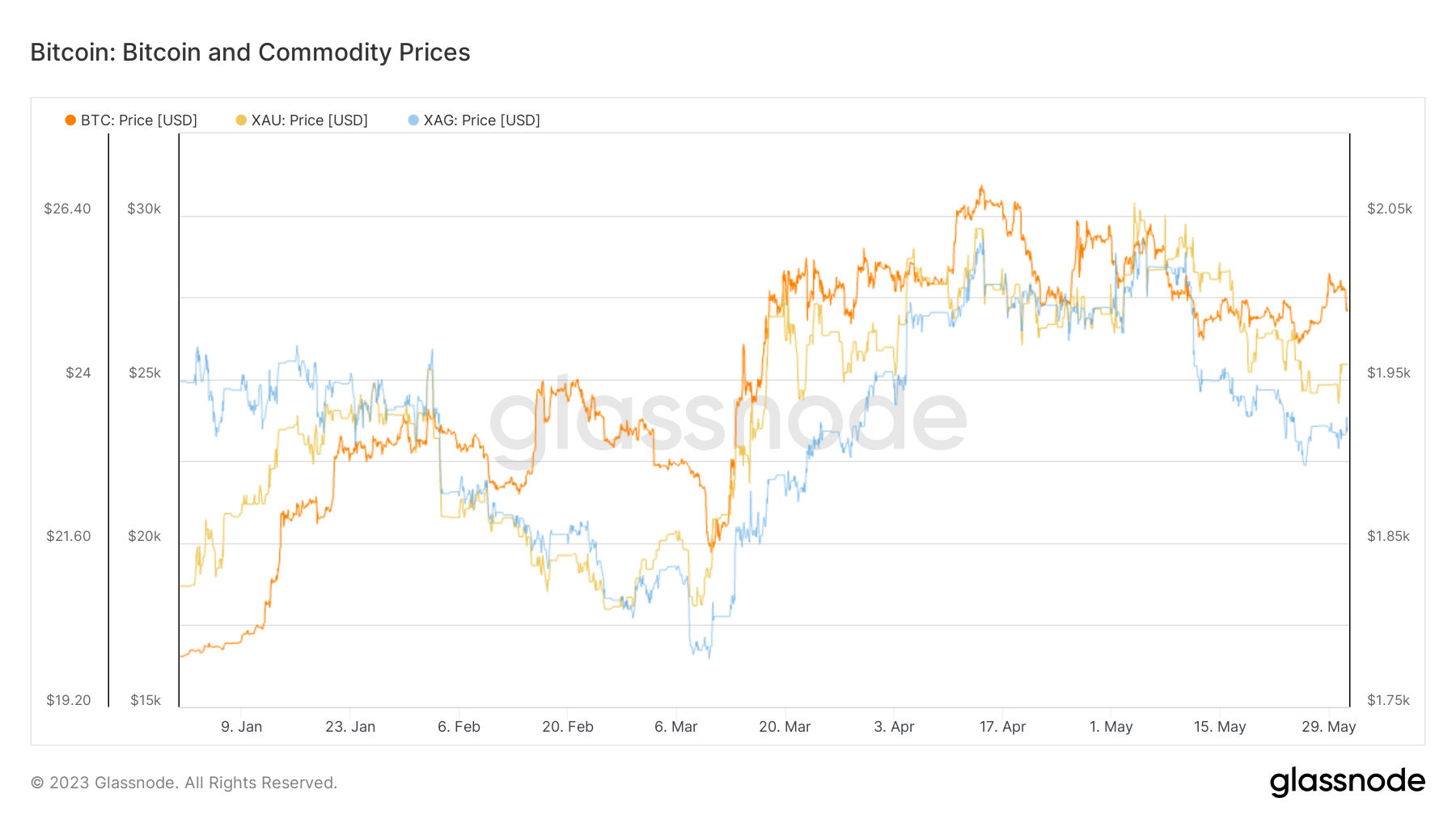

Regardless of the broader market disaster induced by the U.S. debt ceiling difficulty, Bitcoin and commodities, significantly gold and silver, have demonstrated notable efficiency because the begin of 2023.

