Bitcoin’s (BTC) correlation with the Nasdaq sank to three% in June, in line with information from Kaiko – indicating diverging sentiment between cryptocurrencies and tech shares.

The worth-performance for the main cryptocurrency in June was between $24,800 and $31,360, opening the month at $27,200.

BlackRock’s spot Bitcoin ETF submitting on June 15 was a bullish catalyst, reversing the prior downtrend to a brand new year-to-date excessive of $31,440 some eight days later.

Since then, Bitcoin has been buying and selling in a slender band between $29,860 and $31,030 – falling 3% since its YTD excessive on June 23.

In the meantime, the tech-heavy Nasdaq 100 has been in a steady uptrend because the begin of the yr – reaching a YTD excessive of $15,230 on June 16. Since Bitcoin’s year-to-date excessive on June 23, the Nasdaq has risen 0.7%.

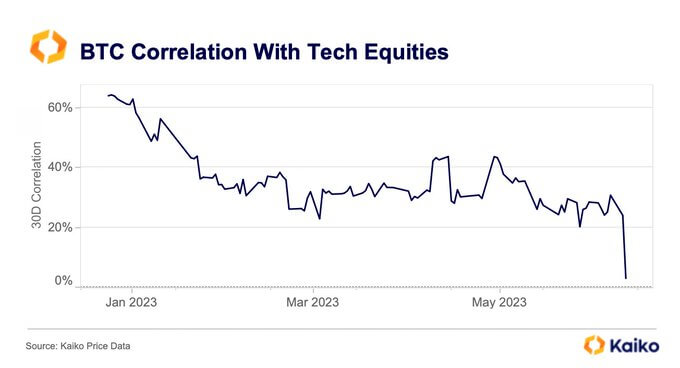

On a 30-day foundation, the Bitcoin-Nasdaq correlation began the yr at 60% and slipped to 22% by March, indicating a lower within the similarity of value actions between the 2. This era of change consolidated considerably, with the correlation struggling to rise above 45%.

The Bitcoin-Nasdaq correlation has continued to maneuver decrease all year long, dropping sharply to three% this week from over 20% in Could.

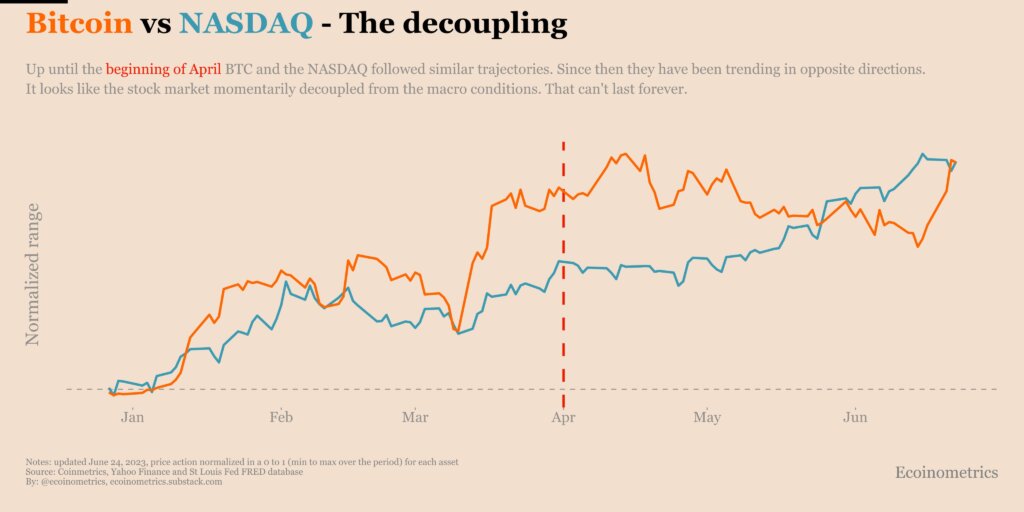

Knowledge analysis agency Ecoinometrics printed a chart of Bitcoin-Nasdaq vary actions from the beginning of the yr to June 24. It confirmed an identical development between the 2 till April, after which a “good decoupling” occurred.

Ecoinometrics additional commented that the Nasdaq’s efficiency is disconnected from the broader macroeconomic panorama – implying an uptrend reversal is on the playing cards.

“However this bear market rally for shares can not escape the awful macro image endlessly.“

The put up Bitcoin correlation to Nasdaq sinks to three% low in June appeared first on StarCrypto.