Bitcoin’s value motion over the previous week has been outstanding, marked by its milestone climb previous $100,000.

Whereas this monumental degree was short-lived, with BTC rapidly correcting to round $91,000 earlier than rebounding to round $97,000, it stays a big achievement. Since first breaching the milestone, Bitcoin has handed via the $100,000 mark a number of occasions, indicating it’s already failing as both help or resistance. The market’s capacity to maintain these elevated ranges is a testomony to the robust underlying demand for BTC.

The truth that Bitcoin hasn’t seen a pointy selloff or a return to cost ranges beneath $90,000 after failing to consolidate above $100,000 is a powerful indicator that the promoting strain is being met by equally robust, if not stronger, shopping for curiosity. At this degree, demand stays sturdy sufficient to counteract any makes an attempt to decrease the worth. Costs round $94,000 have proven robust help, with a number of wicks down to those ranges earlier than rebounding.

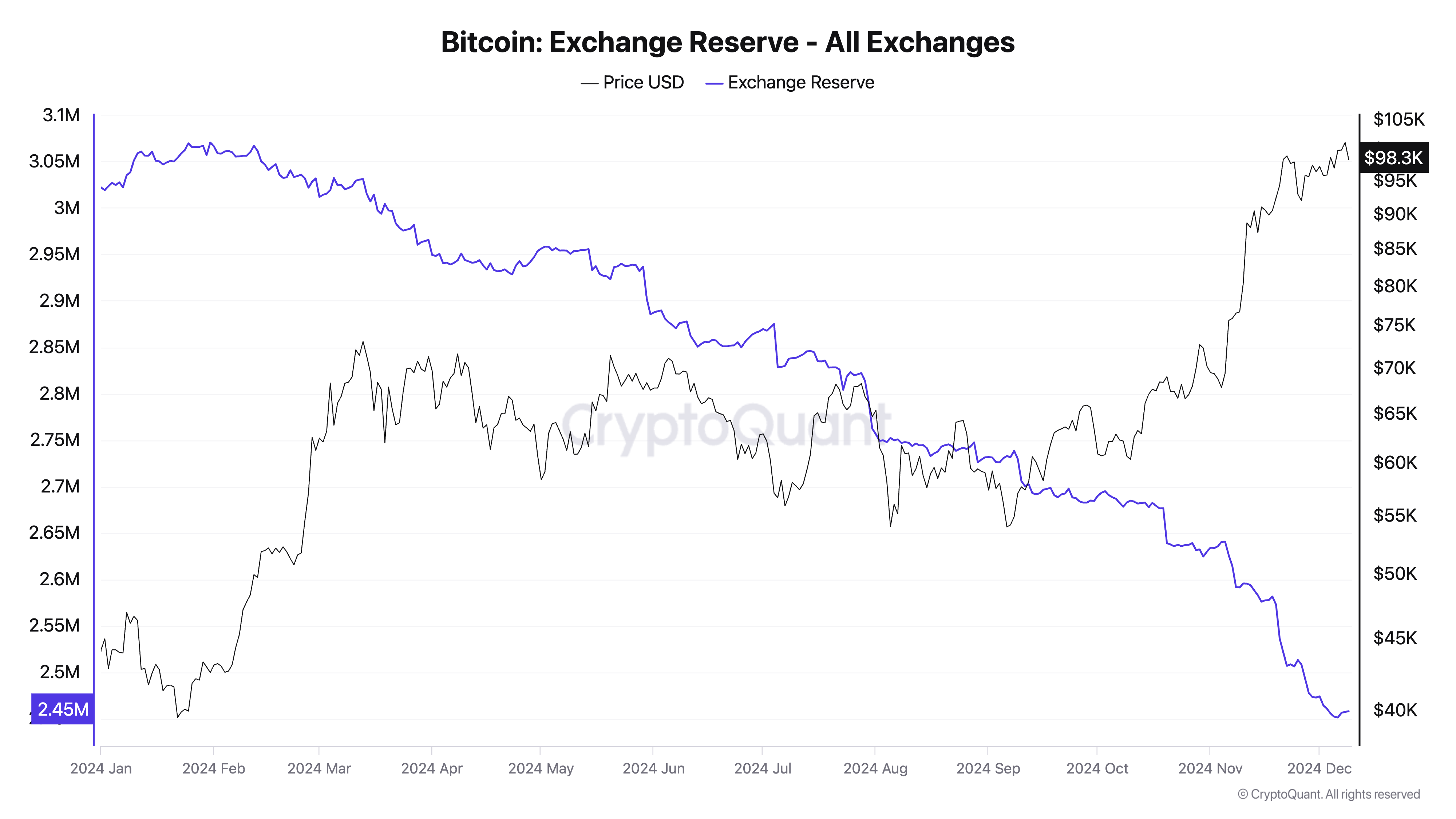

This steadiness between demand and provide is clear when analyzing the connection between trade reserves and trade web flows. Trade reserves — Bitcoin held on centralized platforms — have been steadily declining over the long run and at the moment are at round 2.45 million BTC.

This development displays a transparent desire amongst market members to maneuver Bitcoin into private wallets or chilly storage, signaling confidence in Bitcoin’s long-term worth. Declining reserves scale back the availability of Bitcoin obtainable for speedy sale, which often helps value stability or upward motion.

