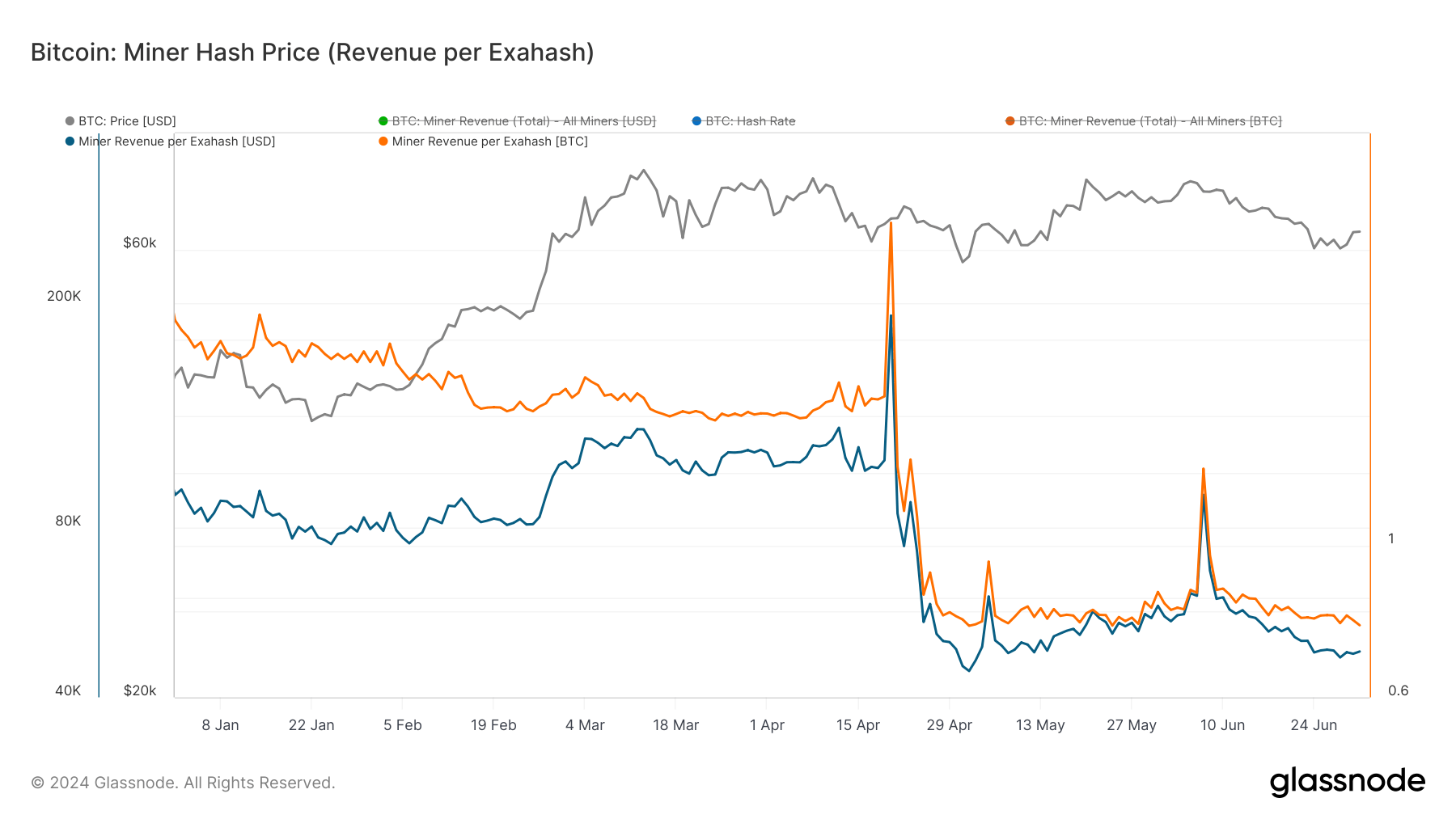

Miner income per exahash measures miners’ day by day revenue relative to their contribution to the community’s hash charge, exhibiting how a lot miners earn per unit of computational energy they contribute. This metric is necessary as a result of it displays the profitability and financial viability of Bitcoin mining, instantly influencing choices on useful resource allocation, funding, and operational methods. Given the dimensions of the Bitcoin mining sector and the efficiency of public mining firms, these metrics turn out to be much more vital.

Since Bitcoin’s fourth halving on April 20, miner income per exahash has declined steeply. Whereas this decline was anticipated and miners have been making ready for it, it precipitated vital financial stress for miners. Initially, on April 20, the miner income per exahash was $190,620 or 2.96 BTC. Nonetheless, by Could 2, it had plummeted to an all-time low of $44,538 or 0.76 BTC.

