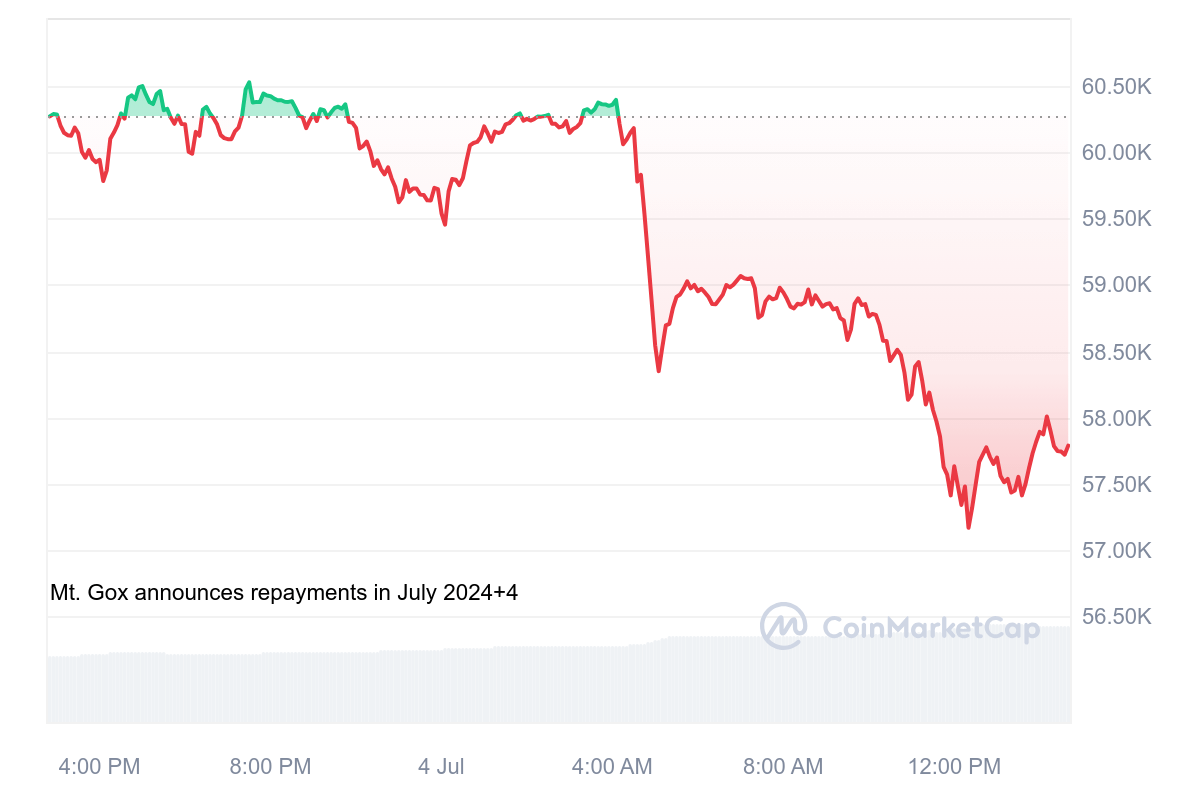

- Bitcoin value dropped beneath $58,000 on Thursday, touching lows of $57,166.

- The practically 5% decline got here amid recent sell-off stress, with whales and authorities wallets promoting BTC.

Bitcoin traded to beneath $58,000 on Thursday, reducing practically 5% in 24 hours amid large sell-off stress. Based on CoinMarketCap, BTC value reached lows of $57,166 throughout main cryptocurrency exchanges.

Whereas value has recovered to above $57,800, Bitcoin stays down 3.9% up to now 24 hours and 5.4% up to now week.

BTC plunges beneath $58k as sell-off intensifies

Per information shared by Spot On Chain, Bitcoin’s sharp value decline right this moment has come amid enormous promoting stress.

On-chain information reveals large BTC offloading by government-linked wallets and whales, which the analyst says are causes probably behind the dump.

One in all these is a whale who moved 3,500 BTC value over $206 million to Binance, with this unidentified giant holder’s pockets nonetheless holding 4,368 BTC at the moment valued round $256 million.

The German authorities, which has actively bought BTC in current weeks, additionally transferred extra Bitcoin to exchanges right this moment. On-chain information reveals 3,000 bitcoins moved right this moment, with 1,300 BTC going to totally different CEX platforms.

Additionally notable is the 237 bitcoin switch by the US authorities pockets and one other 1,023 BTC deposit to Binance by a whale.

In the meantime, Mt.Gox repayments have reportedly started and this might add to extra draw back stress for Bitcoin, Bitcoin Money and different cryptocurrencies.

BTC might drop to $50k

Bitcoin lately rebounded from close to $57k and the realm appears to be like to be a key space for bulls.

Nevertheless, with elevated stress amid a broader market downturn might imply a recent demand zone will likely be decrease. Per analysts at IntoTheBlock, breaching $60k might see bears concentrating on decrease assist ranges.

“Traditionally, demand slightly below $60k has been weak, suggesting additional downward stress. The subsequent vital demand zone lies between $40,000 and $50,000,” the platform posted on X.

In the meantime, former BitMEX CEO Arthur Hayes thinks the draw back stress for BTC is prone to proceed “till morale improves.”