- Bitcoin rose to $26,820 on Wednesday, buying and selling in the wrong way to shares because the Greenback Index hit a 10-month excessive.

- An easing for the DXY may see Bitcoin value strengthen above the $26k base.

Bitcoin (BTC) defied a surge for the Greenback Index (DXY) on Wednesday, spiking to above $26,820 in early US buying and selling hours. The beneficial properties for the benchmark cryptocurrency buoyed the altcoin market, with a number of tokens seeing respectable strikes to push the full market cap up by about 1.5%.

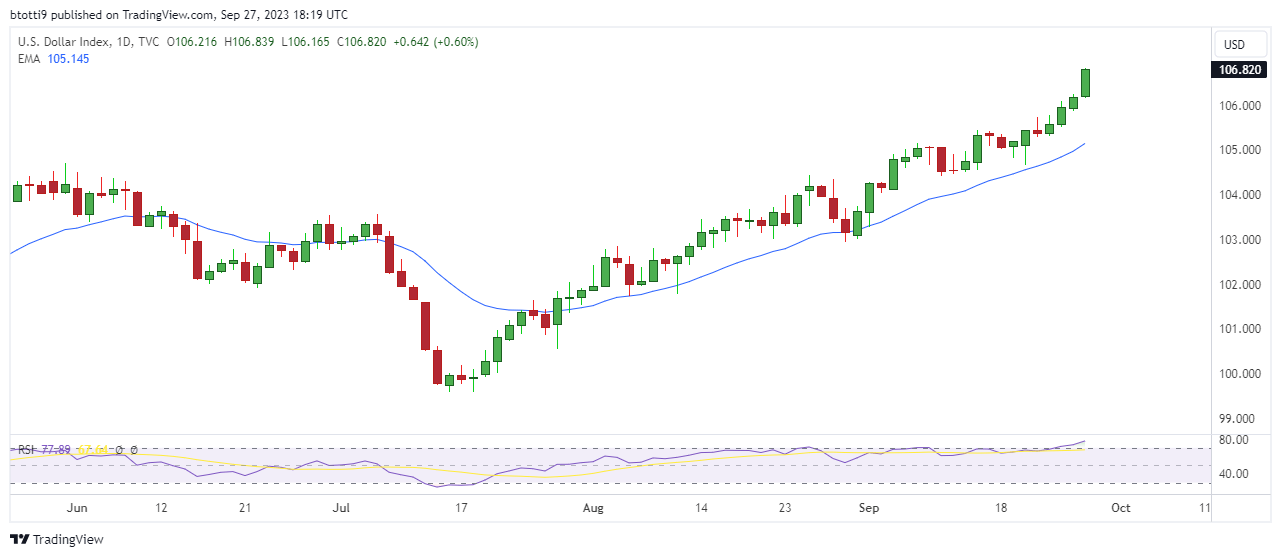

However because the DXY, which measures the dollar’s power towards a basket of different main currencies, hit highs of 106.83 for its highest degree since November 2022, shares moved decrease. Alongside the greenback’s power has been rising yields, with the benchmark 10-year US Treasury yield hovering to a 16-year excessive of 4.64%. The 2-year US yield rose to five.15%

It’s a state of affairs that sees the inventory market compound weak spot seen over the previous week, together with Tuesday’s Dow hunch that was the most important in a single day since March.

BTC value outlook

The US greenback index’s upside has traditionally signaled a bearish outlook for shares and different danger belongings, together with crypto. Market intelligence platform says the detrimental correlation between the greenback index and Bitcoin and S&P 500 has significantly been evident since 2021.

That needs to be the angle, although Bitcoin is displaying a resilience above $26k. In keeping with crypto investor Scott Melker, Bitcoin’s efficiency exhibits it “has its personal life.”

$BTC is at the moment COMPLETELY uncorrelated from each different market.

Bitcoin is up, the greenback is WAY up, shares are down, gold is down.

Bitcoin has a lifetime of its personal.

— The Wolf Of All Streets (@scottmelker) September 27, 2023

In the meantime, Santiment analysts say BTC may see a breakout if the DXY begins to chill off.