Analyzing Bitcoin and fiat buying and selling pairs on centralized exchanges usually reveals efficiency disparities that stay invisible when specializing in international or common costs. It exhibits how liquidity, geopolitical and financial issues, and market sentiment have an effect on efficiency.

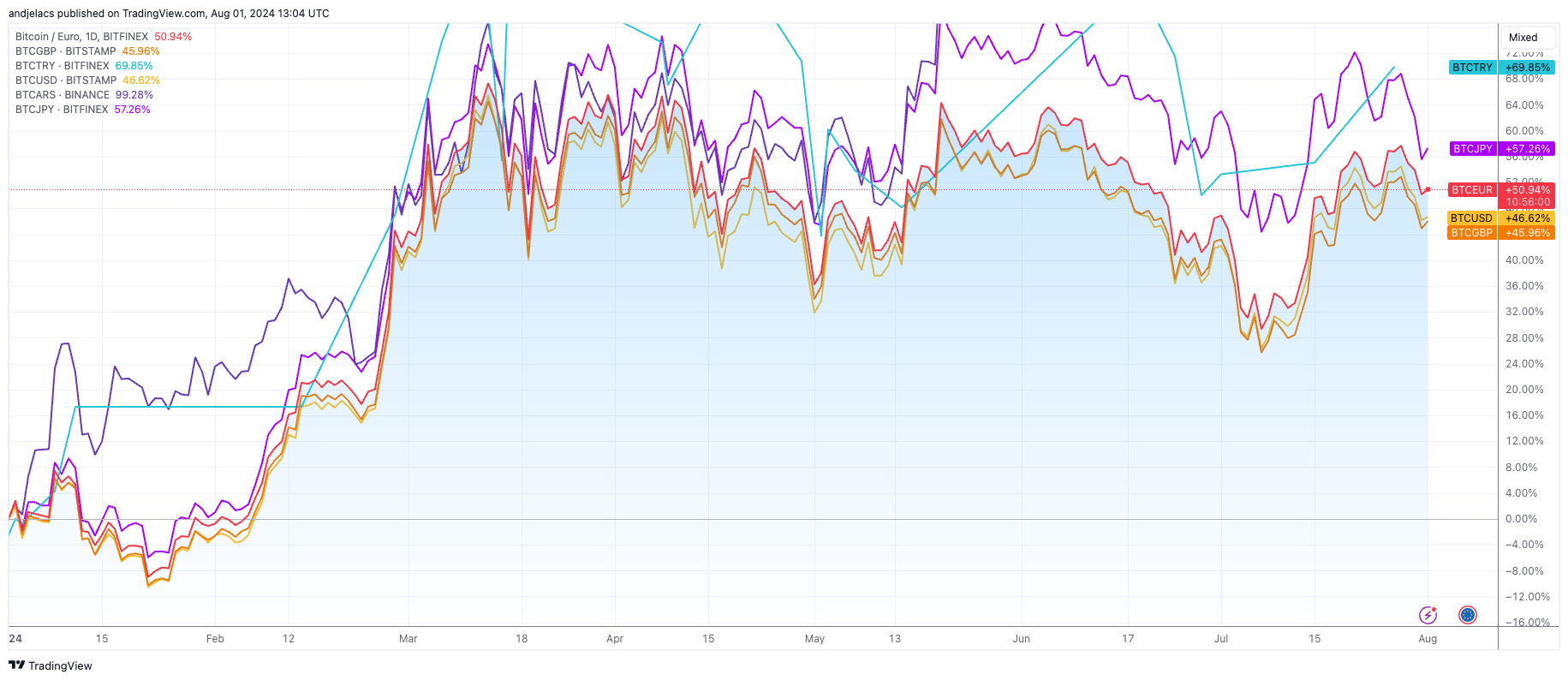

Wanting on the year-to-date (YTD) efficiency of dominant fiat pairs, we will see that BTCARS has seen a powerful 98.27% enhance. BTCTRY has gained 69.85%, BTCJPY is up 55.01%, BTCEUR has grown by 49.85%, BTCUSD by 45.62%, and BTCGBP by 45.07%.

In distinction, the three-month efficiency exhibits BTCARS main with a 19.64% enhance, whereas BTCEUR, BTCUSD, BTCGBP, BTCJPY, and BTCTRY have all posted destructive returns, starting from -1.16% to -6.50%.

