Bitcoin’s drop to under $50,000 on Aug. 5 marked the most important drawdown within the present cycle, leading to substantial revenue losses and liquidations. And whereas BTC has proven stable indicators of restoration since then, consolidating round $60,000, the market nonetheless stays cautious because it just lately dipped under this psychological help.

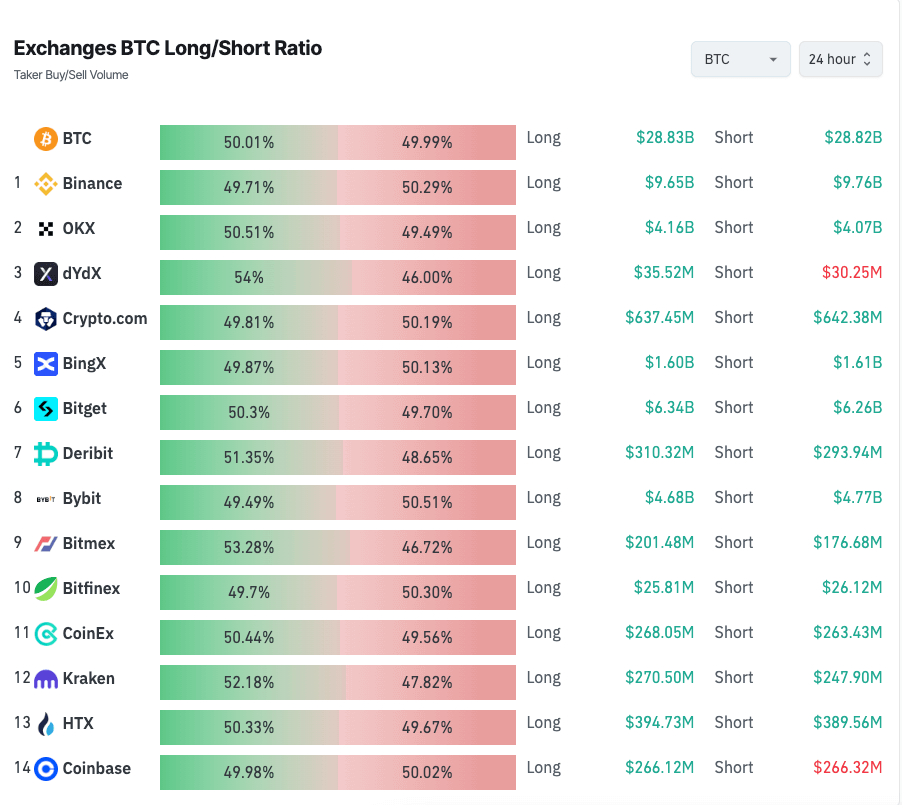

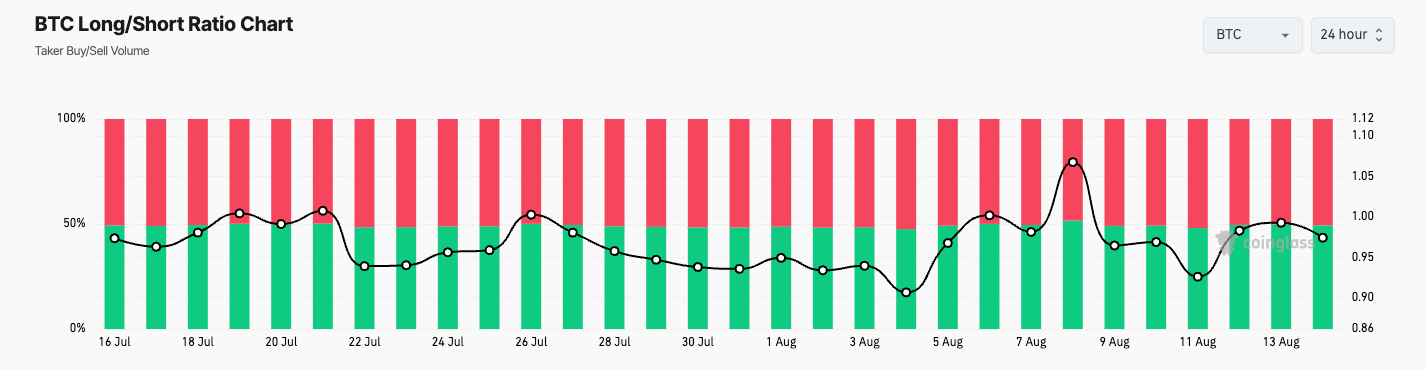

This cautiousness is greatest seen within the derivatives market, the place the futures lengthy/brief ratio has stabilized round 1, with longs at 50.16% and shorts at 49.85%.

This near-equal distribution reveals a scarcity of clear directional bias amongst merchants. The present ratio represents a major shift from the bullish outlook noticed earlier within the month, which peaked on Aug. 8 with a ratio of 1.068.

