The provision of Bitcoin held by long-term holders has elevated considerably up to now month, now undoubtedly reversing the declining pattern that’s been dominant for the reason that starting of the 12 months. Lengthy-term holder provide is a really helpful metric for understanding the sentiment of a extra subtle a part of the market, because it displays the conduct of traders who’re much less prone to promote their holdings in response to short-term value fluctuations.

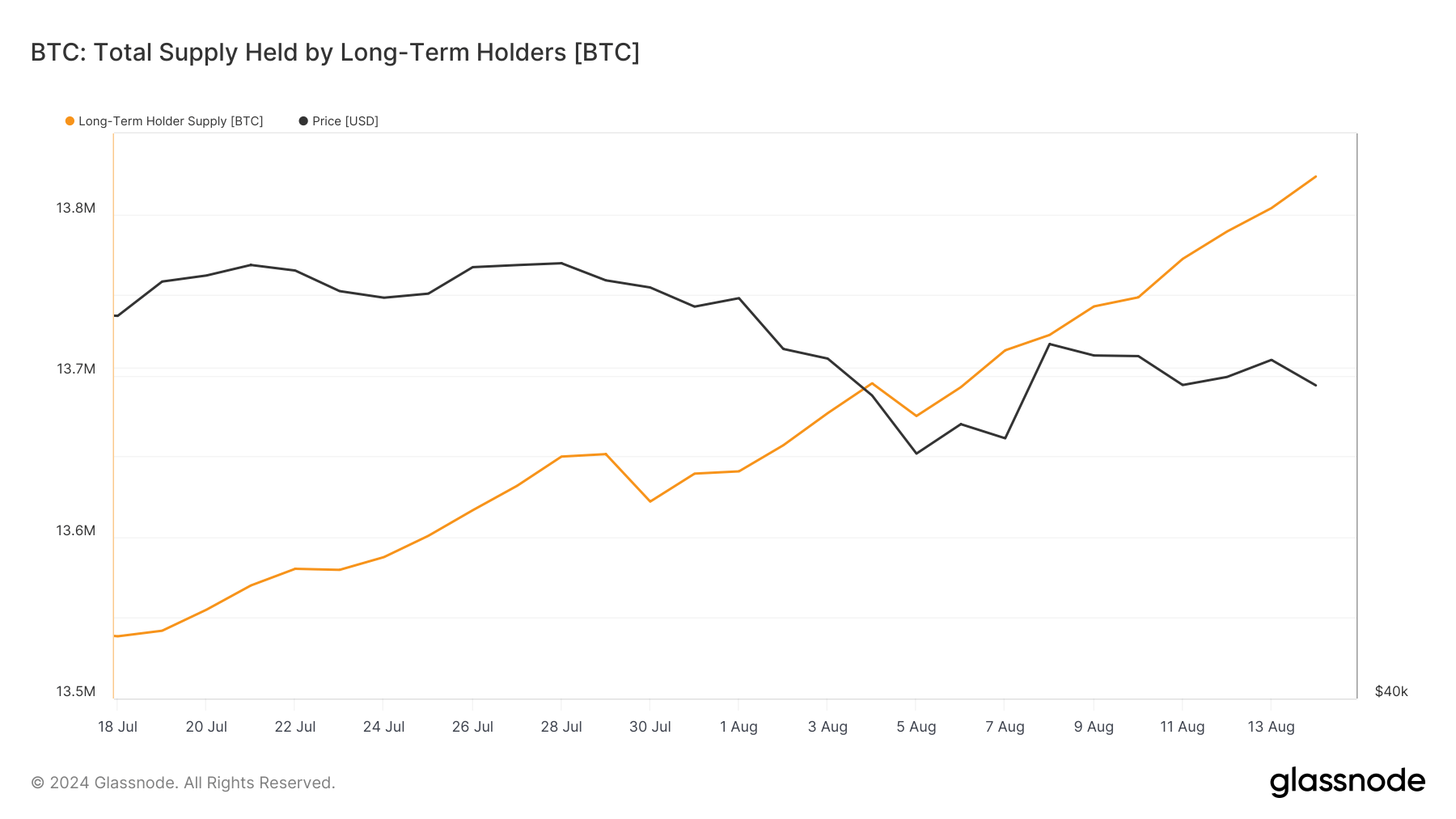

Between Jul. 18 and Aug. 14, the long-term holder provide grew from 13,538,543 to 13,823,283 million BTC, representing a considerable improve of 284,740 BTC. Whereas this progress is noteworthy in itself, it turns into much more important because it comes after a interval of appreciable decline in LTH provide earlier within the 12 months.

