- Bullish Bitcoin Money (BCH) value prediction ranges from $200 to $400.

- Evaluation means that the BCH value may attain above $388.

- The BCH bearish market value prediction for 2023 is $95.

What’s Bitcoin Money (BCH)?

Bitcoin Money (BCH) is a tough fork of Bitcoin that emerged on account of an try to extend the utmost block dimension of Bitcoin. As such, BCH emerged on August 1, 2017.

In the course of the lead-up to the inception of BCH in 2017, Bitcoin was more and more unreliable and costly throughout the 2016-2017 years. This was as a result of the neighborhood couldn’t attain a consensus on growing the community capability. A few of the builders didn’t perceive and agree with Satoshi’s plan. As an alternative, they most well-liked Bitcoin to change into a settlement layer.

By 2017, Bitcoin dominance had plummeted from 95% to as little as 40% as a direct results of the usability issues. Nonetheless, a big portion of the Bitcoin neighborhood, together with builders, traders, customers, and companies, nonetheless believed within the authentic imaginative and prescient of Bitcoin — a low-fee, peer-to-peer digital money system that might be utilized by all of the individuals of the world.

With the inception of BCH, the community now helps as much as 32MB blocks with ongoing analysis to permit huge future will increase.

As per the BCH web site, Bitcoin Money is immune to political and social assaults on protocol improvement. No single group or undertaking can management it. A number of implementations additionally present redundancy to make sure that the community retains 100% uptime.

Bitcoin Money (BCH) Market Overview

| 🪙 Title | Bitcoin Money |

| 💱 Image | bch |

| 🏅 Rank | #19 |

| 💲 Value | $190.99 |

| 📊 Value Change (1h) | 0.11498 % |

| 📊 Value Change (24h) | -0.29608 % |

| 📊 Value Change (7d) | 1.71909 % |

| 💵 Market Cap | $3722141250 |

| 📈 All Time Excessive | $3785.82 |

| 📉 All Time Low | $76.93 |

| 💸 Circulating Provide | 19488549.8967 bch |

| 💰 Complete Provide | 21000000 bch |

Analysts’ Views on Bitcoin Money

The US arm of Binance, BinanceUS tweeted that it’s going to help the improve to Bitcoin Money. Moreover, it ensured its customers that buying and selling won’t be affected.

Kim Dot Com an entrepreneur, advised his followers strive Bitcoin Money in the event that they discovered that BTC to be too costly.

BCH Present Market Standing

The utmost provide of Bitcoin Money (BCH) is 21,000,000 BCH, whereas its circulating provide is nineteen,488,356 BCH, in line with CoinMarketCap. On the time of writing, BCH is buying and selling at $193.06 representing a 24-hour enhance of 0.9%. The buying and selling quantity of BCH up to now 24 hours is $154,636,508which represents an 84.86%% enhance.

Some prime cryptocurrency exchanges for buying and selling Bitcoin Money (BCH) are Binance, Coinbase, KuCoin, and Kraken.

Now that you realize BCH and its present market standing, we will focus on the worth evaluation of Bitcoin Money (BCH) for 2023.

Bitcoin Money (BCH) Value Evaluation 2023

Will the BCH’s blockchain’s most up-to-date enhancements, additions, and modifications assist its value rise? Furthermore, will the modifications within the fee and crypto business have an effect on BCH’s sentiment over time? Learn extra to seek out out about BCH’s 2023 value evaluation.

Bitcoin Money (BCH) Value Evaluation – Bollinger Bands

The Bollinger bands are a kind of value envelope developed by John Bollinger. It offers a variety with an higher and decrease restrict for the worth to fluctuate. The Bollinger bands work on the precept of ordinary deviation and interval (time).

The higher band as proven within the chart is calculated by including two occasions the usual deviation to the Easy Shifting Common whereas the decrease band is calculated by subtracting two occasions the usual deviation from the Easy Shifting Common.

When contemplating the above chart, we will see the growth of the bands. This denotes extra volatility, which implies the worth may fall or enhance by a big margin. Moreover, the inexperienced rectangle denotes a interval of BCH touching the decrease band or being oversold for a while. Nonetheless, we will see that the pattern modified quick and BCH rose in the direction of the higher band.

When wanting on the Bollinger Band tremendous pattern we will see that BCH is at the moment passing by a downward pattern (Crimson spotlight). BCH is now retracing in the direction of the SMA after touching the decrease band. There’s a risk that BCH may maintain transferring in the direction of the higher band, if the patrons maintain this momentum. Nonetheless, since BCH is on a downtrend, there’s a risk that BCH might be rejected on the SMA. If the previous is to occur, then BCH could transfer in the direction of the decrease band.

