- Bitcoin rises to high international property, surpassing commodities and main tech firms.

- Institutional demand and ETFs gasoline Bitcoin’s development and growing market prominence.

- Bitcoin nears key milestones, exhibiting sturdy momentum and potential for future development.

Bitcoin has grow to be the eighth-largest world asset by market capitalization. Valued at $1.786 trillion, Bitcoin ranks forward of conventional commodities like silver and firms like Meta Platforms.

Based on IntoTheBlock, Bitcoin ranks among the many high international property, behind gold, Apple, NVIDIA, Microsoft, Alphabet (Google), Amazon, and Saudi Aramco. Gold leads with a market cap of $17.526 trillion and a unit worth of $2,610. Tech firms dominate the highest, with Apple valued at $3.428 trillion, NVIDIA at $3.401 trillion, and Microsoft at $3.085 trillion.

Bitcoin is valued larger than silver, which has a market cap of $1.746 trillion, and Meta Platforms, valued at $1.400 trillion. Saudi Aramco edges out Bitcoin with a valuation of $1.792 trillion.

Institutional Curiosity Drives Bitcoin’s Development

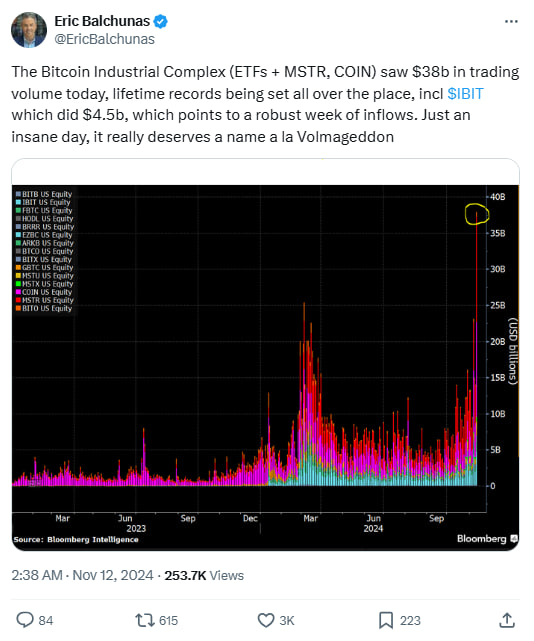

Bloomberg’s Senior ETF Analyst Eric Balchunas famous that institutional curiosity and the rising adoption of Bitcoin exchange-traded funds (ETFs) have fueled the surge in Bitcoin’s market cap.

BlackRock’s iShares Bitcoin Belief (IBIT) recorded a $4.5 billion buying and selling quantity, signaling heightened institutional participation. Moreover, the broader Bitcoin ecosystem, together with ETFs, MicroStrategy, and Coinbase, achieved a record-breaking $38 billion in buying and selling quantity.

Learn additionally: Bitcoin Shatters Data: Surpasses Silver in Market Cap, $145 Billion Traded in 24 Hours! Is $100K Subsequent?

Bitcoin’s Path to $100,000

Bitcoin’s latest rally has seen its worth climb to $91,642.63, representing a 1.22% improve over the previous 24 hours and a 3.90% acquire during the last seven days. With a circulating provide of 20 million BTC, its market cap now stands at $1.813 trillion.

The crypto asset reached an all-time excessive of $88,000 earlier this 12 months, leaving it inside putting distance of the six-figure milestone.

Regardless of its spectacular development, Bitcoin stays smaller than gold, which boasts a market cap practically 10 occasions bigger. The Kobeissi Letter, a monetary markets commentary, identified this distinction, noting the potential for Bitcoin to develop additional within the coming years.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be accountable for any losses incurred because of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.