Crypto funding merchandise have recorded their first inflows since mid-August, as $21 million flowed into these merchandise up to now week.

CoinShares analyst James Butterfill stated the inflows had been a “response to a mix of optimistic value momentum, fears over US authorities debt costs and the current quagmire over authorities funding.”

Nevertheless, he famous that buying and selling “volumes stay seasonally low in each the funding product and broader crypto markets.”

Bitcoin, Solana dominate

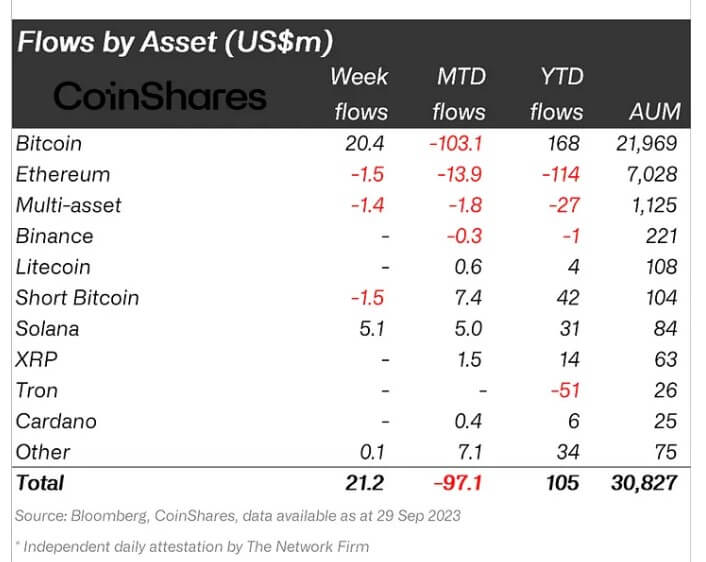

In response to the newest CoinShares weekly report, Bitcoin (BTC) and Solana’s (SOL) funding merchandise contributed considerably to the recorded influx. Per Coinshares, BTC merchandise noticed probably the most inflows with $20 million, whereas SOL “continues to shine” with inflows amounting to $5 million.

Solana merchandise have loved a largely optimistic yr, recording 27 weeks of inflows and simply 4 weeks of outflows. The asset has a optimistic year-to-date circulation of $31 million, greater than that of XRP, Cardano, and others.

In the meantime, Ethereum (ETH) maintained its “least liked altcoin” coin tag by recording outflows totaling $1.5 million the earlier week. This brings Ether product outflows to a seventh consecutive week and a adverse year-to-date circulation of $114 million.

U.S. sentiment stays bearish

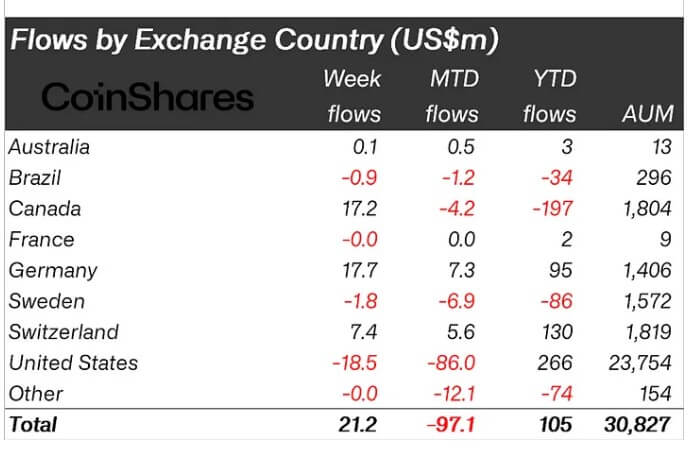

U.S. buyers have proven warning, withdrawing round $19 million from their funding merchandise within the final week. These exits could be attributed to the continued regulatory uncertainty surrounding crypto-related companies throughout the area.

Whereas the U.S. Securities and Change Fee (SEC) has allowed Ethereum futures exchange-traded funds (ETFs) to go dwell right this moment, the monetary regulator has continued to delay selections on spot Bitcoin ETFs.

These unclear regulatory measures have resulted in a adverse month-to-month circulation of $86 million, whereas its year-to-date circulation is a optimistic $266 million.

In the meantime, buyers in Europe and Canada proceed to pump funds into crypto funding merchandise as these areas noticed inflows of $23 million and $17 million, respectively, through the earlier week.

The publish Bitcoin, Solana merchandise lead first crypto funding influx since mid-August appeared first on StarCrypto.