Bitcoin’s worth premiums have resurfaced amidst the latest bullish fervor gripping the market.

Kimchi premium

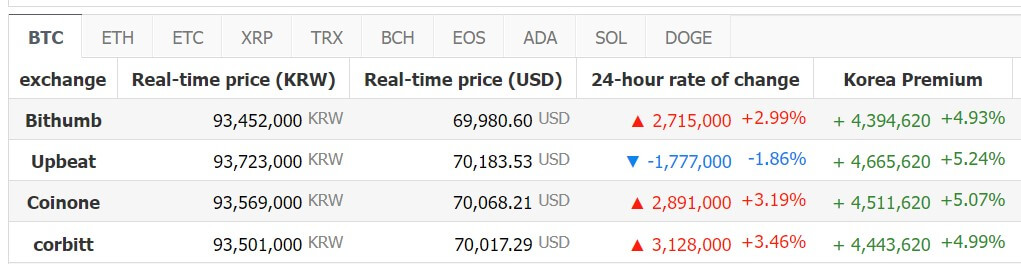

Information reveals BTC buying and selling at a $4,000 premium in South Korea in comparison with different markets. As of press time, Bitcoin was priced at $66,893 on Binance, whereas Korean platforms like Upbit, Coinone, and Bithumb boasted costs round $70,000.

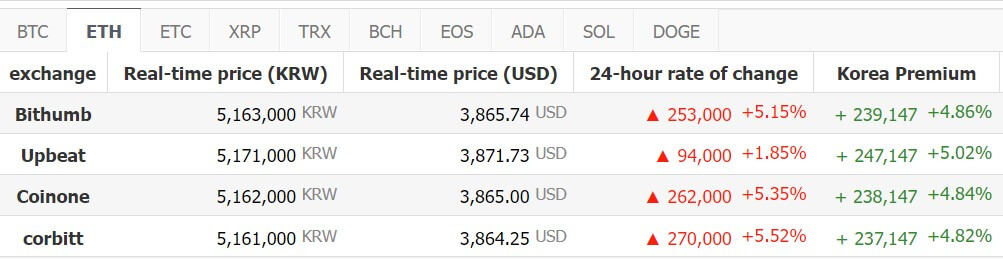

This premium development extends to Ethereum, the second-largest crypto by market cap. ETH instructions round $3,900 on Korean platforms, whereas it hovers round $3,600 on different exchanges.

The Kimchi premium denotes a state of affairs the place a digital asset’s worth is notably larger on South Korean exchanges than in US or European markets, opening up arbitrage alternatives for merchants with entry to each markets.

Sometimes seen as a bullish indicator, the Kimchi premium suggests elevated purchaser exercise within the Korean market. The premium can also be used to infer strong engagement with digital property in South Korea.

CryptoQuant’s CEO Ki Younger Ju not too long ago highlighted strong institutional demand for BTC in Korea, citing widespread adoption even amongst older demographics on platforms like Upbit.

Whereas the present premium resurgence isn’t unprecedented, it echoes earlier occurrences, notably throughout bullish cycles equivalent to in 2021 when BTC commanded considerably larger costs on South Korean exchanges than Coinbase and different main platforms.

CME Premium

Equally, a number of market observers have recognized BTC buying and selling at a premium of over $69,000 on the Chicago Mercantile Alternate (CME) futures, a brand new all-time excessive.

They defined that this means that merchants are prepared to pay a premium for the CME as a result of they imagine that the worth of BTC will proceed to extend regardless.

On-chain analytical platform CoinGlass information reveals that CME’s BTC open curiosity hit a document excessive of virtually $10 billion in the course of the previous day, whereas the general open curiosity on the flagship asset totals a document excessive of $32.36 billion.