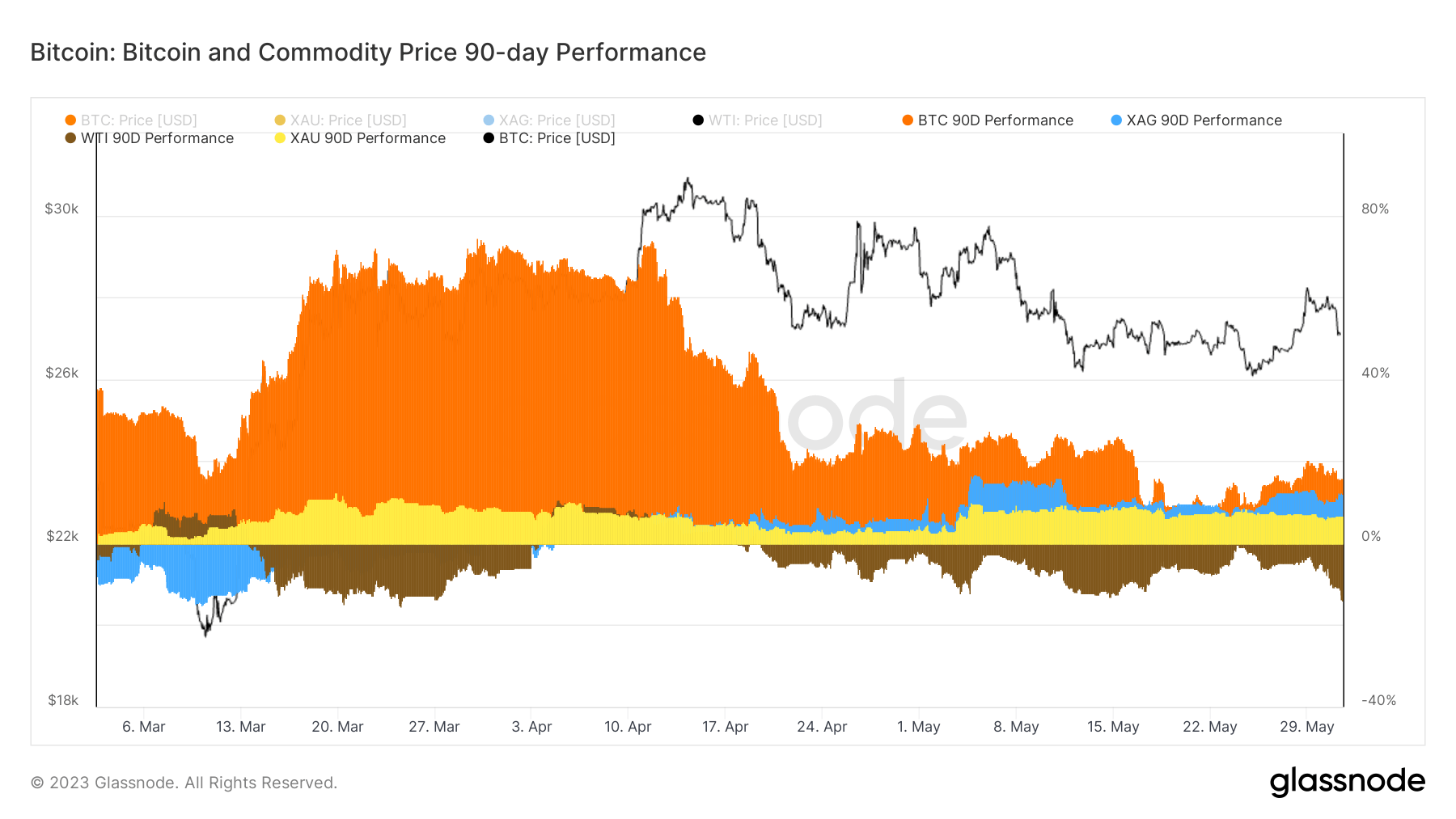

During the last 90 days, Bitcoin has recorded a 15.85% enhance, outperforming silver’s 12.41% rise and gold’s 6.82% achieve.

Nonetheless, the noticed gradual and regular returns of Bitcoin shouldn’t be misconstrued as an indicator of an impending secure market.

