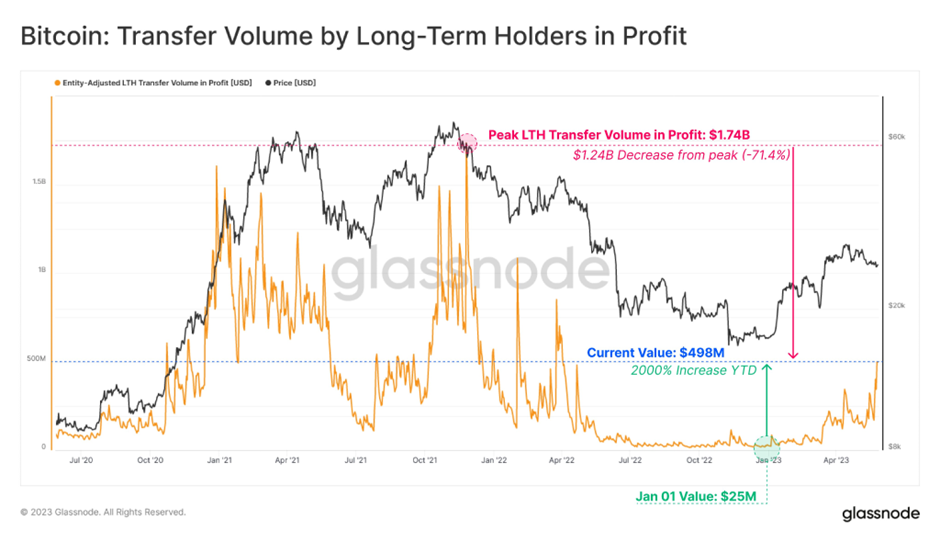

- Glassnode tweeted Bitcoin switch quantity despatched by long-term holders in revenue has surged by virtually 2000% YTD.

- Present worthwhile switch quantity for BTC is $1.24B, 71.4% decrease than the height throughout the 2021 Bull Market.

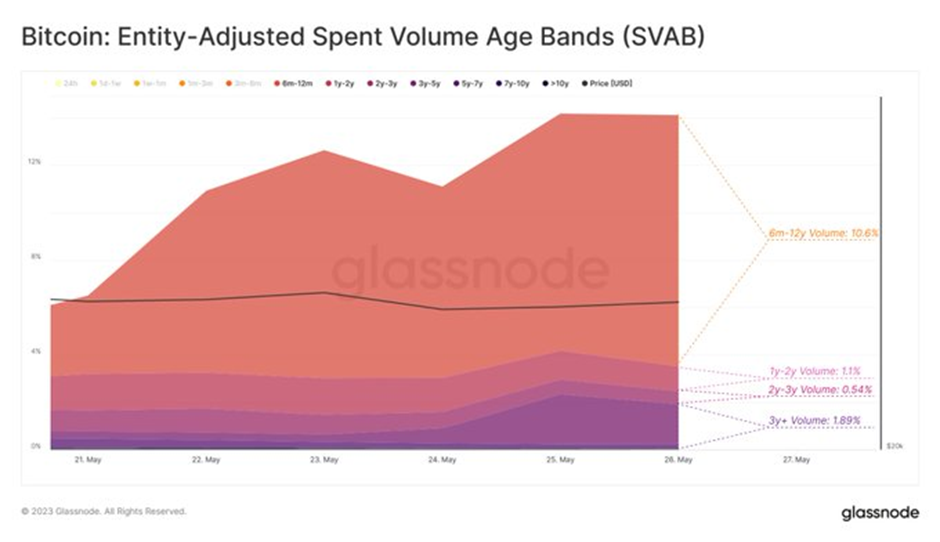

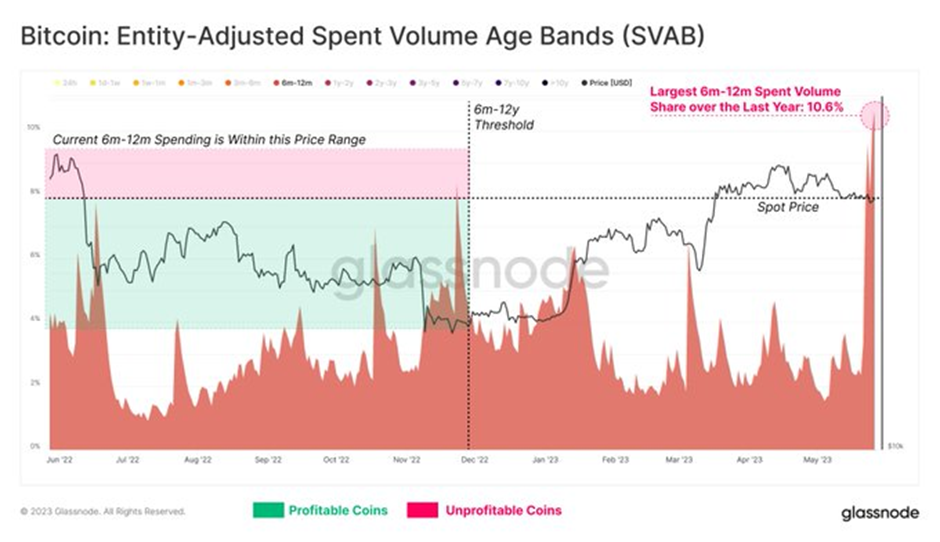

- The 6-month to 12-month cohort of long-term holders are the biggest spenders.

Knowledge analytics platform Glassnode reported that the Bitcoin switch quantity despatched by long-term holders in revenue has skilled a noteworthy rise year-to-date (YTD), surging from $25 million to $489 million, marking an virtually 2000% improve.

Nonetheless, the present worthwhile switch quantity for BTC stands at $1.24 billion, which is 71.4% decrease than the height of $1.74 billion witnessed throughout the 2021 Bull Market.

In the meantime, upon inspecting the breakdown of the Bitcoin long-term holder (LTH) spending by age cohort, Glassnode expressed that it turns into obvious that the 6-month to 12-month cohort stands out as the biggest spenders. They’ve recorded a switch quantity thrice better than all different LTH cohorts – 1 yr or extra.

Furthermore, when analyzing the spending vary for cash aged 6 months to 12 months, Glassnode says it is very important word that out of a complete of 183 potential acquisition days, 167 of them (92%) are at present in a worthwhile place relative to the present spot worth. This data helps to contextualize each the excessive quantity of spending inside the 6-month to 12-month age cohort and the latest surge in worthwhile switch quantity.

Moreover, in a earlier tweet, Glassnode famous that The Bitcoin market continues to function in a state of unrealized revenue, with the provision at present in revenue being virtually twice as giant as the provision in loss, at a ratio of 1.9 to 1.

Nonetheless, the platform emphasizes that it is very important word that this ratio continues to be significantly decrease than the height reached throughout the exuberance of the 2021 Bull Market. At the moment, the Provide in Revenue and Loss Ratio soared to a staggering worth of 554.5, indicating a a lot greater diploma of profitability available in the market.

Disclaimer: The views and opinions, in addition to all the knowledge shared on this worth evaluation, are revealed in good religion. Readers should do their very own analysis and due diligence. Any motion taken by the reader is strictly at their very own threat. Coin Version and its associates won’t be held chargeable for any direct or oblique injury or loss.