- Bitcoin (BTC) consultants anticipate a bullish June amid historic information.

- Based on Willy Woo, June has traditionally proven a bent for bullish habits.

- The actual alternative lies when the market returns to the imply, not throughout excessive actions, based on consultants.

Bitcoin fanatics are eagerly eyeing June for a possible bullish rally, based on analysts engaged in a dialogue on Twitter. A Bitcoin basic information analyst Willy Woo advised that regardless of the often flat or bearish summer season market development, historic information indicated that June, throughout the re-accumulation part, has persistently exhibited a bullish inclination. In the meantime, analyst “Colin Talks Crypto” added a twist by questioning the accuracy of a particular indicator.

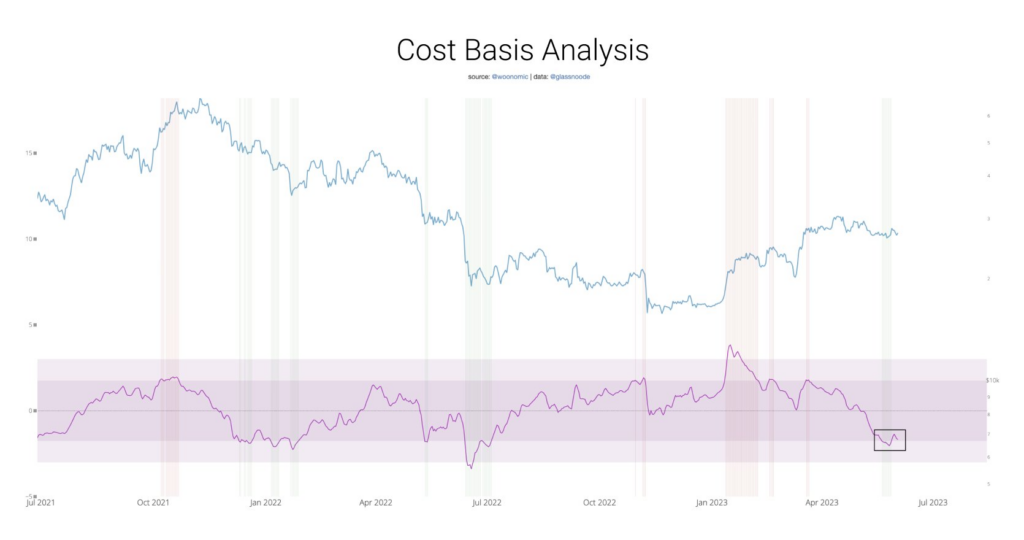

In a sequence of tweets, Willy Woo underscored the significance of analyzing Bitcoin’s value foundation to gauge potential market actions precisely. He identified that the indicator in query, depicted in purple on the chart, represents the pricing relative to the price foundation. Woo suggested in opposition to oversimplifying market dynamics, cautioning in opposition to blindly following a single sign for funding selections.

Increasing on Woo’s rationalization, the lighter pink areas on the chart symbolize excessive zones the place Bitcoin’s pricing has deviated considerably from its value foundation. Nevertheless, these excessive deviations are likely to provoke a imply reversion path again to the middle, indicating a possible alternative for market members.

Whereas the CBBI and related indicators provide priceless insights, the analyst believes that it’s essential to train warning when deciphering their indicators. Woo clarified that these oscillators sign a chance when the market begins its imply reversion towards the middle somewhat than through the motion towards extremes. This clarification highlights the significance of comprehending the broader context and using a complete strategy to analyzing Bitcoin’s market dynamics.

Because the dialog on Twitter between these analysts continues, market members eagerly await the expected “window for BTC to tear” in June. With historic information and value foundation evaluation supporting the potential for a bullish rally, Bitcoin fanatics and buyers are carefully monitoring the market.