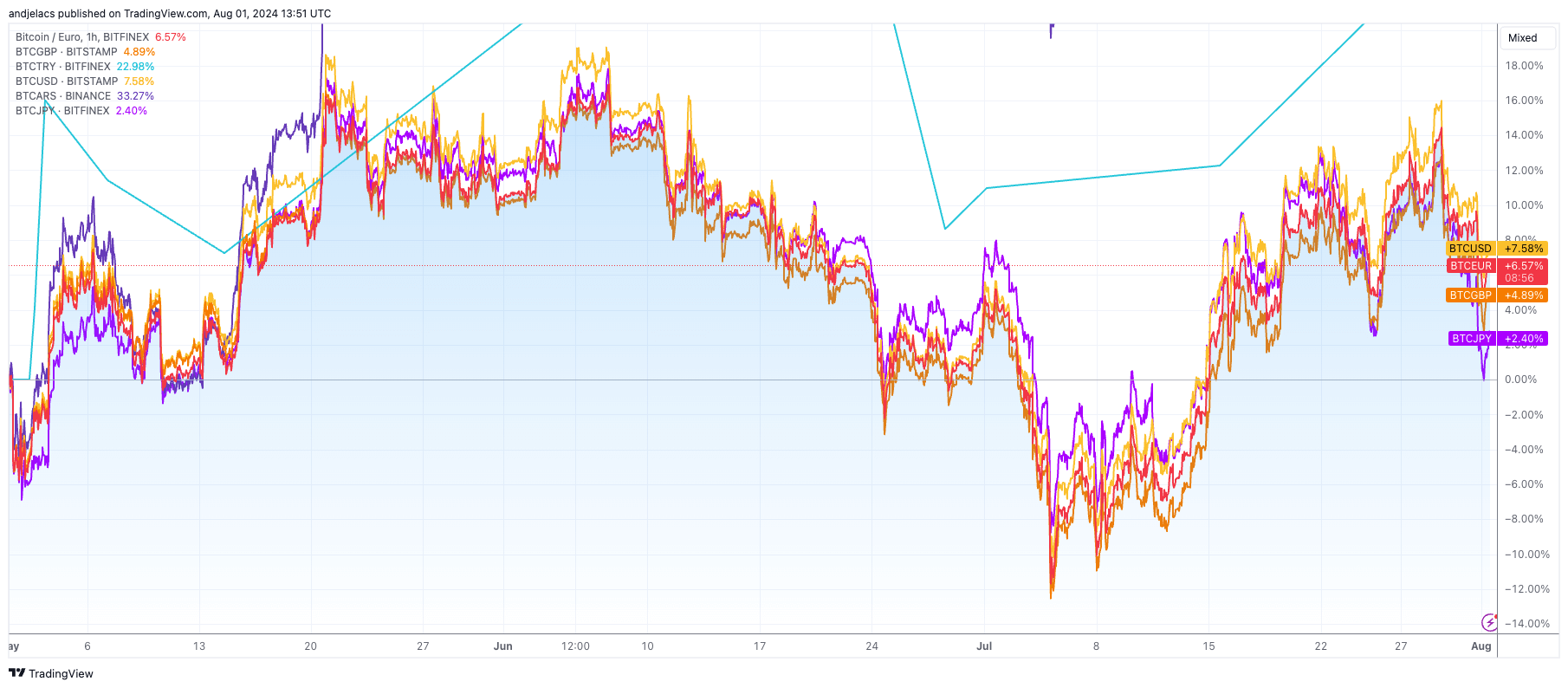

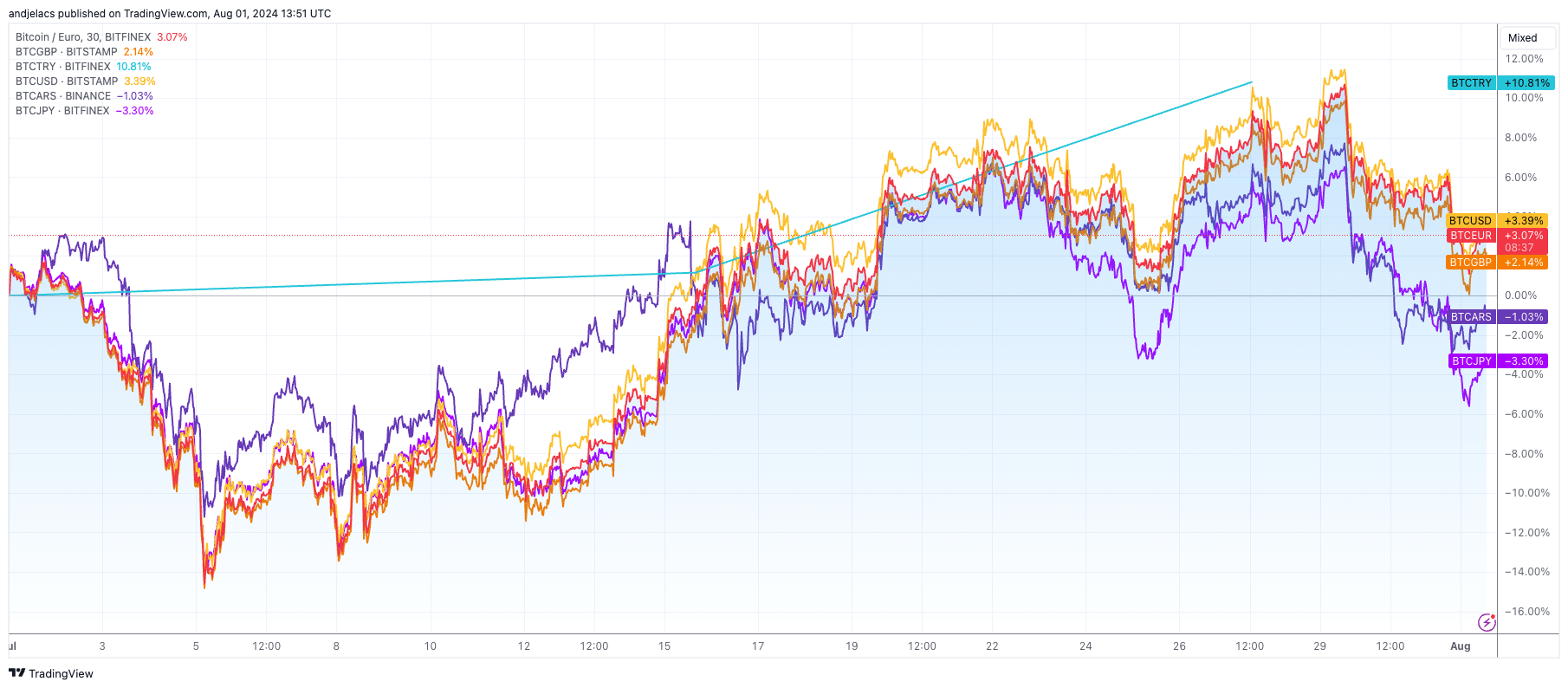

The one-month efficiency presents a blended image, with BTCTRY up by 10.81%, BTCUSD up by 2.97%, BTCEUR up by 2.72%, and BTCGBP up by 2.03%, whereas BTCARS and BTCJPY have declined by -0.85% and -3.89%, respectively.

The standout efficiency of Bitcoin towards the Argentine peso, particularly year-to-date, could be attributed to the nation’s extreme inflation. With inflation charges exceeding 100% yearly, the Argentine peso’s fast devaluation has pushed traders to hunt refuge in Bitcoin.

This conduct is per historic traits the place residents of nations experiencing hyperinflation or financial instability flip to crypto as a hedge towards their native forex’s depreciation. Whereas the financial and political insurance policies of Argentina’s newly elected president, Javier Milei, have slowed inflation, the demand for Bitcoin stays sturdy.

