- BCH’s shopping for power has turn into weak since much less cash flowed into the market.

- Regardless of a barely bullish bias, the coin may solely address consolidation round $262.

- Merchants evaded lengthy positions, as indicators emerged that BCH’s worth might drop decrease.

Bitcoin Money (BCH) has been pressured to take care of retracement after a latest lengthy interval of printing inexperienced. Regardless of the lower in worth, the coin’s 30-day efficiency remained round a 149% hike.

One motive why BCH, Bitcoin’s (BTC) 2017 laborious fork rallied, was due to its inclusion within the EDX Markets alternate launch. In consequence, BCH crossed the $300 threshold on June 30.

A Rally Might Not Be Fast

Apart from that, the BCH/KRW buying and selling pair had the very best quantity on South Korean alternate Upbit, CoinMarketCap revealed. This helped the cryptocurrency get better once more on July 6 after an preliminary drawdown.

However regardless of remaining within the high two buying and selling volumes on Upbit, BCH’s worth had decreased to $282 at press time.

From the BCH/USD 4-hour chart, the Chaikin Cash Movement (CMF) had fallen to -0.04. The CMF, crossing beneath the zero line signifies that BCH’s power out there might have turn into weak.

Moreover, this was an indication of extra capital outflows than inflows. So, distribution thrived over accumulation. Thus, BCH might discover it extraordinarily difficult to development upward because of the waning demand.

The chart above additionally thought of BCH’s volatility. Based mostly on the Bollinger Bands (BB), the coin’s volatility started contracting since promoting strain began round $297.21 on July 3.

Nonetheless, the strain led BCH to an oversold degree after the worth touched the decrease band at $262.42. At this level, the contraction cooled a bit. Additionally, the BCH worth had eluded touching the decrease or higher band. Due to this fact, the coin may proceed consolidation within the quick time period.

Anticipating One other Lower?

Moreover, the Shifting Common Convergence Divergence (MACD) collapsed across the mid-point at 0.67. In the identical vein, each consumers and sellers have been struggling for management for the reason that orange and blue dynamic traces closed in on one another.

Nonetheless, the MACD remaining above zero signifies that there was extra bullish tendency than a bear sign. However on the identical time, if the BCH worth was to extend, it would solely be slight.

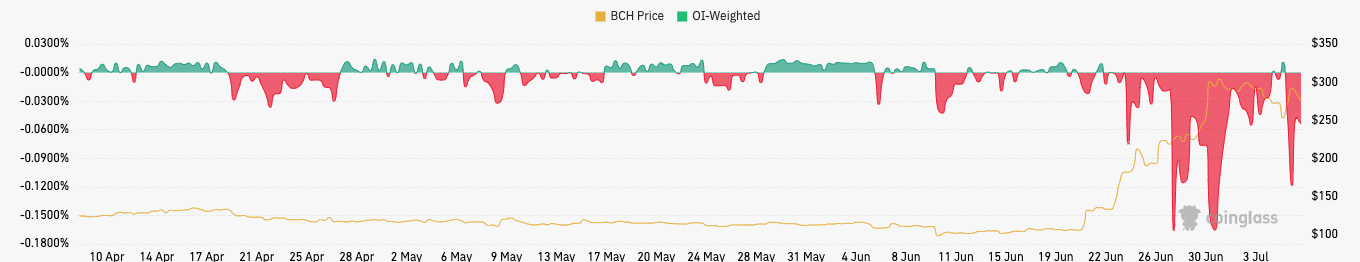

In the meantime, BCH’s 8-hour funding fee was all the way down to $274 at press time. Usually, the funding fee means the distinction between the perpetual worth of an asset and its spot worth.

When the funding fee is optimistic, it implies that merchants are bullish. However BCH’s funding fee lower means that quick merchants have been dominant. Thus, the broader market expects the cryptocurrency to plunge additional.

In conclusion, traders anticipating BCH to regain the $300 mark may want to attend longer. Because the technical outlook revealed, consolidation or a drop beneath its present worth may very well be on the playing cards.

Disclaimer: The views, opinions, and knowledge shared on this worth prediction are revealed in good religion. Readers should do their analysis and due diligence. Any motion taken by the reader is strictly at their very own threat. Coin Version and its associates won’t be accountable for direct or oblique injury or loss