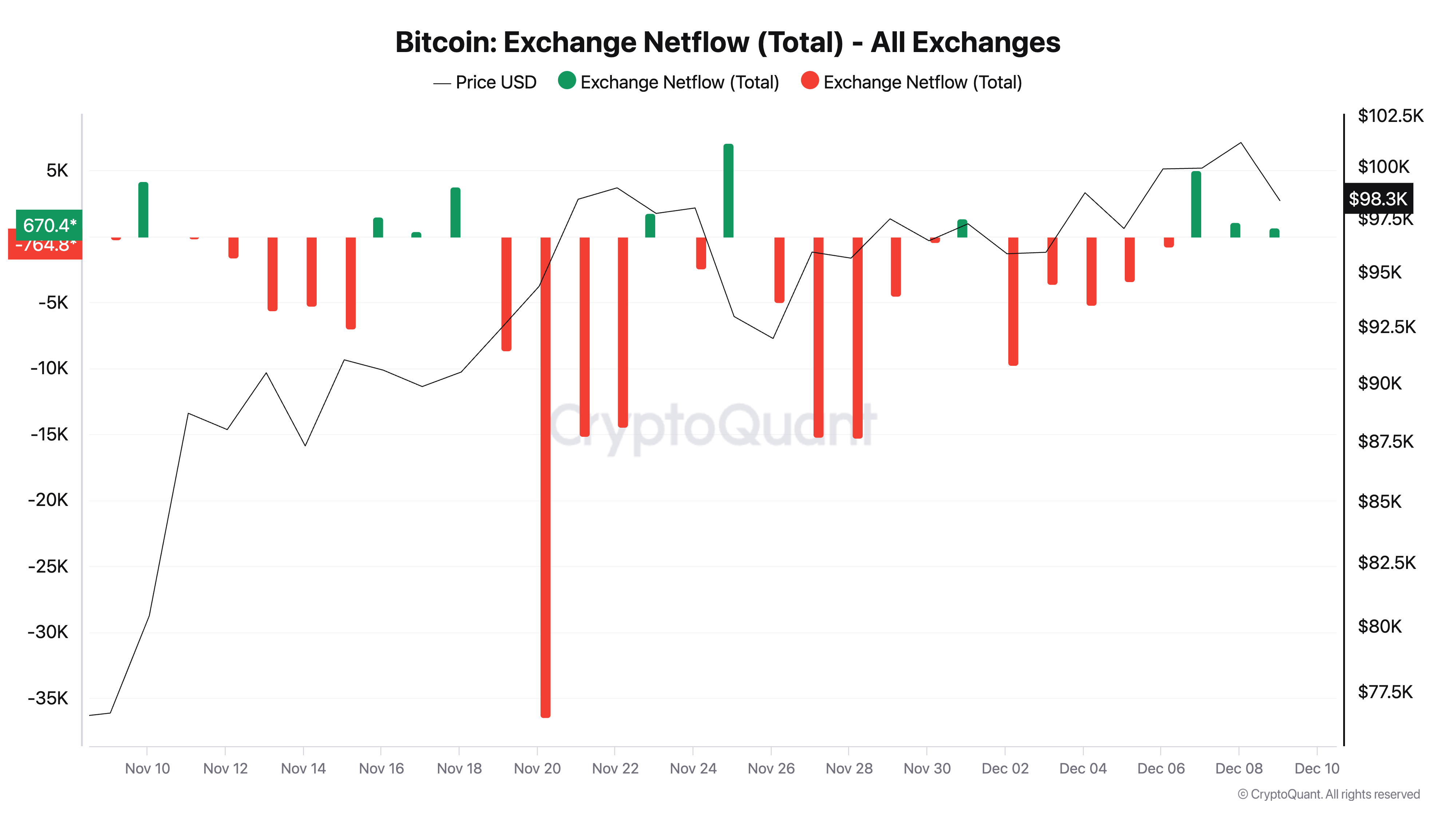

In distinction, trade netflows paint a barely totally different image within the quick time period. Netflows, which measure the distinction between Bitcoin inflows and outflows to exchanges, have proven occasional spikes in inflows over the previous week. These spikes recommend that some traders are shifting Bitcoin again to exchanges, more likely to take income following the latest value rally or to hedge their positions.

Nevertheless, these inflows haven’t translated into important downward strain on the worth. This aligns with a earlier StarCrypto evaluation, which discovered {that a} appreciable quantity of downward value motion comes from the derivatives market.

This suggests that a lot of the Bitcoin being deposited onto exchanges is being absorbed by patrons, stopping any substantial value drop. The distinction between declining long-term reserves and sporadic short-term inflows highlights a balanced market the place provide and demand forces are evenly matched.