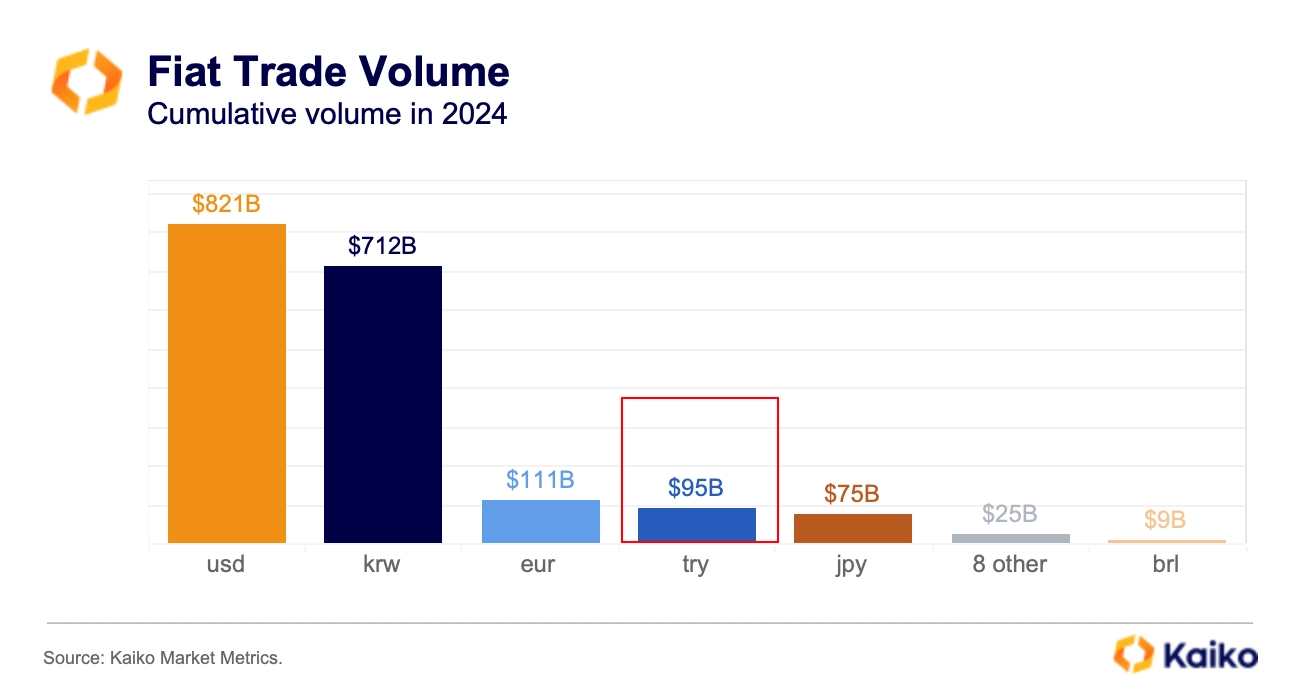

Equally, BTCTRY’s sturdy YTD efficiency comes from Turkey’s financial challenges. Turkey has been grappling with excessive inflation, with latest stories indicating inflation charges surpassing 75%. The Turkish lira’s depreciation has led to elevated adoption of Bitcoin amongst Turkish traders seeking to protect their wealth.

This development is additional supported by the truth that Turkey has one of many world’s highest charges of crypto adoption. Knowledge from Kaiko confirmed that the Turkish lira commerce quantity exceeded $10 billion for eight consecutive months, with the cumulative Lira quantity reaching $95 billion throughout seven exchanges.

The yen’s weakening towards the greenback, pushed by a dovish stance from the Financial institution of Japan, has affected the BTCJPY pair. Japan’s intervention within the forex market to stabilize the yen has additionally contributed to the fluctuations noticed in Bitcoin’s worth relative to the yen. The destructive 3M and 1M efficiency point out short-term volatility and the influence of those interventions.

The euro, the US greenback, and the British pound’s extra modest YTD beneficial properties and blended shorter-term performances could be linked to the comparatively steady financial circumstances and sturdy monetary infrastructures within the Eurozone, the US, and the UK.

The US greenback’s latest energy has affected the BTCUSD pair, resulting in its subdued efficiency over the shorter time period. The euro and pound appear to have skilled barely extra stress from financial challenges and central financial institution insurance policies, resulting in their increased efficiency when in comparison with the greenback.

Liquidity additionally performs an important position within the efficiency of fiat buying and selling pairs. Extremely liquid markets like BTCUSD and BTCEUR are inclined to exhibit decrease volatility and extra steady pricing. It’s because excessive liquidity permits bigger transactions to be executed with out considerably impacting the market worth.

Conversely, pairs with decrease liquidity, akin to BTCARS, are extra vulnerable to massive worth swings and larger volatility. This increased volatility can result in bigger beneficial properties in periods of excessive demand, as seen within the YTD efficiency of BTCARS and BTCTRY.

The put up Bitcoin fiat pair efficiency highlights financial and political challenges appeared first on StarCrypto.