- Buying and selling above $42,000, many BTC holders now commerce at a revenue.

- BTC’s market capitalization has elevated by over 170%, whereas its worth has greater than doubled.

- The crypto market has seen important progress in 2023, with many property at present at multi-month highs.

With many property at present buying and selling at multi-month highs, the yr has marked a restoration from the bearishness that plagued the crypto market in 2022.

In a brand new report assessing the on-chain efficiency of main cash, on-chain information supplier Glassnode discovered that Bitcoin’s [BTC] market capitalization has risen by over 170% since January. As for Ethereum [ETH] and different altcoins, they’ve witnessed over 90% progress of their market capitalizations.

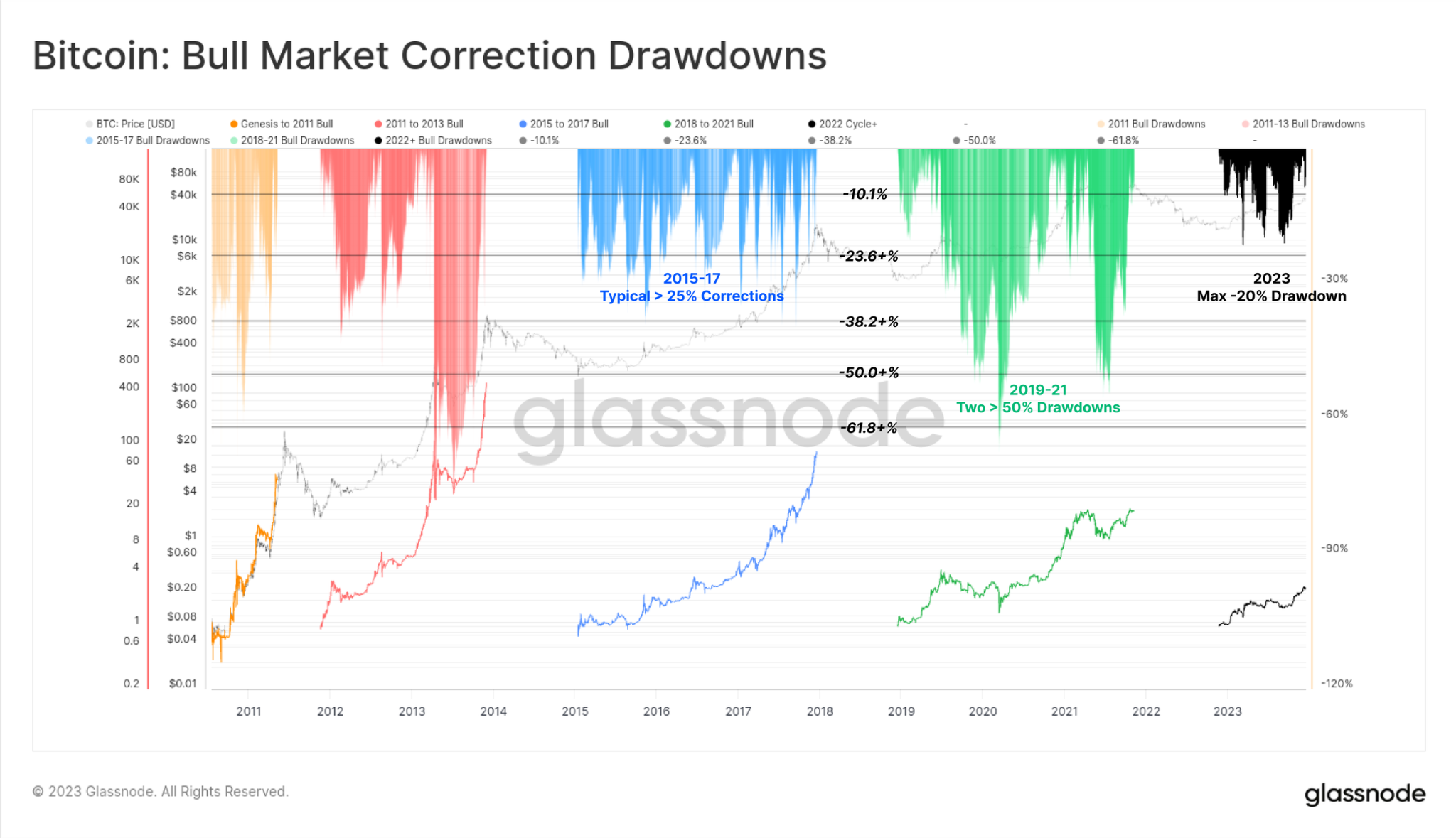

12 months of the Bull for BTC In response to Glassnode, a notable attribute of this buying and selling yr has been the weird shallowness of worth pullbacks and corrections for BTC.

BTC Bull Market Correction Drawdowns (Supply: Glassnode)

In comparison with previous bull markets with frequent 25% and even 50% retracements, this yr’s deepest correction has been a 20% dip within the BTC’s worth.

The analysis agency famous:

The buy-side help and the general provide and demand steadiness has been favorable all yr.

