- Kiyosaki sees Bitcoin as a retailer of worth and urges shopping for throughout market dips.

- Bitcoin dips create potential shopping for alternatives, says Robert Kiyosaki.

- Kiyosaki’s Bitcoin recommendation positive factors traction amid market volatility and investor losses.

Robert Kiyosaki, creator of the best-selling monetary self-help e book “Wealthy Dad, Poor Dad,” has a message for traders throughout this market crash: Purchase Bitcoin. Kiyosaki believes it’s by no means too late to start out, whatever the cryptocurrency’s worth, and that Bitcoin’s design makes it a priceless retailer of worth.

In a put up on X (previously Twitter), Kiyosaki stated Bitcoin’s design makes it “by no means too late to start out” regardless of the cryptocurrency’s worth. He stated Bitcoin is a retailer of worth, which provides its holders the potential to turn out to be wealthy. The creator reiterated his recommendation to accumulate extra BTC and cautioned traders in opposition to greed.

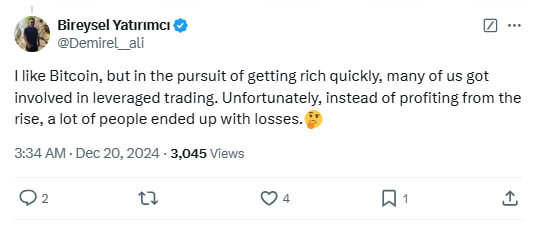

Leveraged Buying and selling and Liquidations

An investor identified that market members made income from spot Bitcoin buying and selling however had large losses from leveraged buying and selling, which might go as excessive as 125x on sure digital asset buying and selling platforms. Coinglass knowledge reveals $839 million in liquidations prior to now 24 hours, with $687 million in longs worn out.

Learn additionally: Bitcoin to $350K in 2025? Trump’s Backing and Market Tendencies Level to a Surge

CoinMarketCap knowledge reveals Bitcoin reached a every day excessive of $102,748.15 after which crashed to its every day low of $95,587.68 prior to now 24 hours. Nevertheless, consumers took over, and the main cryptocurrency traded at $97,073.02, down by greater than 4% prior to now day

Blockchain evaluation platform Santiment experiences that discuss shopping for the present market dip is at its highest level in over eight months. The agency stated BTC has climbed 81% since August 4, the final time traders have been this enthusiastic about shopping for the dip.

An analogous impact might occur this time, too. The US Fed’s projection for fewer charge cuts in 2025 precipitated BTC and altcoins to crash. The market is cooling down earlier than the subsequent leg up.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version just isn’t chargeable for any losses incurred on account of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.