The crypto scene continues to stay so sizzling that bitcoin is hitting one new excessive after one other. It surpassed $72,700 on Monday. This was initially pushed by the approval of spot bitcoin ETFs, however is now being pushed greater forward of a “halving” occasion, which can restrict the quantity of latest provide put into circulation from bitcoin miners.

Bitcoin has elevated 9.5% prior to now seven days and is up 50% on the month, in line with CoinMarketCap information. The full crypto market cap throughout all tokens has elevated 10% on the week to $2.71 trillion, with bitcoin making up 52.7% of that quantity.

There’s, after all, no method of telling how excessive bitcoin can rise through the present bull frenzy. Whereas many are feeling the hopium, there’s not less than one indicator that thinks we’re nearing the highest of the highs, with value dips to shortly comply with.

The CoinMarketCap Crypto Concern & Greed Index is in “excessive greed” territory at 89.12 factors, up from “impartial” at 59.3 factors, in early February. The index measures value and buying and selling information of the largest cryptocurrencies, with its consumer conduct information to measure crypto market sentiment from 0-100. When the index is nearer to zero, buyers have over-sold their positions “irrationally,” in comparison with when the worth is nearer to 100, the market is more likely to face a correction.

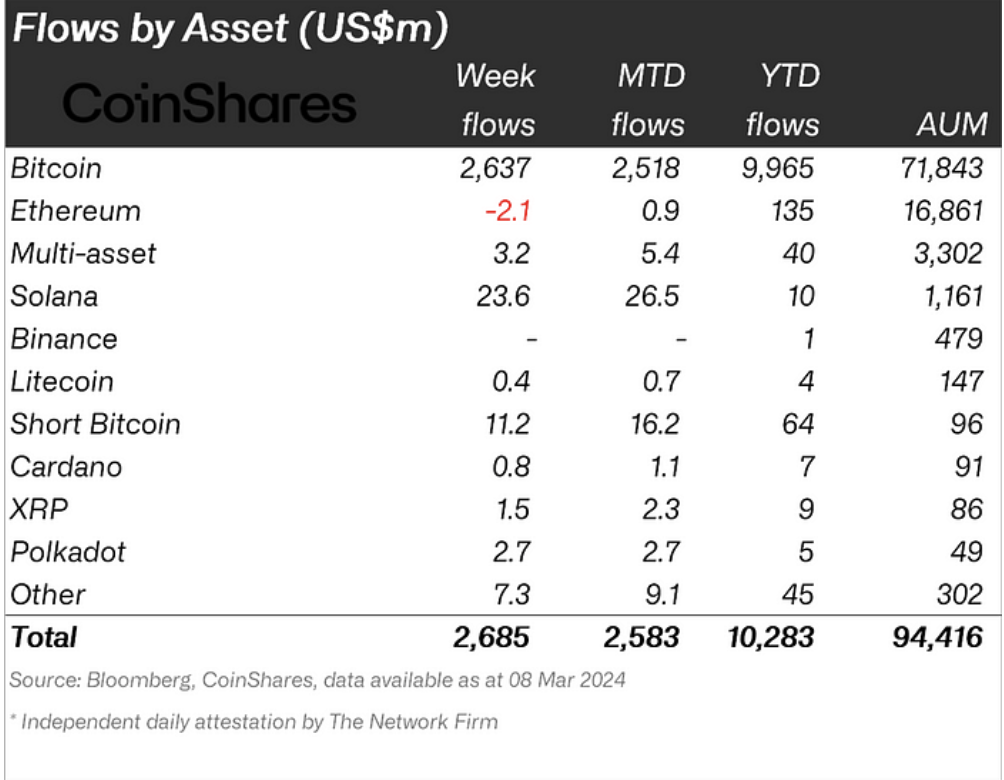

With that stated, bitcoin has remained the primary focus for retail and institutional buyers, with $2.6 billion inflows on the week, aka cash being put into the asset, and $9.9 billion year-to-date, in line with CoinShares’ Digital Asset Fund Flows Weekly Report. Ether, the second largest cryptocurrency, isn’t benefiting straight from any bitcoin enthusiasm hype. Its inflows this previous week are down $2.1 million, though it’s up $135 million year-to-date.

CoinShares Quantity 173: Digital Asset Fund Flows Weekly Report

No matter how excessive buyers will push bitcoin up forward of the bitcoin halving occasion, which is predicted to transpire in mid-April and occurs each 4 years, there’s no cause to imagine that what goes up received’t come down. Once more. In earlier cycles, bitcoin halvings elevated demand and pricing for the cryptocurrency.

The final bitcoin halving was on Might 11, 2020 and drove its value up about 600% from round $9,000 to $63,000 by the April 2021 mark. Then it fell about 50% inside three months, signaling renewed volatility for the asset.