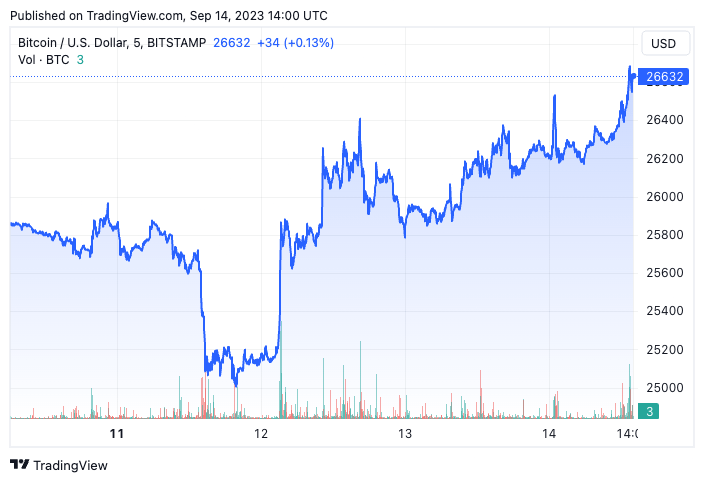

On Sep. 12, Bitcoin surpassed the $26,000 mark after stagnating round $25,000 for an prolonged interval. Although this worth motion has introduced a touch of optimism to the market, an evaluation of the conduct of long-term holders is essential for a complete understanding.

Lengthy-term holders (LTHs) are traders who retain their Bitcoin for over six months. Their holding or promoting patterns are pivotal in figuring out market sentiment. The actions of this group provide insights into the general confidence degree available in the market and potential worth actions.

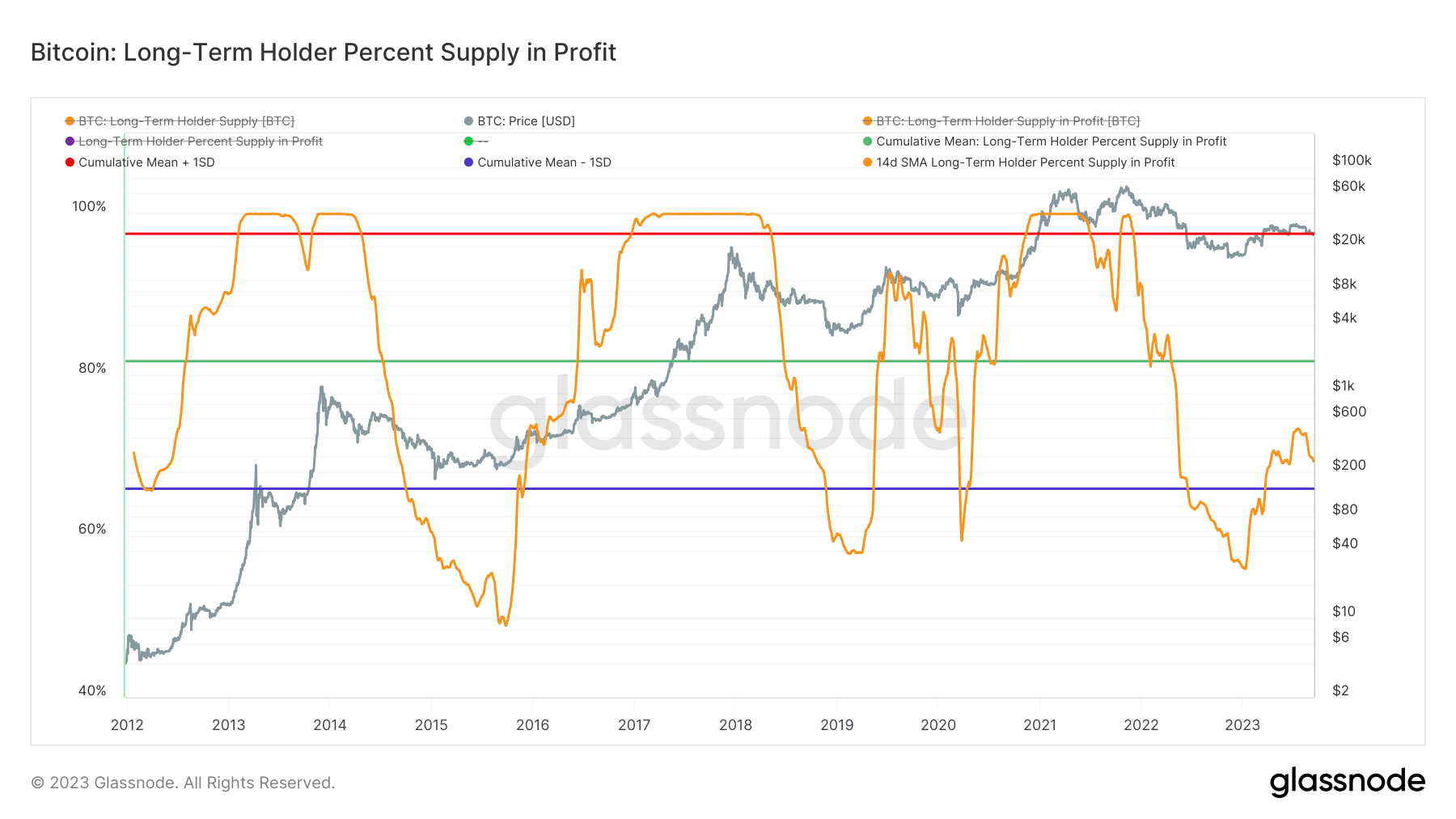

Current information from Glassnode paints an fascinating image of LTH profitability. Whereas the current worth improve has mirrored positively on some LTHs, solely 69.28% of the LTH provide is in revenue, contrasting sharply with the all-time imply of 81.7%. This information implies that over 30% of the LTHs haven’t but reached a worthwhile state relative to their preliminary acquisition worth.

