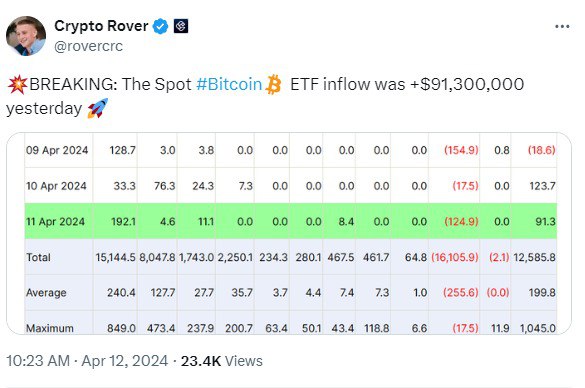

- The Bitcoin ETF influx marked a staggering $91.3 million on April 11, retaining the constructive momentum.

- The full web influx of the Bitcoin ETF market has reached a notable $1.5 billion.

- BlackRock’s $192.1 million inflows resulted in canceling out the outflows on April 11.

The Bitcoin ETF influx surpassed an astounding $91 million on April 11, 2024, retaining the constructive momentum. Analyst Crypto Rover shared an X put up shedding gentle on the large influx of Bitcoin ETFs, which reached a complete of $12.5 billion.

As per the report, Spot Bitcoin ETFs’ $91,300,000 influx on April 11 is way lower than the $123,700,000 influx on April 12. Nonetheless, the quantity has considerably contributed to the general constructive stream of Bitcoin ETFs.

On April 8 and 9, the Bitcoin ETFs exhibited a unfavorable stream, with the whole outflow exceeding the influx. Whereas the outflow was valued at $223.8 million on April 8, the Bitcoin ETFs marked an outflow of 18.6 million on April 9.

WhalePanda, a distinguished voice within the crypto house, took to X to share insights on the constructive growth within the Bitcoin ETF market. Based on WhalePanda’s put up, BlackRock’s staggering $192.1 million of inflows have canceled out the outflows fully.

Grayscale’s GBTC has reportedly seen growing outflows. From Wednesday’s $17.5 million outflows, GBTC has reached a large $124.9 million on Thursday. WhalePanda acknowledged that Grayscale’s outflows are immediately proportional to the market energy.

As well as, WhalePanda unveiled Grayscale’s declining Bitcoin holdings. Based on Grayscale’s official web site, their BTC holdings have dipped to 316,000, and as per Arkham Intelligence, GBTC’s BTC holdings have decreased to 321,000.

In the meantime, Bitcoin is hovering above the numerous $70k level, with the much-awaited halving occasion nearing. As of press time, Bitcoin is ready at $70,972, marking a marginal surge

of 0.35% in in the future and a notable 6.35% in 7 days. Nonetheless, over the past month, Bitcoin has skilled a slight lower of 1.26%.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any form. Coin Version shouldn’t be answerable for any losses incurred on account of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.