Shallow corrections are good as a result of they point out the presence of a bull cycle the place there are average worth will increase as an alternative of sharp rallies and declines.

Additionally, the yr has seen a gradual restoration of capital that left the BTC market throughout the 2022 bear market. Glassnode discovered that in 2022, BTC skilled important capital outflows, with its Realized Capital plummeting by 18%.

Nonetheless, whereas some capital has flown on this yr, it’s a lot slower than in earlier cycles.

Glassnode said:

Capital inflows have been recovering at a a lot slower charge, nonetheless, with the Bitcoin Realized Cap ATH (all-time excessive) hit over 715 days in the past. This compares to a full restoration of the Realized Cap taking round ~550 days2 in prior cycles,

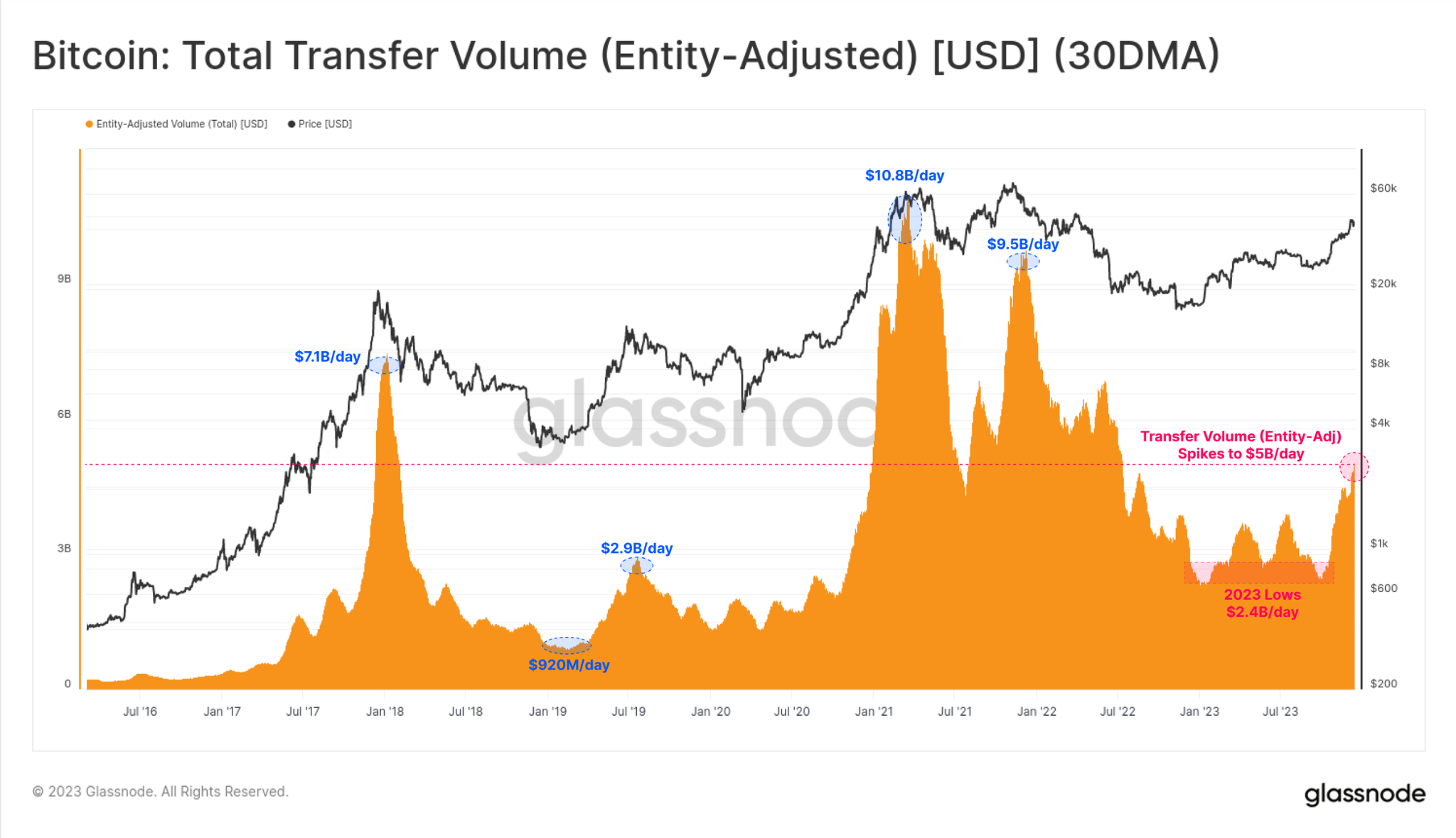

Other than the surge in BTC’s worth, the Bitcoin community has additionally skilled an uptick in consumer exercise, buying and selling quantity, and inscriptions.

Because the October rally pushed BTC previous its psychological $30,000 worth degree, the community witnessed an upswing in every day transaction volumes.

The worth rally led to a twofold improve in BTC switch volumes, because it elevated from $2.4 billion every day to over $5 billion. This represents its highest degree since June 2022.