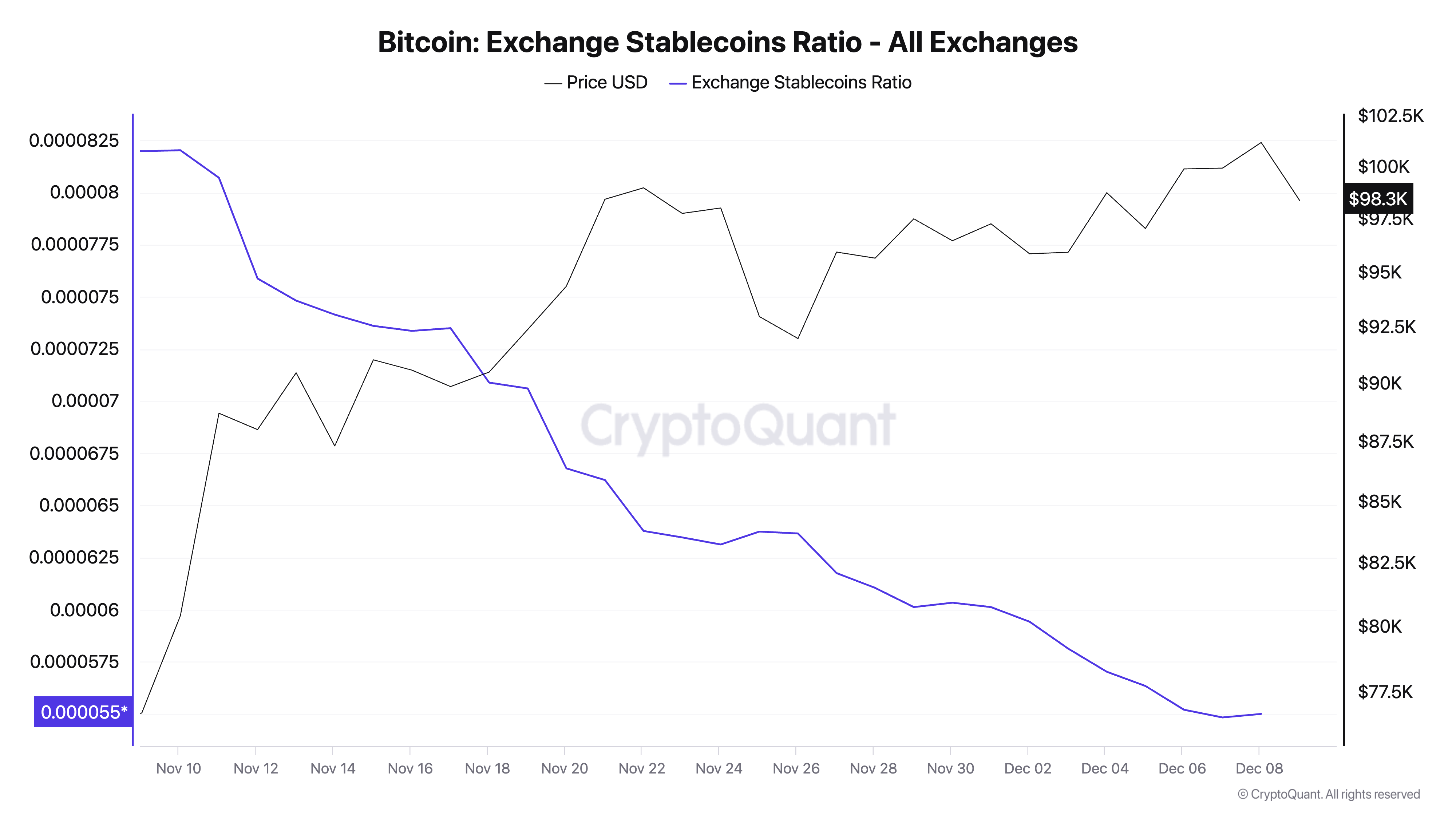

Ample shopping for strain is additional confirmed by trying on the trade stablecoin ratio. Beforehand analyzed by StarCrypto, this metric measures the quantity of Bitcoin reserves relative to stablecoin reserves held on exchanges. A decrease ratio signifies a better proportion of stablecoins, signifying that exchanges are well-capitalized with shopping for energy.

With the trade stablecoin ratio at the moment at an all-time low, we are able to see that the market is flush with liquidity and able to soak up any promoting strain from exchanges. Having a big variety of stablecoins obtainable on exchanges permits the market to maintain demand for Bitcoin even within the face of elevated promoting exercise—such because the one we noticed when BTC handed $100,000.

The low stablecoin ratio enhances the traits in trade reserves and web flows. Whereas reserves present a structural decline in obtainable Bitcoin and web flows spotlight short-term promoting makes an attempt, the abundance of stablecoins confirms that there’s sufficient capital on the sidelines to soak up this promoting.

Collectively, these metrics paint an image of a market well-supported by liquidity, even because it navigates intervals of profit-taking. This liquidity seemingly has stored Bitcoin between $95,000 and $99,000 regardless of its incapability to reclaim $100,000 for now.

The declining trade reserves level to lowered promoting liquidity over the long run, creating a possible provide squeeze. On the identical time, the presence of stablecoins alerts that purchasing curiosity shouldn’t be solely current however substantial sufficient to counteract promoting makes an attempt.

Web flows act as a real-time gauge of short-term sentiment, and the truth that inflows haven’t led to a breakdown in value additional confirms the energy of demand. This creates a suggestions loop the place promoting strain is mitigated by the liquidity offered by stablecoins whereas falling reserves be sure that even modest demand can considerably influence value.

The put up Bitcoin holds regular close to $100,000 as promoting strain is absorbed appeared first on StarCrypto.