- Bitcoin worth has declined by almost 7% up to now week, with bulls failing to carry above the $70k degree. BTC has at this time retreated to round $66,350 amid recent promoting stress.

- Whereas costs are down because the market reacts to macroeconomic occasions, analysts at CryptoQuant say among the draw back comes from sell-off stress dealing with miners.

In response to a CryptoQuant replace on Thursday, there’s been an uptick in mining pool transfers and OTC desk gross sales for BTC. Some main publicly-traded Bitcoin mining firms have additionally lately decreased their holdings.

“BTC miners have ramped up promoting as costs fluctuated between $69k and $71k. On June ninth, transfers from mining swimming pools to Binance surged, hitting a 2-month peak of over 3,000 BTC. This shift aligns with a worth correction, that dropped Bitcoin to $66k,”the CryptoQuant group famous in a put up on X

Knowledge additionally exhibits elevated OTC gross sales, with the most recent being a 1,200 BTC OTC desk sale on June 10.

In the meantime, main US Bitcoin mining corporations have offered off cash – as an illustration, Marathon Digital (MARA) offloaded 1,400 BTC in June. The corporate solely offered 390 in Might.

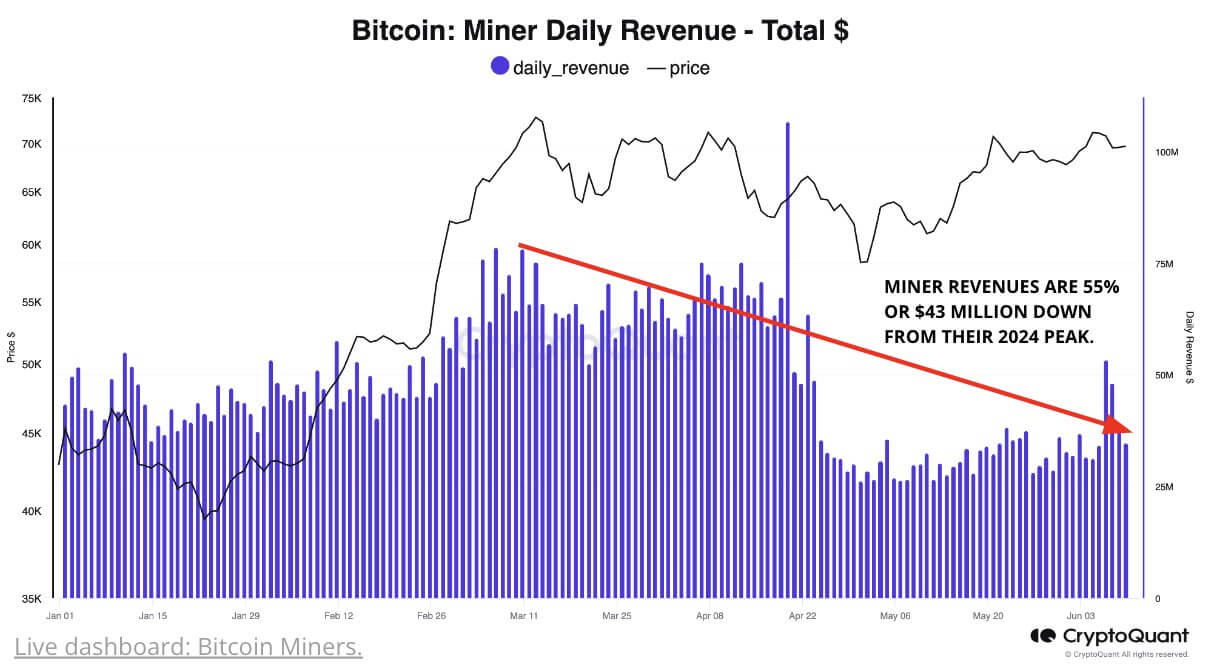

Miner income plummeted 55%

Miner sell-off stress has intensified as mining income fell.

For instance, post-halving, each day miner revenues have reached $35 million. In March, that peaked at over $78 million, indicating a pointy decline of 55%.

“Amidst low miner revenues post-halving, each day Bitcoin transaction charges have dropped to round 65 Bitcoin from 117 previous to April 18th. Regardless of record-high transactions, median transaction charges in USD stay low, underscoring the stress on miners’ earnings,” the CryptoQuant group famous.

The analysts additionally say that the Bitcoin community has additionally seen a dip in hashrate post-halving, however that’s solely by 4%.

It means miners face stiff competitors amid a decreased block reward and a mixture of low miner revenues and excessive hashrate “usually level to potential market lows.”

“Since Might, miners have confronted vital underpayment, suggesting we could be close to a worth backside,”