Understanding Bitcoin’s (BTC) valuation towards numerous currencies isn’t merely a matter of numbers — it’s about greedy world financial tides, gauging investor sentiment, and pinpointing geopolitical fluctuations. By juxtaposing Bitcoin towards totally different fiat forex buying and selling pairs, we acquire insights into regional financial well being, investor conduct, and potential macroeconomic shifts.

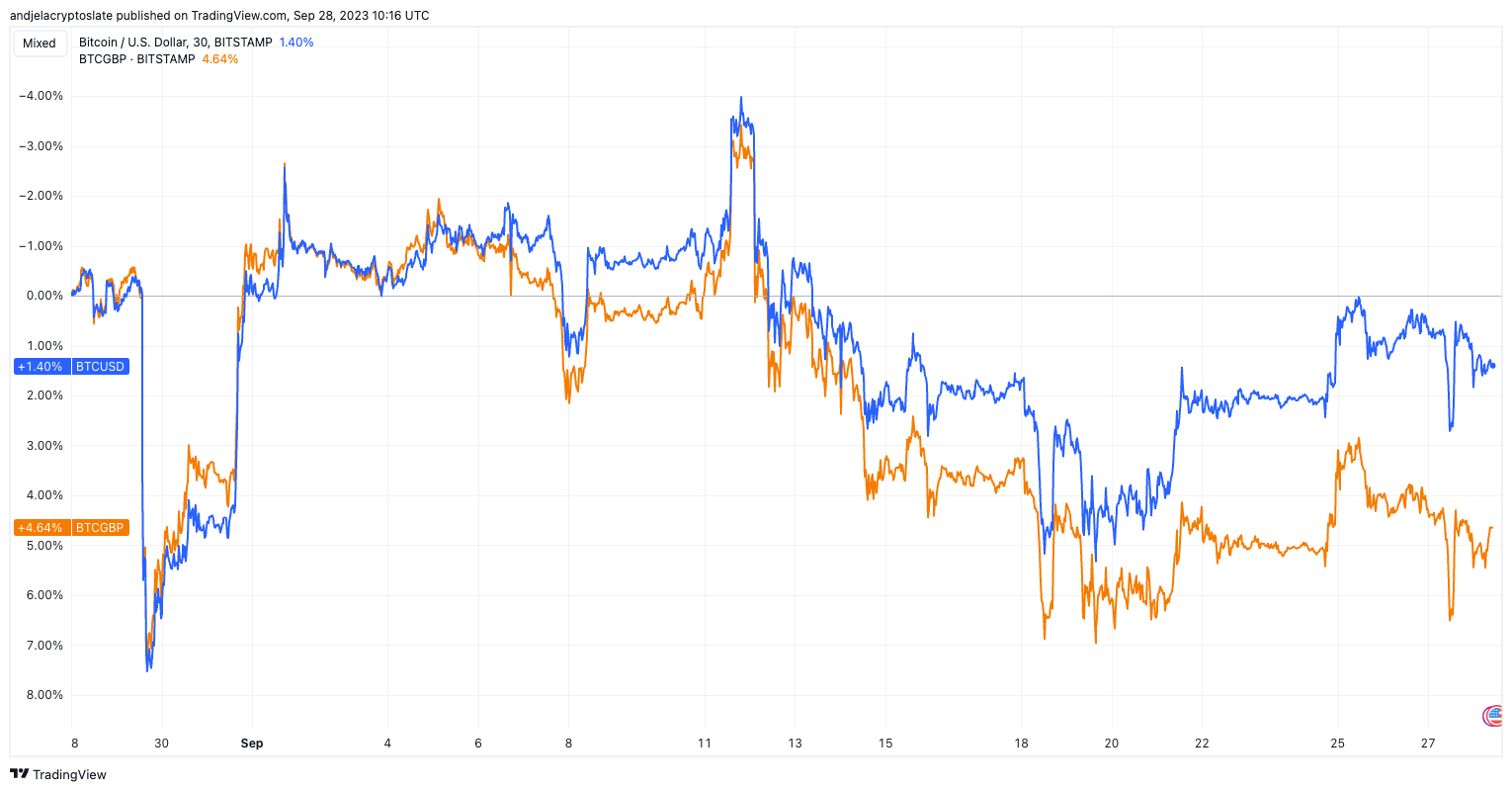

Latest market developments level to a major variance within the trajectory of the BTCUSD and BTCGBP buying and selling pairs. Over the previous 30 days, whereas each pairs have seen progress, the BTCGBP pair has constantly outperformed its USD counterpart.

This divergence may not simply be a results of elevated Bitcoin demand within the UK, but in addition an indicator of the pound’s relative weak spot towards each the USD and Bitcoin. A number of elements is perhaps driving this heightened curiosity in Bitcoin amongst GBP customers. The declining GBP could possibly be propelling traders in direction of Bitcoin as a substitute retailer of worth, hedging towards additional depreciation. Additionally, with the present world financial outlook, Bitcoin more and more seems as a refuge towards conventional forex fluctuations.