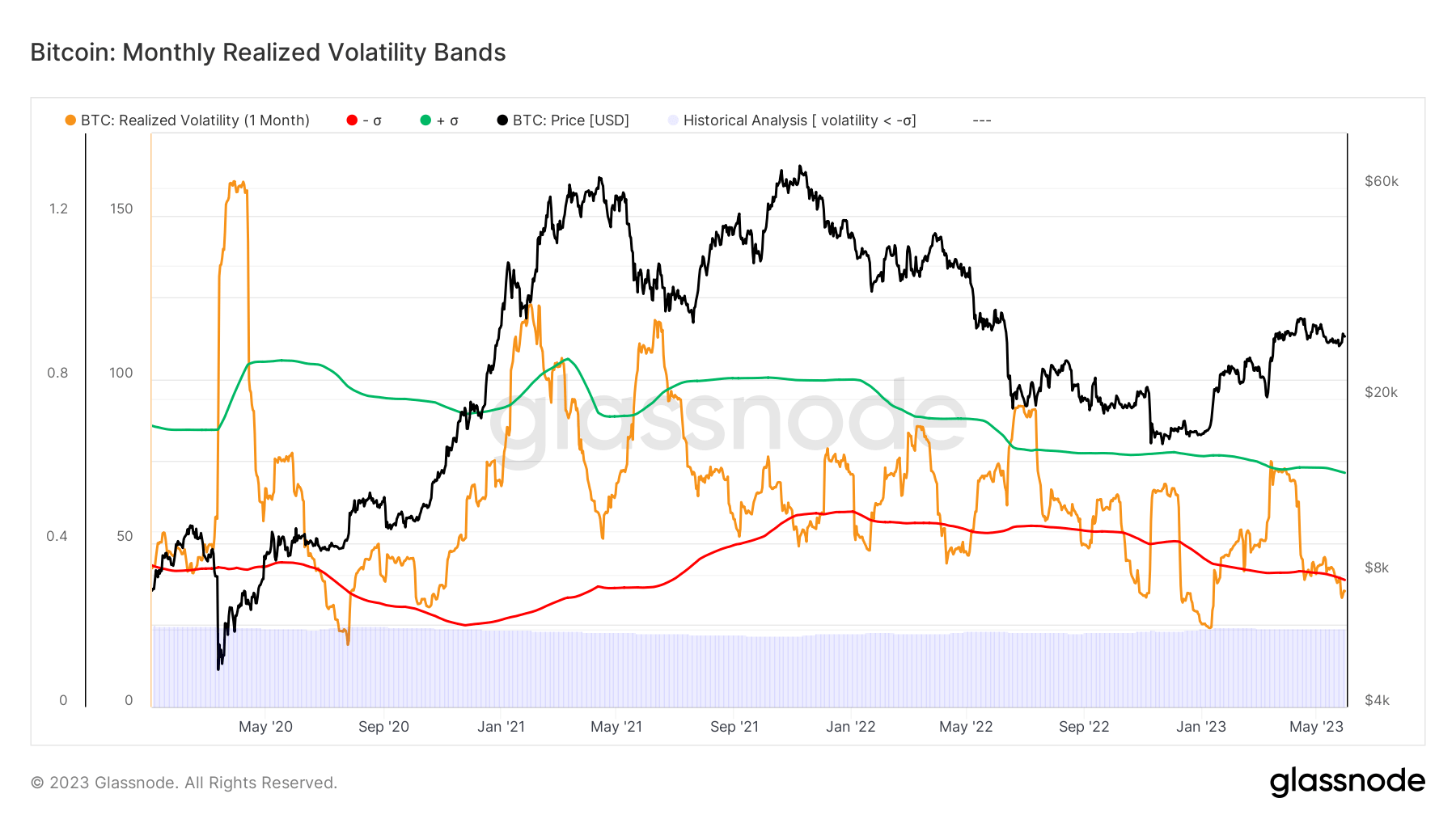

Bitcoin’s month-to-month realized volatility, a metric reflecting the diploma of variation or dispersion of an asset’s returns over a month, has dropped to 34.1%, slipping beneath the decrease restrict of the 1-standard deviation Bollinger Band.

Bollinger Bands are a technical evaluation software that plots a set vary round an asset’s value, with wider bands indicating larger volatility and vice versa. A drop beneath the decrease band could sign an upcoming correction or reversal.