Bitcoin Whole Switch Quantity (Supply: Glassnode)

Furthermore, as a result of exercise round Inscriptions and Ordinals on the BTC community, its transaction depend recorded a brand new all-time excessive.

Financial transactions on the chain have surged to new multi-year highs, virtually reaching all-time highs at 372,500 transactions per day. Additionally, transactions involving inscriptions have contributed a further 175,000 to 356,000 every day transactions to those.

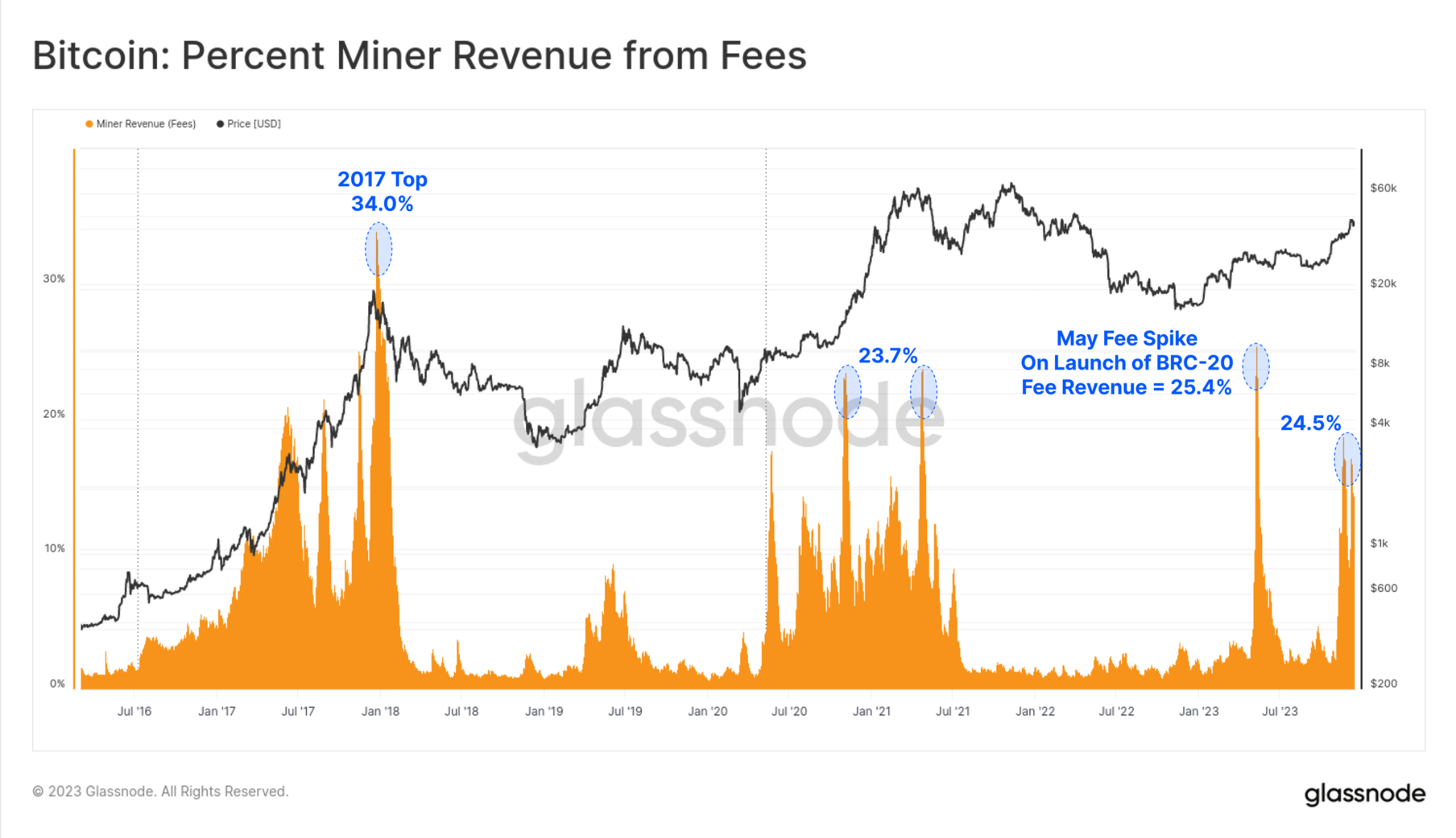

As anticipated, the uptick in demand for the BTC community led to a spike in miner income. In response to Glassnode:

Because of this new purchaser of Bitcoin block area, miner income from charges has elevated considerably, with a number of blocks in 2023 paying charges which even exceeded the 6.25 BTC subsidy..

Bitcoin Miner Income From Charges (Supply: Glassnode)

At an 18-month excessive, BTC exchanged arms at $42,500 at press time. At its present worth, “a super-majority of investor cash have returned to being ‘in-profit.’”

Disclaimer: The data introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any form. Coin Version will not be answerable for any losses incurred on account of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.