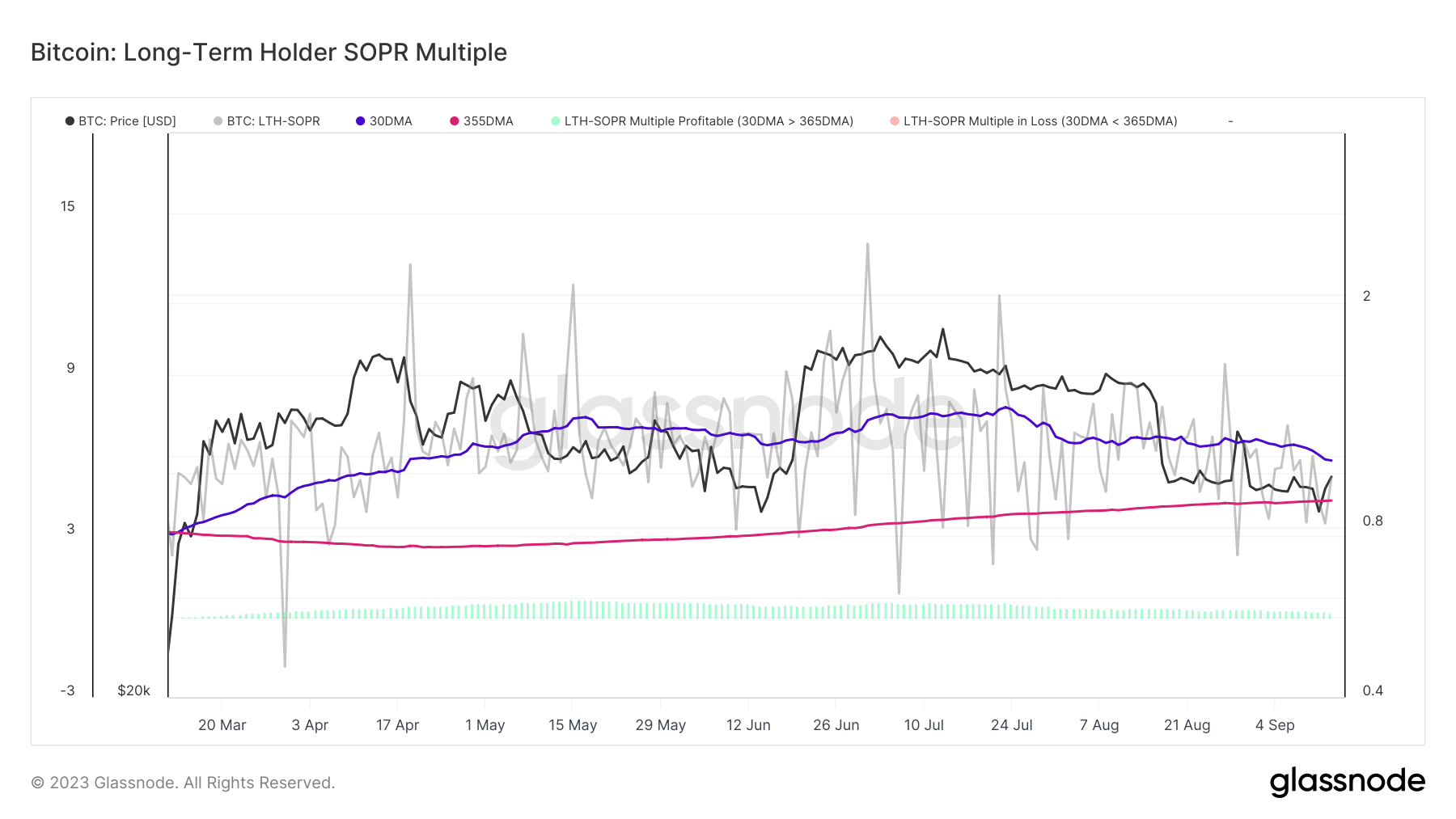

To additional consider the LTHs’ sentiment, we flip to the LTH-SOPR (Spent Output Revenue Ratio) a number of. In essence, the LTH-SOPR measures the typical revenue (values higher than 1) or loss (values lower than 1) realized by LTHs when transacting their cash. A key focal point is the 30-day Shifting Common (30DMA) of the LTH-SOPR, which has seen a downtrend since July 23, shifting from 1.30 to 1.05 on Sep. 12. Furthermore, the distinction between the yearly 365-day Shifting Common (365DMA) and the 30DMA is the smallest it’s been since March.

When the LTH-SOPR 30-DMA exceeds the 365-DMA, it signifies that LTH profitability is greater than the yearly common. Whereas the LTH-SOPR A number of stays optimistic, it has trended downwards since July 23. Which means that the profitability of LTHs, whereas nonetheless optimistic, is diminishing relative to its yearly common.

Whereas Bitcoin’s current worth motion supplies a cause for short-term optimism, the lowered profitability amongst LTHs suggests warning. The decline within the LTH-SOPR A number of might trace at potential market changes within the close to future.

The submit Bitcoin passes $26,000 however 30% of long-term holders stay in loss appeared first on StarCrypto.