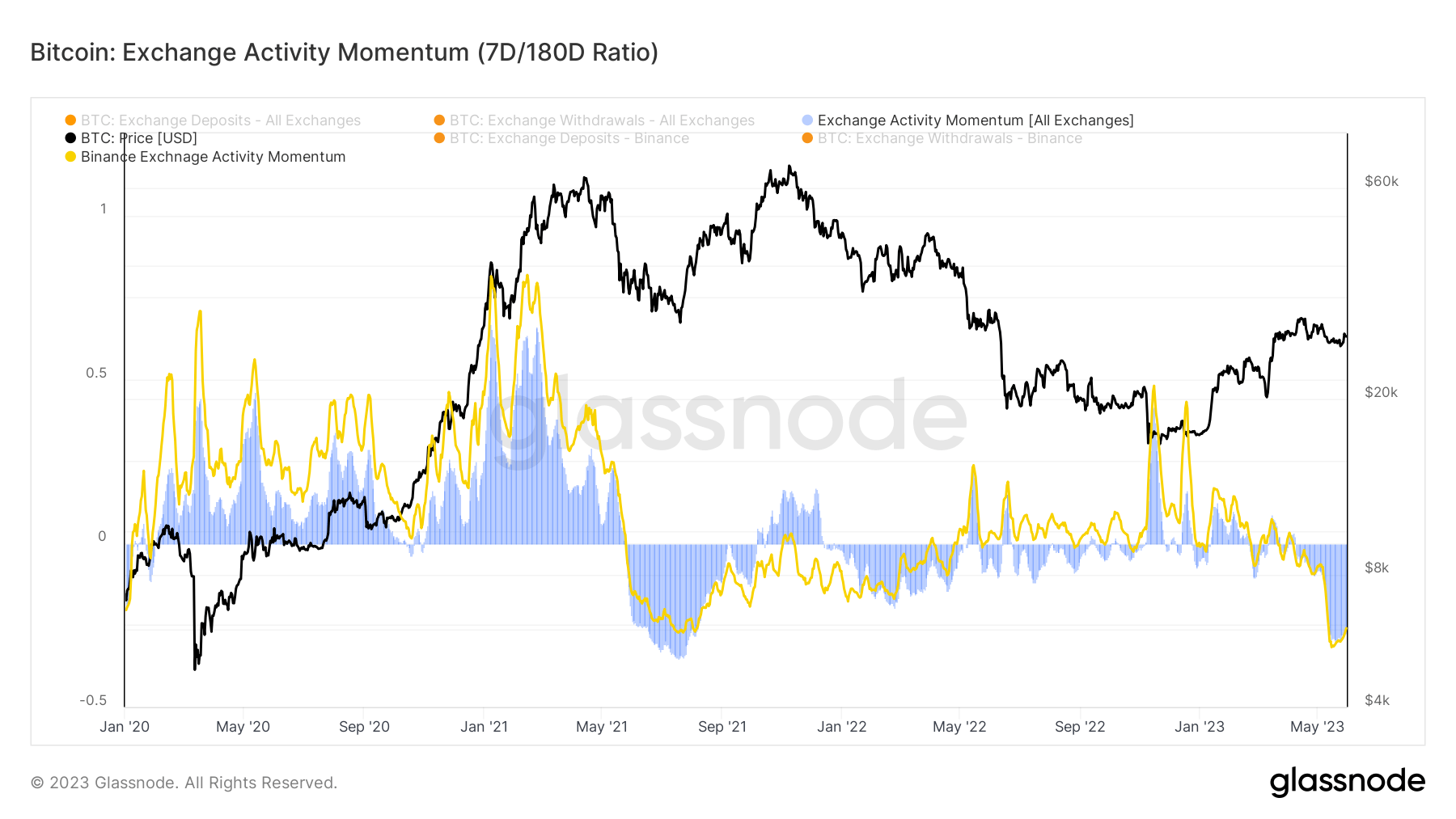

The slowing down of Bitcoin’s market exercise is additional substantiated by the momentum seen in alternate exercise. Glassnode calculates this metric by evaluating the present week’s common variety of alternate deposit/withdrawal transactions to the median of such transactions over the previous six months, creating an exercise ratio.

A latest 27.3% discount on this ratio, in comparison with the final six months, verifies the development of diminishing market participation.

These two elements – low investor exercise and decreased month-to-month realized volatility – paint an image of a dormant, flat market. Nonetheless, in keeping with Glassnode, such low-volatility intervals represent solely 19.3% of Bitcoin’s market historical past, suggesting a robust chance of an incoming volatility surge.

The submit Bitcoin outperforms commodities as market gears up for prime volatility appeared first on StarCrypto.