Bitcoin’s worth begins the brand new week within the crimson after a surge in Ordinals minting resulted in a clogged blockchain community over the weekend.

Information from StarCrypto exhibits that BTC’s worth fell by round 2% throughout Asia buying and selling hours to $41,189, paying homage to how the flagship digital asset started the earlier week.

Equally, different large-cap different cryptocurrencies like Ethereum, Solana, Cardano, and Avalanche recorded substantial losses between 2% and 5% throughout buying and selling hours.

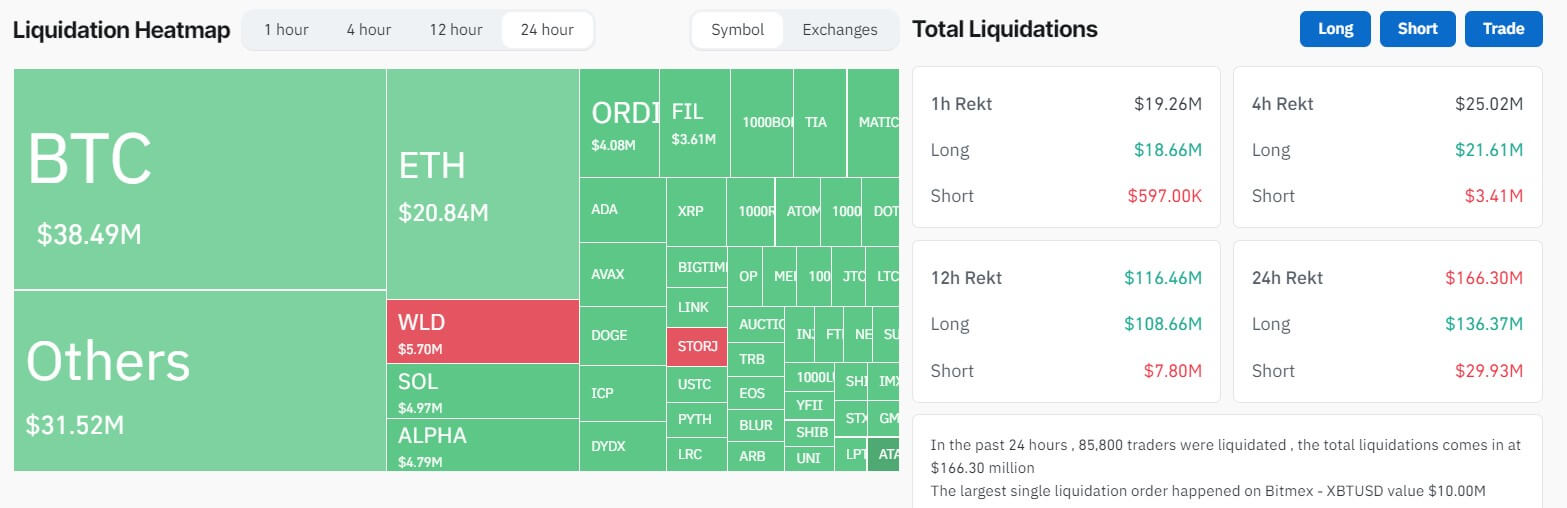

$166M liquidated

Coinglass knowledge exhibits that the current worth decline precipitated roughly $166 million in losses for roughly 85,000 crypto merchants with lively market positions.

The breakdown of those liquidations reveals that lengthy merchants suffered essentially the most important losses, totaling $136 million, whereas quick merchants misplaced $30 million.

Merchants with positions on BTC noticed losses totaling over $40 million throughout totally different positions. Lengthy positions, or these speculating on greater BTC costs, contributed $38 million to this sum, whereas quick place holders, or merchants betting on decrease costs, accounted for $7 million.

Ethereum buyers additionally skilled notable losses, with roughly $20 million liquidated from lengthy positions and $2.66 million from quick positions.

Throughout exchanges, Binance and OKX recorded essentially the most substantial losses, with liquidations exceeding $74 million and $42 million, respectively. Notably, essentially the most important particular person loss was a $10 million lengthy guess on Bitcoin’s worth by means of BitMEX.

Notably, Bitcoin retains a low Liquidation Sensitivity Index (LSI) rating of simply $15.5 million USD/%, highlighting the discount in leverage in comparison with the 2021 bull run, which noticed a mean of $74 million liquidated per 1% change in Bitcoin’s worth.

Clogged community

Over the weekend, a surge in Ordinals Inscriptions resulted in a clogged blockchain community that pushed the typical transaction payment on Bitcoin to over $37, in keeping with BitInfoCharts knowledge.

Information from Mempool additional exhibits that these transactions resulted in over 288,000 unconfirmed transactions as of press time.

Earlier within the month, Ordinals generated heated debate among the many BTC group, with purists arguing that these belongings had been exploiting a vulnerability within the Bitcoin Core to spam the blockchain.

Nonetheless, many locally oppose this view, arguing that inscriptions won’t ever cease and are an evolution of the blockchain community.

Curiously, the same development was noticed in Ethereum digital machine (EVM)-compatible chains like Avalanche, Polygon, and Arbitrum, with customers spending greater than $10 million as transaction charges on these belongings over the weekend, per a Dune analytics dashboard by Hildobby.