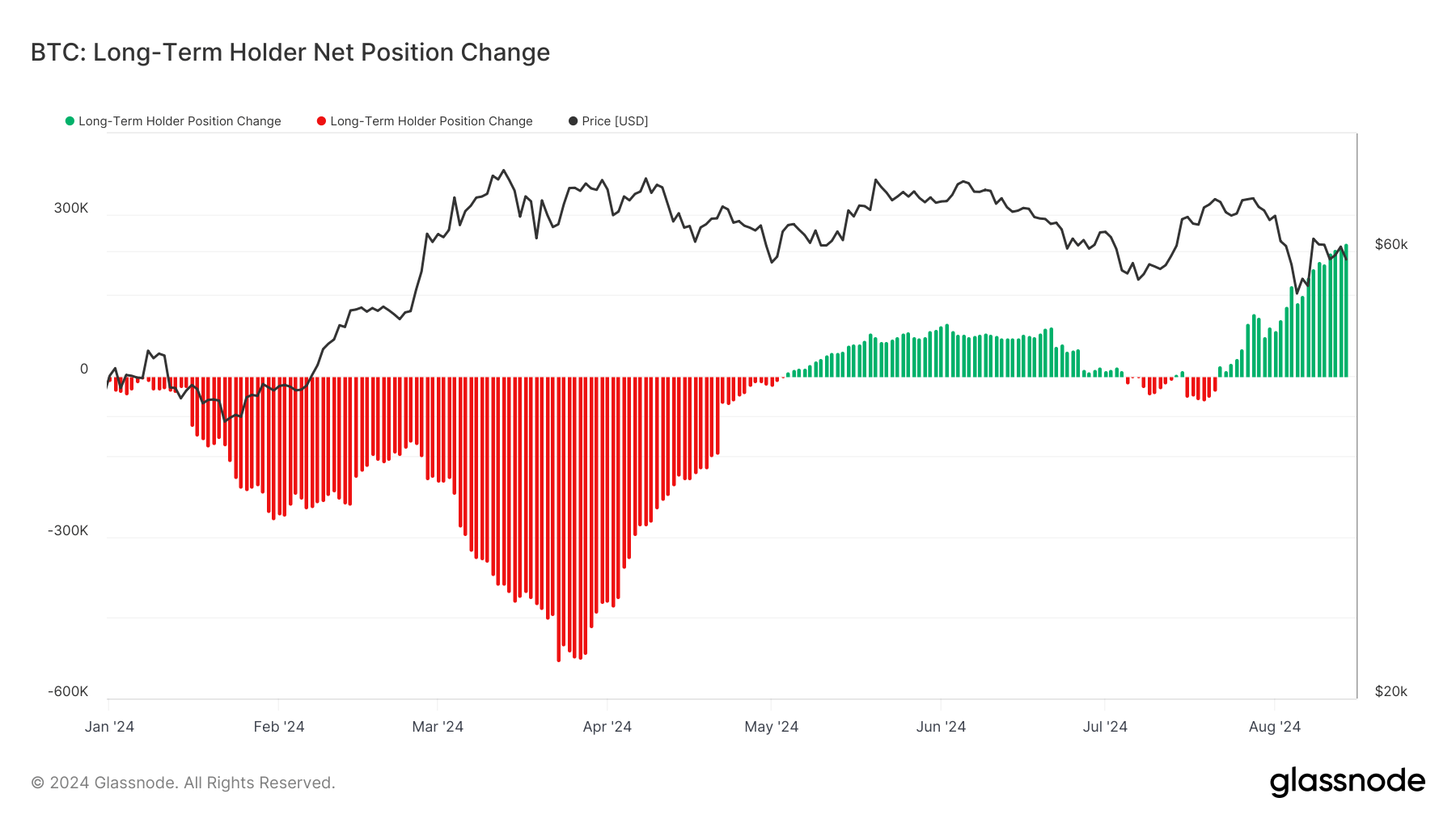

The pattern reversal started on Could 4 and continued for 2 months, after which a quick two-week lower in LTH provide correlated with Bitcoin’s value improve.

Monitoring LTH provide is essential as a result of it supplies invaluable insights into potential future value actions. Lengthy-term holders are usually thought-about extra dedicated traders who’re much less prone to promote their Bitcoin in response to short-term value fluctuations. In consequence, a rise in LTH provide usually signifies a discount within the quantity of Bitcoin obtainable for buying and selling, doubtlessly resulting in decreased market volatility and elevated value stability.

The latest surge in LTH provide, notably the most important 30-day change recorded on Aug. 14 with 246,196 BTC added, is a big growth that warrants additional evaluation. This improve reveals rising confidence amongst traders, who select to carry onto their Bitcoin for longer intervals regardless of value volatility.

