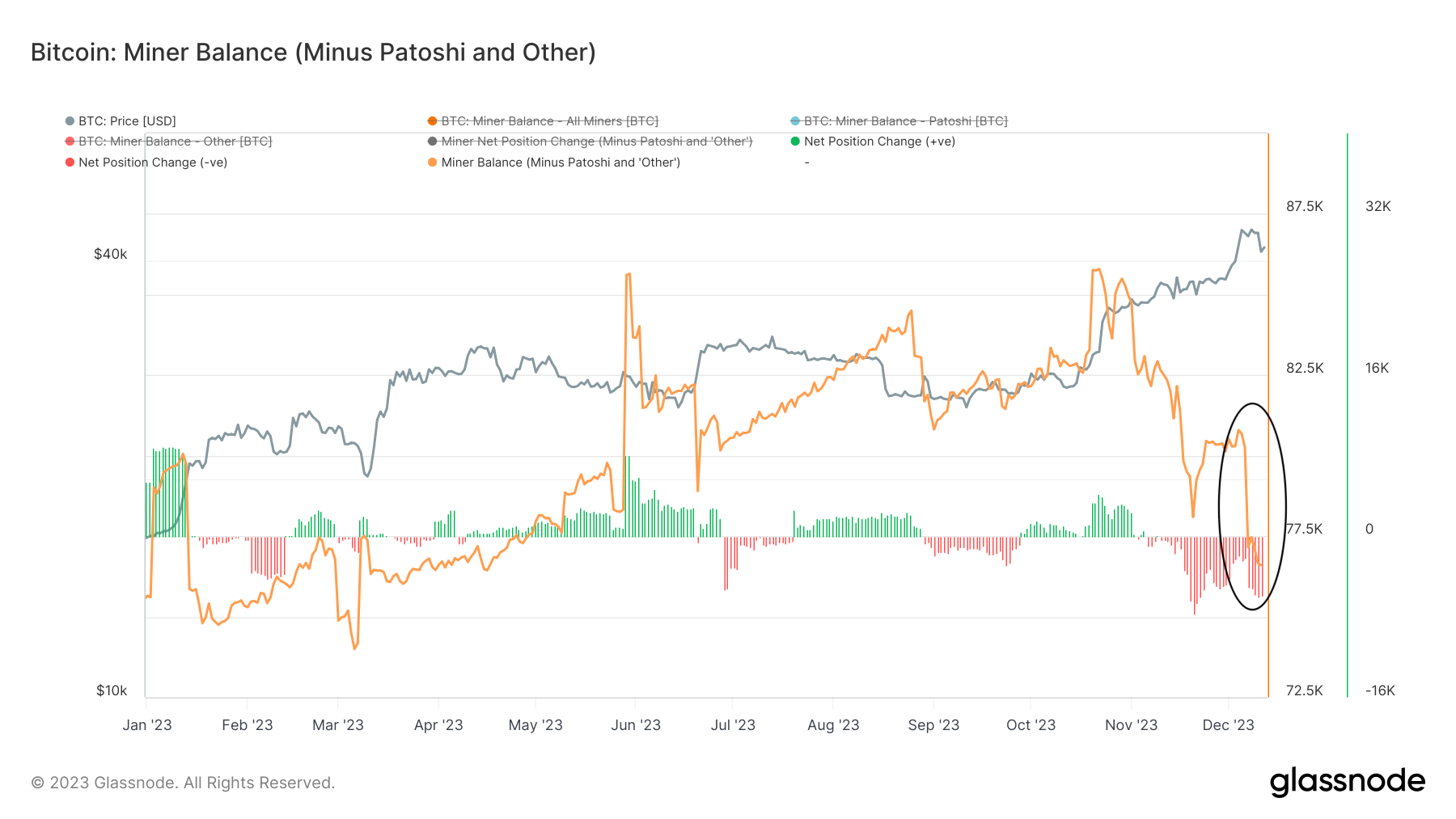

As Bitcoin’s worth rallied, a noticeable decline was noticed in miner balances. From 80,520 BTC on Dec. 1, the stability dropped to 76,602 BTC by Dec. 11, reaching its lowest level since April. This discount of three,918 BTC, or roughly 4.86%, suggests a strategic response from miners, seemingly aiming to capitalize on the rising costs by promoting off their holdings.

Whereas there are numerous the reason why miners may scale back their balances, operational prices are sometimes on the forefront. The newest unfavourable mining issue adjustment could have provided miners an opportune second to safe income amidst escalating costs.

The fluctuation in miner balances mirrors the adaptive nature of the Bitcoin mining sector. Throughout bear markets, miners are likely to accumulate income from block rewards and charges, betting on future worth restoration. Nevertheless, in bull runs, they usually liquidate holdings, aiming to maximise income from their operations.

The present pattern of accelerating Bitcoin costs coupled with reducing miner balances factors to a market section characterised by miner confidence within the worth stability or anticipation of additional development. But, this decline in miner balances additionally raises a flag of warning. A big sell-off by miners might improve market provide, probably exerting downward strain on costs if not balanced by sufficient demand.

As miners react to market circumstances, their habits gives priceless insights into the market’s well being and future trajectory. It’s a reminder of the necessity for steady monitoring of varied on-chain metrics to understand the evolving panorama of Bitcoin’s market absolutely.

With the present market circumstances, miners appear to be cautiously optimistic, presumably signaling a optimistic sentiment within the broader market. Nevertheless, the potential impression of elevated provide as a consequence of miner sell-offs shouldn’t be underestimated.

The submit Bitcoin surge triggers miner sell-off appeared first on StarCrypto.