Furthermore, the Bollinger band width percentile learn a price of 42% and it appears to be falling vertically down. As such, we may anticipate the bands to scale back in width. Because of this if the bands contract, there will likely be much less volatility out there.

Bitcoin Money (BCH) Value Evaluation – Relative Energy Index

The Relative Energy Index is an indicator that’s used to measure whether or not the worth of a cryptocurrency is over or undervalued. For this function, it has two excessive areas often known as the overbought and oversold areas.

When the RSI reads a price (>70) then the crypto is overbought, which implies that resulting from extra shopping for the demand has elevated as such the worth has additionally elevated. Then again, when it’s oversold, many are promoting, as such, its value is undervalued.

At the moment, the RSI for BCH exhibits a price of 38.28 and the RSI is above the Sign. Therefore, let’s imagine that BCH is bullish. Because the worth is neither overbought nor oversold, let’s imagine that the pattern is robust. Nonetheless, the RSI appears to be heading in the direction of the Sign line which is slightly below it. There’s a risk that the RSI may cross beneath the Sign line.

When wanting on the longer timeframe, we will see that the RSI is crashing beneath the Sign. The RSI reads a price of 48. Because the RSI is reciprocating the conduct of BCH, we will anticipate the costs to fall sooner or later. Nonetheless, the RSI is also used to detect divergences.

A divergence happens when the worth of the cryptocurrency strikes in the wrong way, to that of the RSI. For instance, when the crypto makes the next excessive, the RSI ought to make the next excessive. Nonetheless, within the occasion that the RSI makes a decrease excessive, then it’s known as a bearish divergence. If it occurs vice versa, then it’s a bullish divergence.

Bitcoin Money (BCH) Value Evaluation – Shifting Common

The exponential transferring common will not be a lot completely different from the straightforward transferring common. The EMA offers extra weightage to the current costs whereas the SMA equally distributes the values to the frequency. Therefore, when the EMA is plotted within the graph it offers a tough concept about how the cryptocurrency has been performing up to now.

Furthermore, the 50-day EMA is taken into account the short-term size, and the 200-day EMA is taken into account the long-term. Every time the 50-day EMA crosses the 200-day EMA from beneath it’s known as a Golden cross, whereas if it crosses from above, then it’s a demise cross.

We will see that at the moment, BCH is rising in the direction of the 50-day EMA after rebounding off of the 200-day EMA. If this movement of rising retains persevering with, we’d see BCH take a look at the 50-day EMA. Nonetheless, within the occasion that BCH is rejected at a 50-day EMA, it could search the help of the 200-day EMA. Nonetheless, when wanting on the candlesticks, we may see that the promoting strain is growing. If the sellers dominate the market, then BCH could fail to maintain its rising momentum.