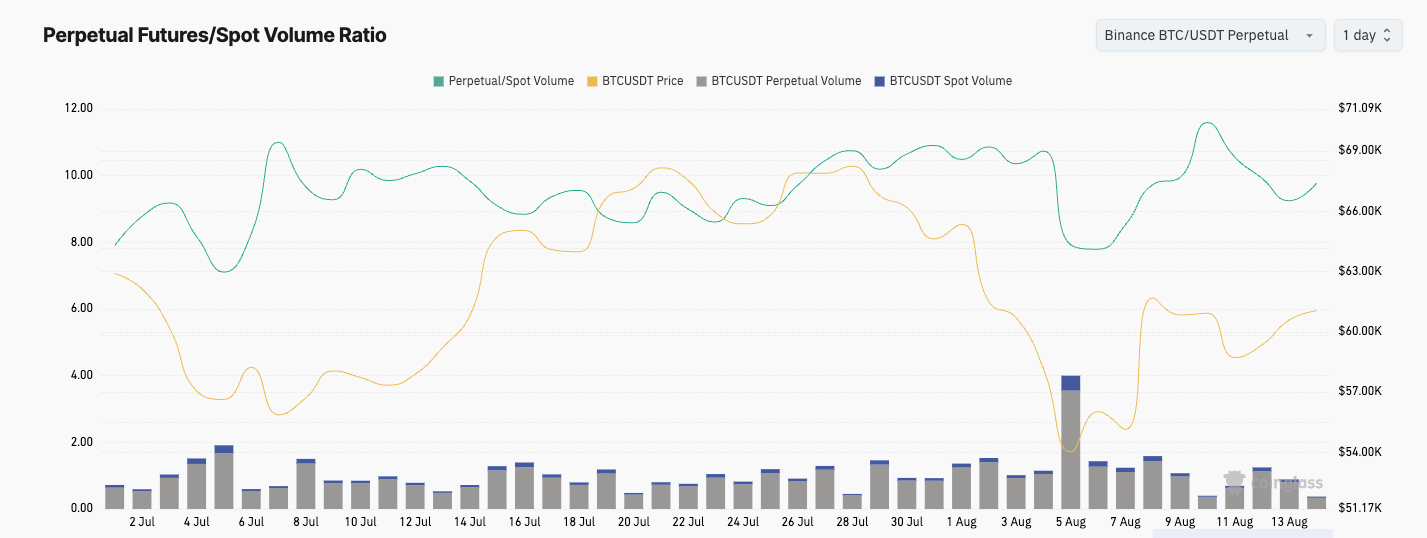

With perpetual futures turning into the dominant Bitcoin derivatives buying and selling instrument, this lack of directional bias may be simply maintained. On Aug. 5, perpetual futures quantity reached $67.88 billion, almost eight occasions the spot market quantity of $8.58 billion. The perpetual futures to identify quantity ratio hit its second-highest degree this 12 months on Aug.10, reaching 11.60.

Such a excessive futures-to-spot quantity ratio reveals simply how essential derivatives are in value discovery and liquidity. Excessive volumes, as we’ve seen over the previous 12 months, are inclined to result in elevated volatility and sooner value actions. And with nearly all of that quantity on Binance, the volatility danger turns into even higher.

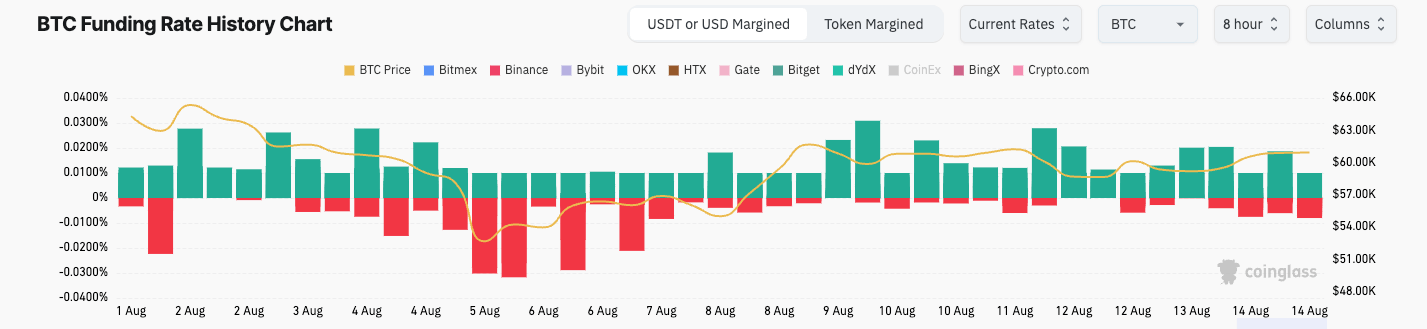

Perpetual futures funding charges have been persistently unfavourable since Aug. 13, following a interval of primarily optimistic charges earlier within the month. The numerous quantity in Bitcoin perpetual futures suggests excessive leverage out there. Destructive funding charges within the perpetual futures market point out short-term bearish strain. Nevertheless, this might additionally set the stage for a possible brief squeeze if shopping for strain emerges from one other rally.

The sluggish restoration we’ve seen in open curiosity additional confirms that the Bitcoin market is presently in a state of cautious restoration. Whereas the worth has rebounded from its latest low, derivatives information reveals that merchants are nonetheless unsure about future course.

The dominance of perpetual futures and the balanced lengthy/brief ratio level to a market that might expertise vital volatility within the close to time period, as a big portion of extremely refined merchants are getting ready for the market to go each methods.

The put up Bitcoin market cautious as longs and shorts stability out appeared first on StarCrypto.