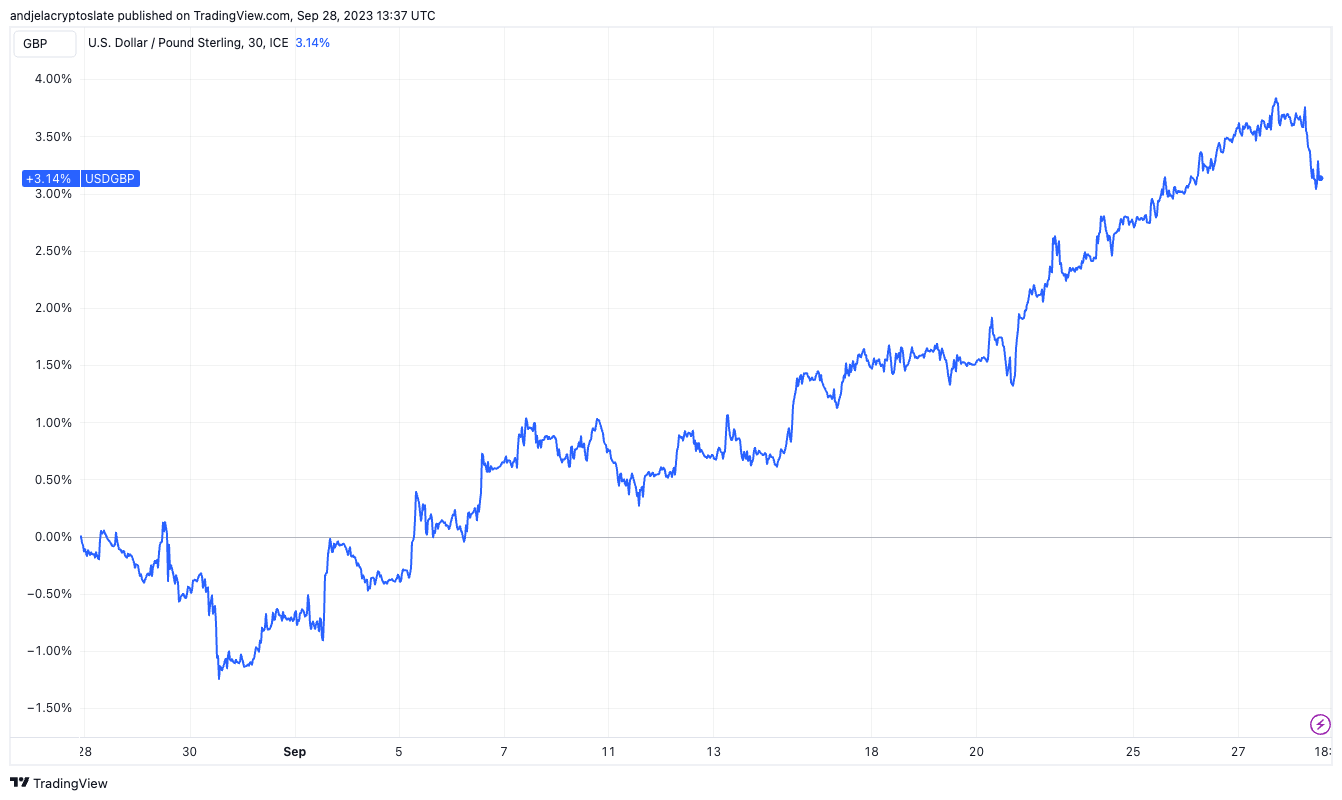

Diving deeper into the forex charts, USDGBP reveals a pronounced enhance of three.08% over the past month, signifying the US greenback’s strengthening towards the British pound. Conversely, the GBPUSD development signifies a depreciation of the pound towards the greenback. This isn’t only a month’s aberration however appears to be symptomatic of deeper financial undercurrents.

The pound is at the moment experiencing one in all its most important month-to-month decreases towards the greenback. Its vulnerability out there has been evident, particularly because it seeks stability amidst widespread monetary turbulence. Furthermore, the greenback’s ascent to a notable excessive towards main currencies, together with the pound, additional underscores the challenges confronted by the GBP.

A number of underlying elements contribute to the pound’s present decline. There’s a discernible development of traders transferring away from riskier property, and the pound hasn’t been spared. Moreover, the UK grapples with escalating inflation charges, prompting speculations concerning the Financial institution of England’s potential measures. Warnings concerning the potential stagnation of the UK’s economic system have emerged, and there are evident indicators of renewed financial stress, suggesting a presumably tumultuous monetary future for the nation.

A weakening GBP usually alerts issues concerning the UK’s financial well being. Buyers, cautious of market turbulence, may more and more flip to cryptocurrencies like Bitcoin as different funding avenues. The shifting dynamics within the GBP’s efficiency towards main currencies and Bitcoin may point out a broader development: cryptocurrencies aren’t simply speculative property however are steadily changing into integral to world monetary methods.

Because the GBP faces headwinds, Bitcoin’s attract within the UK appears to be rising.

The submit Bitcoin sees rising demand within the UK as British pound struggles appeared first on StarCrypto.