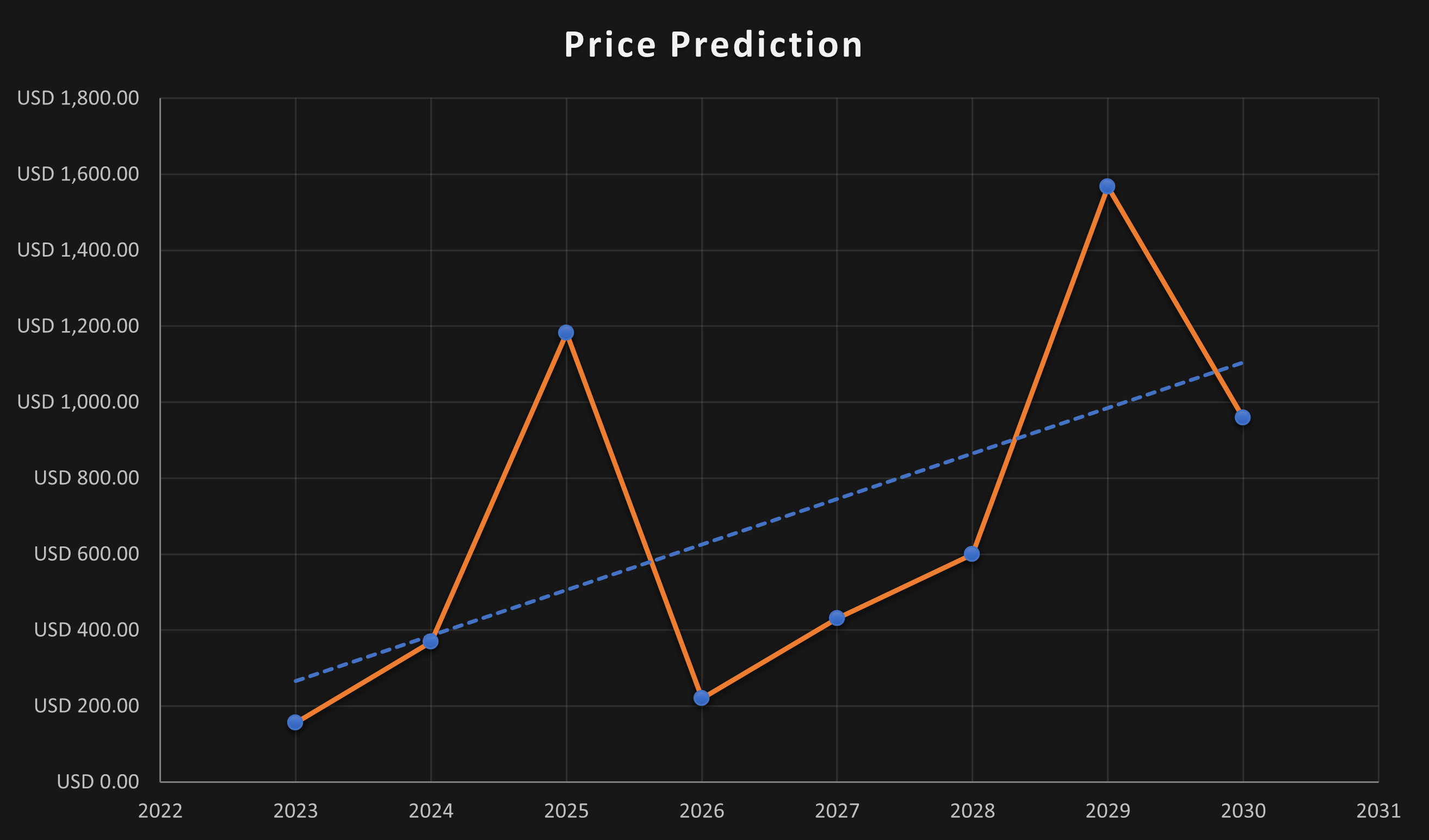

Bitcoin Money (BCH) Value Prediction 2023-2030 Overview

| Yr | Minimal Value | Common Value | Most Value |

| 2023 | $350 | $388 | $400 |

| 2024 | $680 | $728 | $800 |

| 2025 | $1,500 | $2,138 | $2,500 |

| 2026 | $1,000 | $1,164 | $2,000 |

| 2027 | $1,100 | $1,644 | $2,000 |

| 2028 | $1,500 | $1,995 | $2,800 |

| 2029 | $3,000 | $3,400 | $4,000 |

| 2030 | $2,500 | $3,219 | $3,800 |

| 2040 | $6,500 | $7,068 | $8,000 |

| 2050 | $8,500 | $10,846 | $15,000 |

Bitcoin Money (BCH) Value Prediction 2023

When wanting on the chart above, we may see that BCH has been fluctuating inside a falling wedge throughout the previous month. Nonetheless, in distinction to an upward pattern after the breakout, BCH has been transferring in a downward route. It broke out the falling wedge with a giant crimson candlestick and touched the decrease Bollinger band.

At press time BCH is transferring in the direction of the SMA, as such we may anticipate it to rise in the direction of Resistance 1 at $348 after which in the direction of $388.

Nonetheless, the Bollinger bands are going through downwards, as such, the costs of BCH have the opportunity of transferring in the direction of Help 1 at $110. The Fastened quantity profile indicator exhibits that there’s extra buying and selling within the upward route slightly than the wrong way. Because the current area is stuffed with buying and selling exercise with the Worth Space Up exceeding the Worth Space Down, the worth of BCH could stand up.

When wanting on the longer timeframe for BCH, we will see that the encircled portion exhibits some similarity. If BCH reciprocates its conduct in early 2020, then we’d see extra consolidation sooner or later. The value could swing between $388 and $95. As such, merchants could have to take heed and make educated choices.

Bitcoin Money (BCH) Value Prediction – Resistance and Help Ranges

We may see how BCH crashed slightly below the 1:2 Gann fan line earlier than receiving help on the 1-fib retracement degree. Because it obtained help entrance the 1 fib retracement degree in July 2022, BCH has been transferring sideways. It was predominantly underneath the 8:1 Gann fan from July 2022 till July 2023. With the daybreak of July 2023, BCH spiked and reached the three:1 Gann line. Nonetheless, shortly after reaching this degree, BCH crashed and is now reaching for help from the 8:1 Gann line.

Since BCH appears to have obtained help from the 8:1 Gann line, we may even see it rise towards the 4:1 Gann fan line.

Bitcoin Money (BCH) Prediction 2024

There will likely be Bitcoin halving in 2024, and therefore we must always anticipate a optimistic pattern out there resulting from consumer sentiments and the hunt by traders to build up extra of the coin. Nonetheless, the 12 months of BTC halving didn’t yield the utmost for BCH primarily based on the earlier halving. Therefore, we may anticipate BCH to commerce at a value, not beneath $728 by the top of 2024.

