The crypto market is present process a major correction as traders withdrew $584 million from crypto-related funding merchandise final week, in accordance with CoinShares’ newest report.

Moreover, world buying and selling volumes for crypto ETPs hit their lowest ranges because the US Securities and Trade Fee authorized the launch of a number of spot Bitcoin exchange-traded funds (ETFs) in January, totaling simply $6.9 billion for the week.

This decline continues a pattern from the earlier week, the place traders pulled out round $600 million, bringing the two-week complete to just about $1.2 billion in outflows.

James Butterfill, the pinnacle of analysis at CoinShares, commented:

“We consider that is in response to the pessimism amongst traders concerning the prospect of rate of interest cuts by the FED this yr.”

Bitcoin and US lead outflows

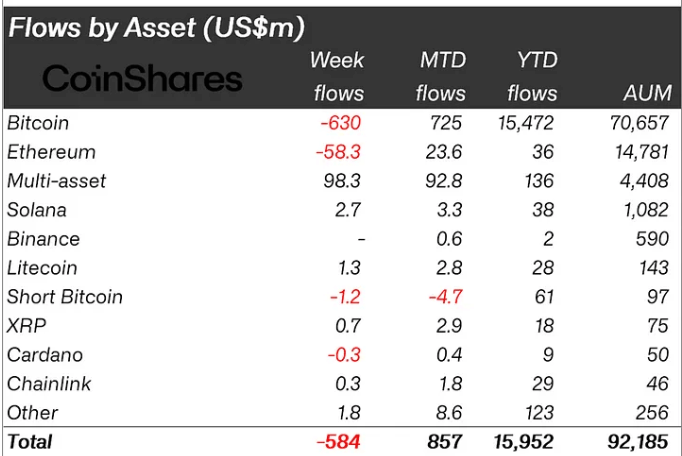

Bitcoin funding merchandise noticed essentially the most vital outflows, totaling $630 million. Bitcoin ETPs skilled six consecutive days of outflows within the US, primarily from Grayscale Bitcoin ETF and Constancy’s FBTC.

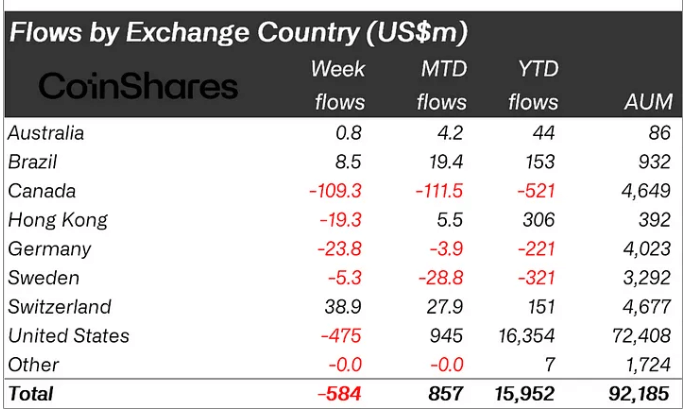

Canada additionally witnessed substantial outflows from crypto ETPs, with $109 million withdrawn. This was adopted by Germany and Hong Kong, which noticed outflows of $24 million and $19 million, respectively.

Conversely, Switzerland and Brazil recorded inflows of $39 million and $48.5 million, respectively, serving to to offset the general outflows.

Traders with bearish sentiments additionally withdrew about $1.2 million from brief Bitcoin merchandise.

In the meantime, Ethereum joined the outflow pattern, seeing its first withdrawals in weeks, totaling roughly $58 million. This diminished its month-to-date movement to round $23 million from $82 million.

Altcoins show enticing

Regardless of the outflows from the main digital asset, multi-asset funding merchandise and a few altcoins noticed vital inflows.

Based on CoinShares, multi-asset merchandise attracted over $98 million, whereas Solana, Litecoin, and Polygon obtained $2.7 million, $1.3 million, and $1 million, respectively.

Butterfill defined that these inflows point out a brand new investor give attention to altcoins. He said:

“[These inflows] counsel traders view the weak spot within the altcoin market as a shopping for alternative.”