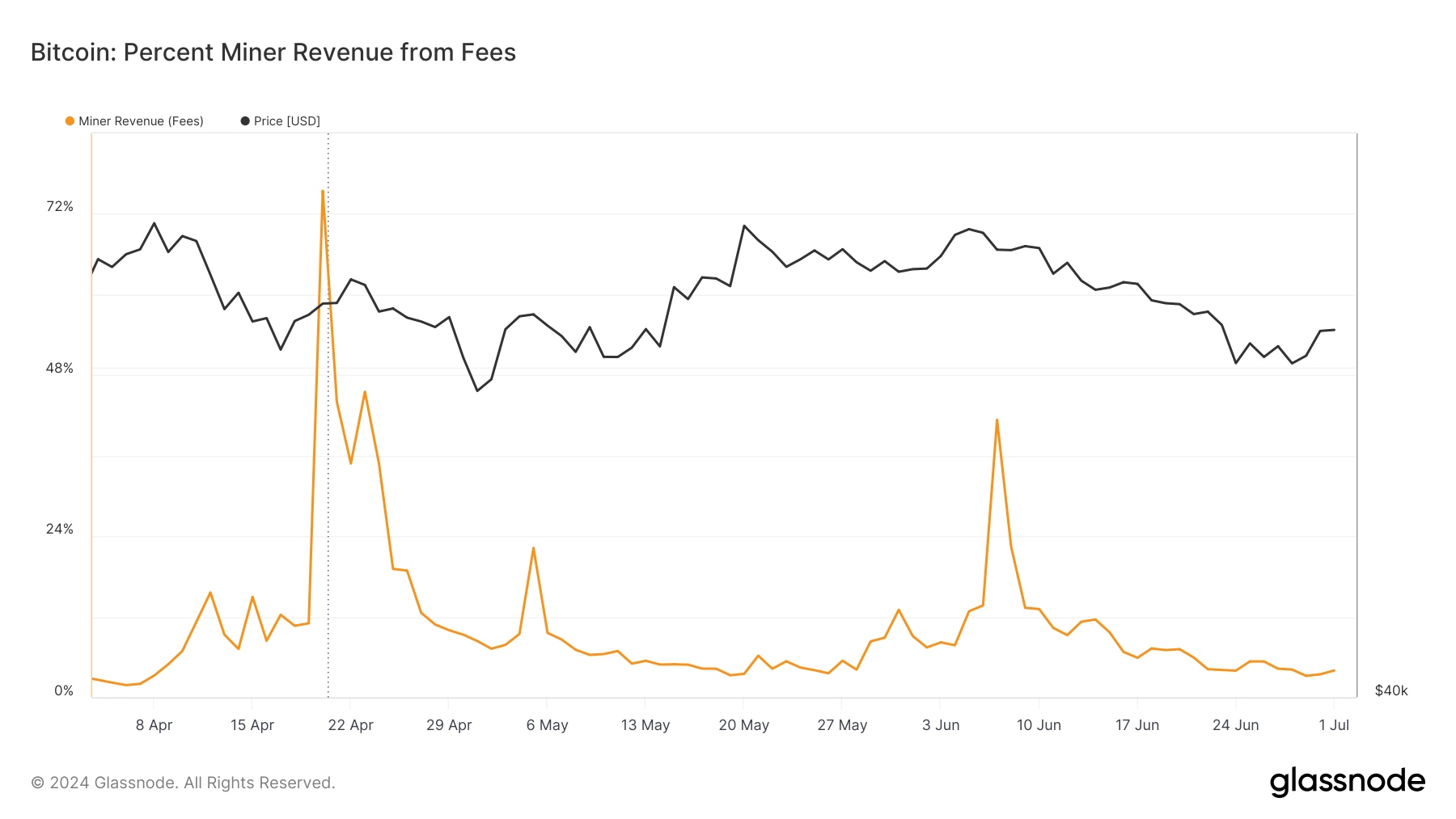

Glassnode’s knowledge confirmed a quick income restoration peaking on June 7 with $91,774 or 1.29 BTC per exahash. This non permanent enhance was pushed by a major surge in transaction charges as a consequence of community congestion, with charges comprising 41.335% of miner income on that day, a considerable rise from simply 7% three days earlier. This peak reveals the occasional spikes in miner income as a consequence of community exercise and highlights the significance of transaction charges as a supplementary revenue stream for miners, considerably when block rewards diminish.

As of July 1, miner income per exahash stands at $48,230 or 0.76 BTC, indicating a decrease stabilization stage than pre-halving figures. This extended interval of diminished income poses challenges for miners, notably these with increased operational prices or much less environment friendly {hardware}.