Bitcoin Money (BCH) Prediction 2025

BCH could expertise the after-effects of the Bitcoin halving and is anticipated to commerce a lot increased than its 2024 value. Many commerce analysts speculate that BTC halving may create a big impact on the crypto market. Furthermore, just like many altcoins, BCH will proceed to rise in 2025 forming new resistance ranges. It’s anticipated that BCH would commerce past the $2,138 degree.

Bitcoin Money (BCH) Prediction 2026

It’s anticipated that after a protracted interval of bull run, the bears will come into energy and begin negatively impacting the cryptocurrencies. Throughout this bearish sentiment, BCH may tumble into its help areas. Throughout this era of value correction, BCH may lose momentum and be approach beneath its 2025 value. As such, it might be buying and selling at $1,164 by 2026.

Bitcoin Money (BCH) Prediction 2027

Naturally, merchants anticipate a bullish market sentiment after the crypto business was affected negatively by the bears’ claw. Furthermore, the build-up to the subsequent Bitcoin halving in 2028 may evoke pleasure in merchants. Nonetheless, there’ll be a dip in value earlier than the thrill will likely be reciprocated in BCH. As such, we may anticipate BCH to commerce at round $1,644 by the top of 2027.

Bitcoin Money (BCH) Prediction 2028

Because the crypto neighborhood’s hope will likely be re-ignited wanting ahead to Bitcoin halving like many altcoins, BCH could reciprocate its previous conduct throughout the BTC halving. Therefore, BCH can be buying and selling at $1,995 after experiencing a substantial surge by the top of 2028.

Bitcoin Money (BCH) Prediction 2029

2029 is anticipated to be one other bull run as a result of aftermath of the BTC halving. Nonetheless, merchants speculate that the crypto market will step by step change into secure by this 12 months. In tandem with the secure market sentiment, BCH might be buying and selling at $3,400 by the top of 2029.

Bitcoin Money (BCH) Prediction 2030

After witnessing a bullish run out there, BCH and plenty of altcoins would present indicators of consolidation and may commerce sideways and transfer downwards for a while whereas experiencing minor spikes. Subsequently, by the top of 2030, BCH might be buying and selling at $3,219.

Bitcoin Money (BCH) Prediction 2040

The long-term forecast for BCH signifies that this altcoin may attain a brand new all-time excessive(ATH). This might be one of many key moments as HODLERS could anticipate to promote a few of their tokens on the ATH level.

If they begin promoting then BCH may fall in worth. It’s anticipated that the common value of BCH may attain $7,068 by 2040.

Bitcoin Money (BCH) Prediction 2050

Since Cryptocurrency will likely be revered and broadly accepted by most individuals throughout the 2050s, we’ll see the plenty consider extra in it. As such BCH may attain $10,846.

Conclusion

If traders proceed displaying their curiosity in BCH and add these tokens to their portfolio, it may proceed to rise. BCH’s bullish value prediction exhibits that it may attain the $388 degree.

FAQ

Bitcoin Money (BCH) is a tough fork of Bitcoin that emerged on account of an try to extend the utmost block dimension of Bitcoin.

BCH tokens will be traded on many exchanges like different digital belongings within the crypto world. Binance, Coinbase, KuCoin, and Kraken are a few of them.

BCH has a risk of surpassing its current all-time excessive (ATH) value of $4,355.62. Nonetheless, as a result of optimistic sentiments of its traders, this might be reached inside a brief body of time.

BCH is without doubt one of the few cryptocurrencies that has proven resilience for a lot of days. If this momentum is maintained, BCH may attain $388 quickly after it breaks the Resistance 1 degree.

BCH has been one of the appropriate investments within the crypto house. It has been rising exponentially, therefore, merchants could also be allured to spend money on BCH.

BCH has a gift all-time low value of $75.08.

The utmost provide of BCH is unavailable.

BCH will be saved in a chilly pockets, scorching pockets, or alternate pockets.

BCH is anticipated to succeed in $728 by 2024.

BCH is anticipated to succeed in $2,138 by 2025.

BCH is anticipated to succeed in $1,164 by 2026.

BCH is anticipated to succeed in $1,644 by 2027.

BCH is anticipated to succeed in $1,995 by 2028.

BCH is anticipated to succeed in $3,400 by 2029.

BCH is anticipated to succeed in $3,219 by 2030.

BCH is anticipated to succeed in $7,068 by 2040.

BCH is anticipated to succeed in $10,846 by 2050.

Disclaimer: The views and opinions, in addition to all the knowledge shared on this value prediction, are revealed in good religion. Readers should do their very own analysis and due diligence. Any motion taken by the reader is strictly at their very own danger. CoinEdition and its associates won’t be held responsible for any direct or oblique harm or loss.