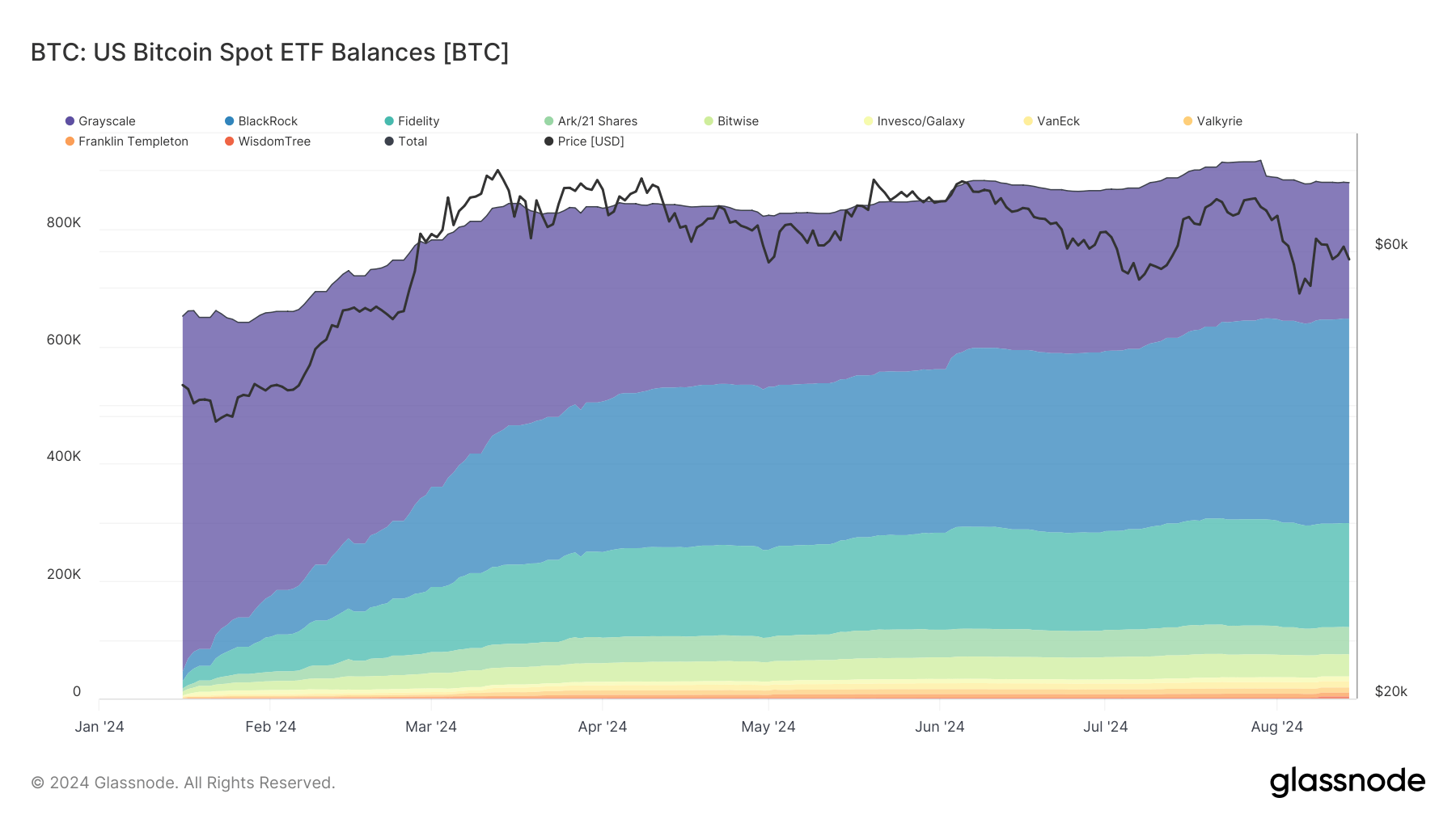

One cause behind this rise in LTH provide might be the maturation of BTC held by spot ETFs. The methodology for calculating LTH provide considers Bitcoin that has not moved for 155 days or extra as a part of the long-term holder provide. Provided that US Bitcoin spot ETF balances have elevated from 651,641 BTC on Jan.16 to 879,799 BTC on Aug. 14, a good portion of those holdings would now have crossed the 155-day threshold, contributing to the rise in LTH provide.

This clarification aligns with the timing of the rise, as most of the ETF inflows from earlier within the 12 months would have simply reached the 155-day mark. The substantial progress in ETF holdings, amounting to roughly 228,158 BTC for the reason that starting of the 12 months, carefully matches the rise in LTH provide.

This implies institutional traders are adopting a long-term funding technique for Bitcoin via spot ETFs. The market appears to see this as a vote of confidence in Bitcoin’s future within the TradFi market, which may encourage different massive traders to comply with swimsuit.

Moreover, the rise in LTH provide may doubtlessly result in a provide squeeze available in the market. If extra BTC is held by long-term traders and ETFs, each of that are much less prone to promote rapidly and aggressively, the quantity obtainable for lively buying and selling decreases. If this discount in circulating provide continues, it may, in principle, result in elevated value strain after we see one other rally.

The resilience proven by long-term holders within the face of latest value decreases can also be value mentioning. Regardless of Bitcoin’s value drop, the LTH steadiness has elevated considerably. This implies that long-term holders and institutional traders, via ETFs, preserve their positions, doubtlessly viewing the present market circumstances as a shopping for alternative moderately than a cause to promote. Nonetheless, it’s going to take one other three or so months earlier than any property purchased throughout this value dip mature to be thought-about long-term holder provide and be mirrored in on-chain metrics.

The put up Bitcoin sees report progress in long-term holder provide appeared first on StarCrypto.