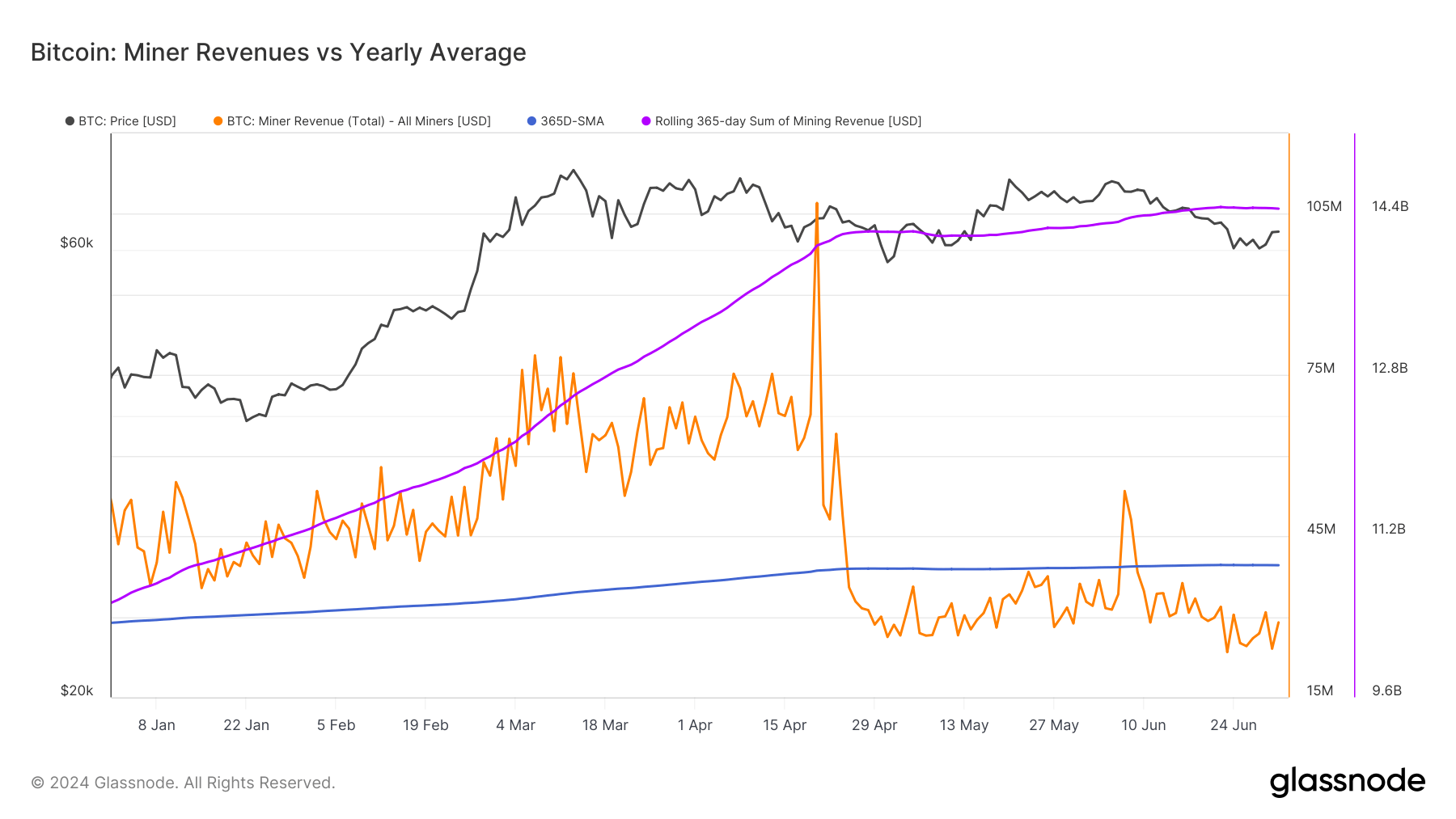

In evaluating miner income in opposition to the yearly common, we see that whole day by day USD income paid to Bitcoin miners has remained beneath the 365-day easy shifting common since April 25, aside from the spike on June 7. This vital development marks a departure from the earlier 15 months, the place miner income typically exceeded the yearly common. Sustained income beneath the annual common suggests a interval of diminished profitability for miners, which may result in broader implications for the mining trade and the Bitcoin community.

The drop in income relative to the yearly common highlights elevated volatility and the potential for monetary pressure on miners. In response to those financial pressures, Bitcoin miners have been enterprise varied methods to mitigate the affect of diminished revenues. CleanSpark’s acquisition of GRIID Infrastructure for $155 million reveals firms are consolidating to leverage economies of scale. Bitdeer’s announcement of a 570 MW growth in Ohio demonstrates the identical strategic strategy: growing operational capability to boost total output and mitigate the consequences of decrease income per unit of hash energy.

Marathon’s diversification into mining altcoins like Kaspa is one other instance of miners looking for different income streams. By not solely counting on Bitcoin, Marathon Digital is hedging in opposition to Bitcoin-specific market dangers and broadening its income base. Core Scientific signed a $3.5 billion cope with CoreWeave to diversify past Bitcoin mining into AI-related actions, showcasing one other shift in technique.

The marginal drop in Bitcoin mining issue reveals that a number of miners discover it difficult to stay operational. This issue adjustment may assist rebalance the community, permitting remaining miners to profit from barely diminished competitors and probably increased revenues if the Bitcoin value or transaction charges enhance.

Nonetheless, the arrogance within the mining sector solely appears to develop. US-listed Bitcoin miners noticed an enormous surge in inventory value over the previous week, reaching a document market capitalization of $22.8 billion. This means traders are optimistic in regards to the long-term prospects of Bitcoin mining firms, seemingly as a consequence of their strategic diversifications and the potential for future income development as community congestion and transaction charges fluctuate.

The put up Bitcoin miners diversify and consolidate to outlive income drop appeared first on StarCrypto.