As Bitcoin’s market cap rises, evaluating Bitcoin’s value to that of gold turns into more and more related. This comparability is embodied within the BTC/GOLD ratio, a metric that divides the worth of Bitcoin by the worth of gold per ounce.

The importance of the ratio lies in its skill to point shifts in investor desire and market dynamics. A rising ratio suggests a rising desire for Bitcoin over gold, typically reflecting investor confidence in Bitcoin as a tough asset and a hedge towards inflation. Conversely, a declining ratio can sign elevated confidence in gold or a cautious method in the direction of digital currencies.

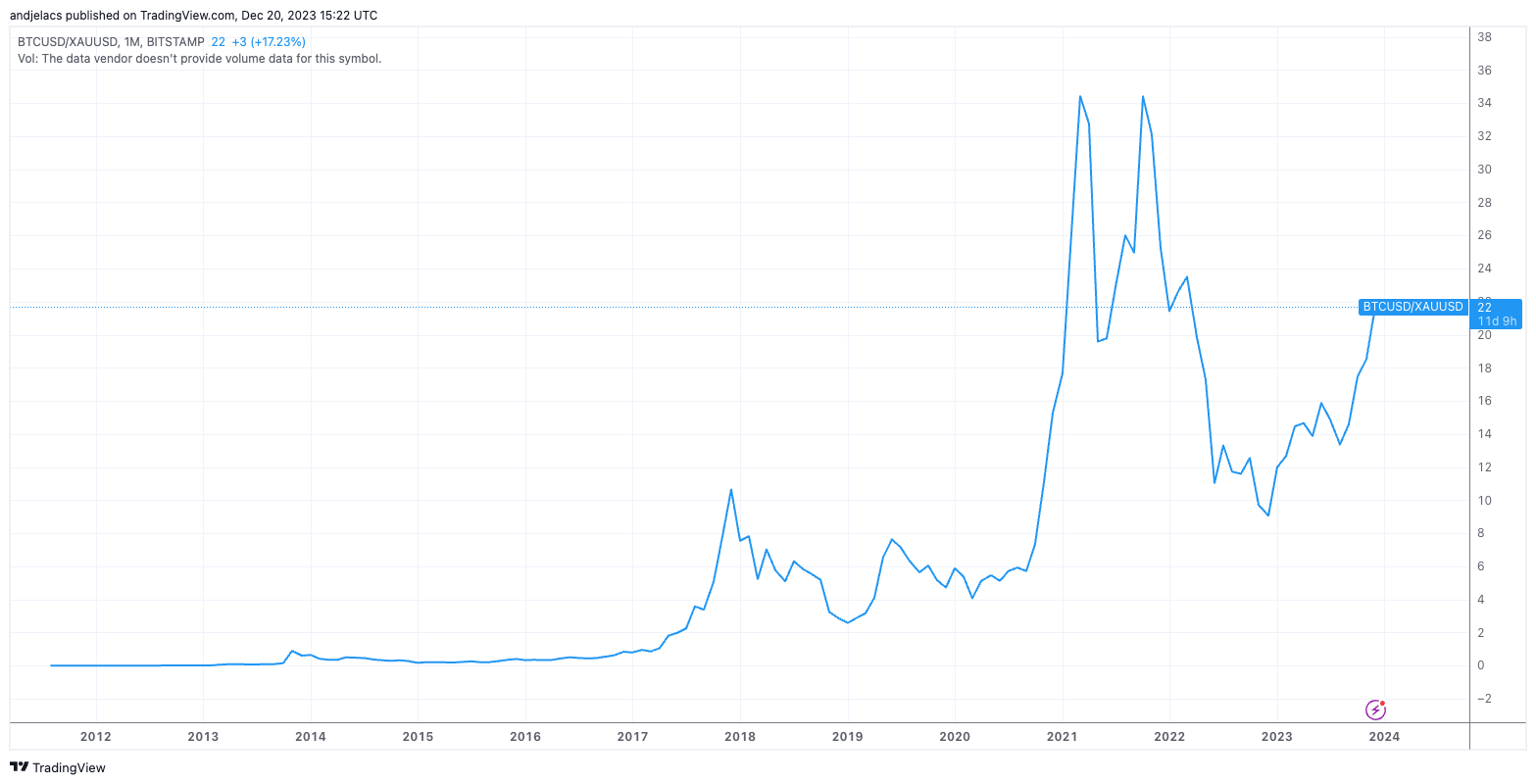

Between 2011 and 2017, the ratio witnessed a gradual and gradual enhance, reflecting the rising curiosity and acceptance of Bitcoin. The crypto trade’s first true bull market in 2017 noticed this ratio reaching unprecedented heights, solely to say no sharply by the start of 2019. Particularly, the ratio plummeted by 75.75% from its peak on Dec. 1, 2017, showcasing the market’s volatility and the shifting investor sentiment in the course of the bear market.

The interval between 2019 and 2021 marked an outstanding restoration and progress for Bitcoin, mirrored within the BTC/GOLD ratio. The ratio soared 1,232% between Jan. 1, 2019, and Mar. 1, 2021, attaining an all-time excessive. This era highlighted Bitcoin’s resilience and rising enchantment as a digital asset. Nevertheless, this peak was adopted by a 37.94% lower within the ratio by the start of 2023, reflecting the advanced interaction of market forces, regulatory developments, and world financial circumstances.

Nevertheless, this yr has been significantly important for the ratio’s efficiency. For the reason that begin of the yr, the ratio has proven a exceptional enhance of 139.9%. The typical ratio is roughly 15.31, peaking at about 21.36 and a trough of round 11.99. The usual deviation of roughly 2.66 signifies important variability, underscoring the inherent volatility of Bitcoin’s value.

The efficiency of the BTC/GOLD ratio in 2023 carries important implications for the valuation and notion of each Bitcoin and gold within the monetary market. The rising ratio signifies the market’s growing desire for Bitcoin over gold, probably attributable to its perceived attributes as a digital retailer of worth and a hedge towards inflation. The variability of the ratio, nonetheless, additionally speaks to the persistent uncertainties and the evolving regulatory panorama surrounding cryptocurrencies.

The BTC/GOLD ratio is not only a measure of value comparability — it displays the altering monetary panorama the place digital belongings are more and more pitted towards conventional ones. Whereas Bitcoin continues to realize floor as a possible various to gold, the journey is marked by volatility and uncertainty. This ratio, subsequently, stays a necessary software for evaluation, providing insights into market sentiments and the evolving position of Bitcoin within the broader monetary market.

The publish Bitcoin challenges gold’s supremacy as protected haven asset appeared first on StarCrypto.