- BTC worth is close to the $30k mark, which bulls could also be determined to guard.

- Bitcoin’s historic volatility is at its lowest stage in 2023.

- Brief-term bullish goal may very well be above $34k, whereas main help is close to $28.2k.

Bitcoin’s worth stays above $30,000 on Monday, however is seeing “remarkably little volatility.” In response to a key technical evaluation indicator for this measure, the costs are tightly squeezed to recommend a breakout in both course may very well be huge.

Bitcoin worth outlook: Bollinger Bands

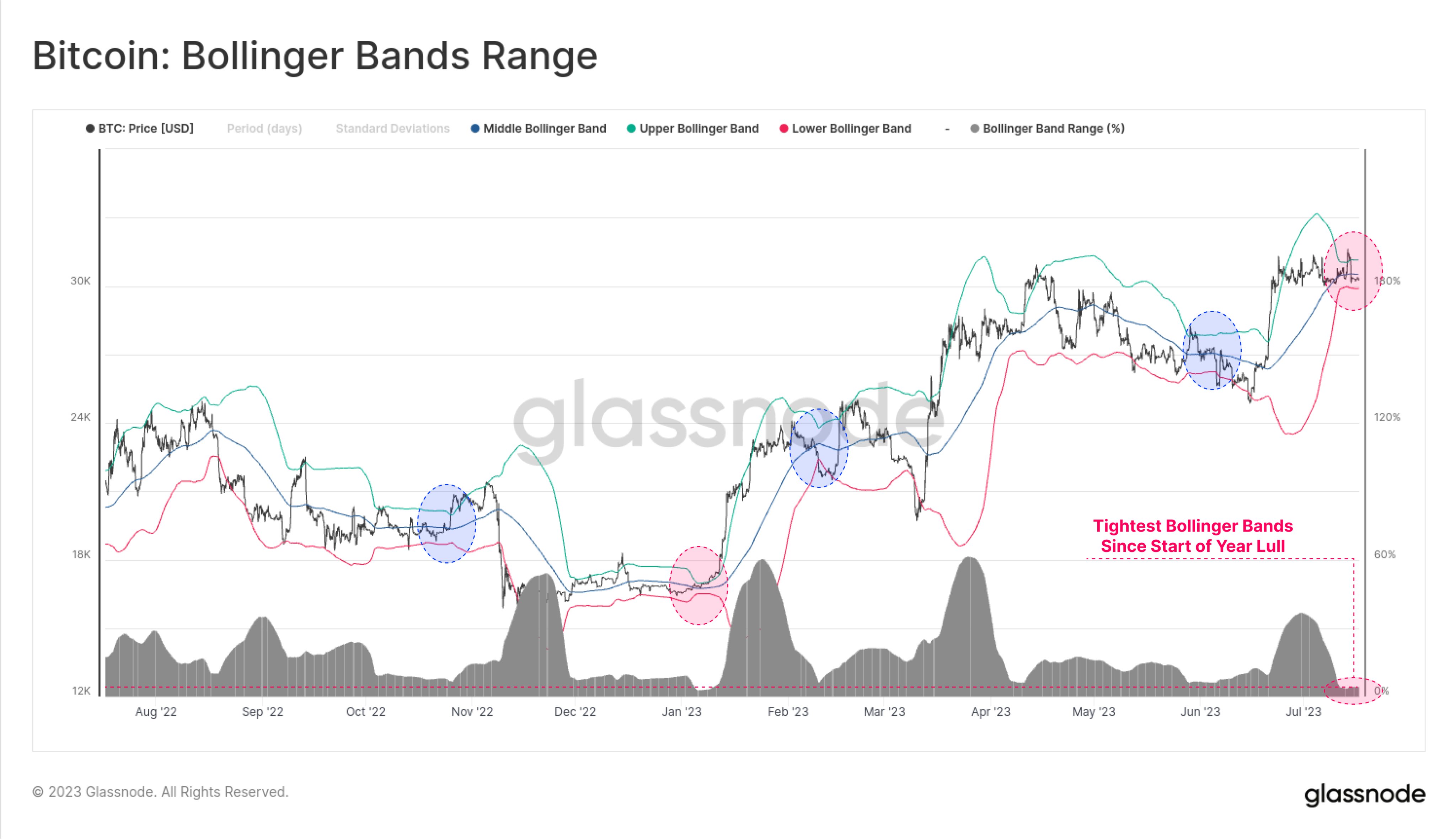

In response to on-chain knowledge and analytics supplier Glassnode, the Bollinger Bands are tightly squeezed and a worth vary of solely 4.2% separates the higher and decrease bands. The platform notes that this outlook has Bitcoin at its quietest since early January.

“The digital asset market continues to see remarkably little volatility, with the traditional 20-day Bollinger Bands experiencing an excessive squeeze. A worth vary of simply 4.2% separates the higher and decrease Bollinger bands, making that is the quietest #Bitcoin market for the reason that lull in early January,” Glassnode analysts tweeted, sharing the chart beneath.

Bitcoin worth Bollinger Bands vary. Supply: Glassnode on Twitter.

Bitcoin worth Bollinger Bands vary. Supply: Glassnode on Twitter.

In technical evaluation, the Bollinger indicator gives a chart outlook the place worth developments replicate the market’s volatility. Merchants use the indicator to determine overbought or oversold market circumstances.

Bitcoin just lately broke from above the higher bands and at the moment fluctuates beneath the center trendline. Assist of the decrease Bollinger bands is across the essential $30k stage.

Knowledge reveals BTC worth has declined from highs of $30,400 late Sunday, touching intraday lows of $30.079 on Monday morning. Presently at round $30,180, the highest cryptocurrency by market cap is down about 0.5%.

Whereas accumulation across the present costs is staggering, bulls have to carry above this psychological help base. If not, bears might push decrease first earlier than a probable brief squeeze catapults BTC/USD to doubtlessly information YTD highs of $34k. The important thing downturn ranges to observe within the brief time period are at $28,200 and $25,600.