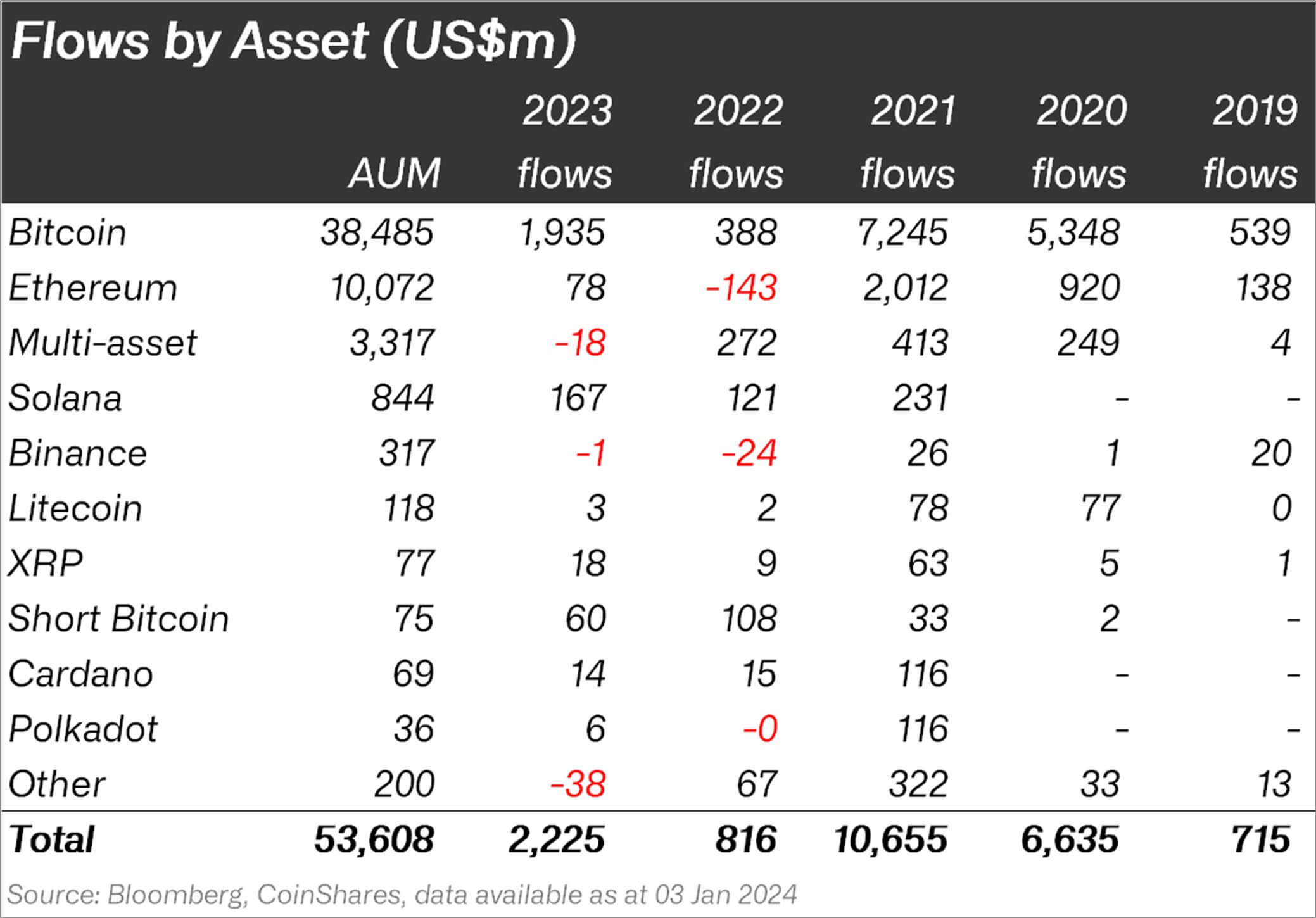

Inflows into crypto-related funding merchandise elevated 170% year-on-year to $2.2 billion final yr from the $816 million recorded in 2022, in keeping with CoinShares knowledge shared by its head of analysis James Butterfill, on social media platform X (previously Twitter).

The rise displays the resurgence of the burgeoning crypto sector, fueled by exceptional rallies in cryptocurrencies like Solana and Bitcoin. This surge has been largely attributed to the anticipation surrounding the potential approval of an inaugural spot Bitcoin exchange-traded funds (ETFs) within the U.S.

Bitcoin dominates influx

Final yr, Bitcoin-related property dominated the market, constituting over 86% of the recorded inflows, equating to $1.9 billion. This marks a big surge of practically 400% from the $388 million inflows documented in 2022. Nevertheless, it’s price noting that this determine displays a decline of 74% from the $7.2 billion peak seen in 2021.

Market observers have attributed this upsurge of inflows to the anticipation of a spot Bitcoin ETF launch within the U.S. StarCrypto reported that the U.S. Securities and Change Fee (SEC) might begin approving numerous pending spot Bitcoin ETFs by the tip of the week.

Solana emerged as one of the vital favorable property for traders final yr, witnessing whole inflows of $167 million. Throughout the interval, Solana’s SOL token value rallied by greater than 850% to above $100 from below $10 because the asset attracted new customers and solid strategic alliances with famend world monetary gamers like Visa and Shopify.

Alternatively, Ethereum funding merchandise noticed inflows of lower than $100 million final yr and attracted the “least liked altcoin” tag for a number of weeks. The second-largest cryptocurrency by market capitalization didn’t see a lot curiosity regardless of the launch of a number of Ether futures-based exchange-traded funds (ETF) in October.

In the meantime, the general bullish sentiment resulted in some traders taking a bearish stand in the marketplace, with $60 million in inflows to Brief Bitcoin merchandise final yr.

Different digital property like Litecoin, XRP, Polkadot, and Cardano ended the yr with cumulative inflows of $41 million.