- Bitcoin’s worth corrected however market members are shifting their property into self-custody.

- BTC shaped a golden cross, indicating that merchants are bullish on the worth motion.

- Sustaining the $27,000 psychological assist may propel Bitcoin to $30,000.

Since Bitcoin (BTC) rose above $28,000 for the primary time since August, merchants have been displaying confidence {that a} return to $30,000 might quickly happen. Nonetheless, the Bitcoin breakout solely lasted some time because the cryptocurrency was again buying and selling at $27,667 at press time.

Regardless of the correction, market members will not be giving up hope on the doable BTC upward trajectory, and on-chain analytic platform Santiment’s month-to-month report highlighted this stance. Utilizing the social quantity metric, which is a measure of the commentary about an asset, Santiment famous that the market is extraordinarily bullish on Bitcoin.

Bitcoin Is Not Alone

The market was additionally bullish on altcoins together with Chainlink (LINK), Aave (AAVE), and Ethereum (ETH). However there was one half about Bitcoin that made it appear to be $30,000 was the subsequent cease.

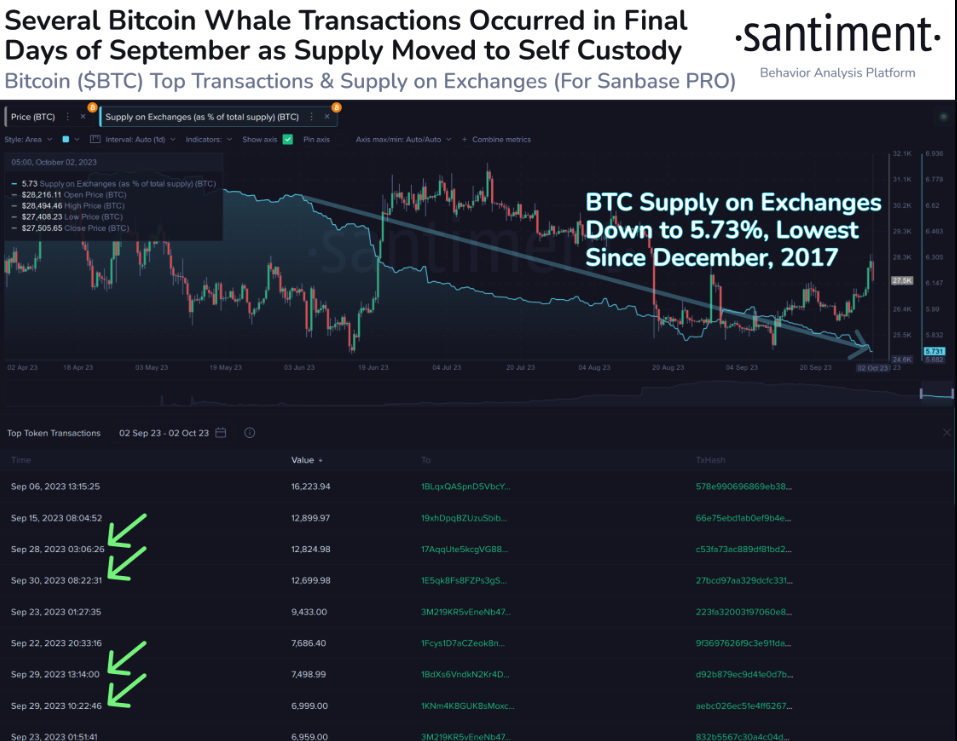

In response to Santiment, Bitcoin’s provide on exchanges hit its lowest level since December 2017. This lower is a testomony to whales’ motion of their asset to self-custody. Usually, the switch is an indication that promoting strain is probably not rampant, and Bitcoin might be prepared for one more upward motion.

To buttress its level, the on-chain information supplier defined, “And once we have a look at these in distinction to the availability of Bitcoin on exchanges, we see that many of the largest token transactions contributed to cash shifting increasingly to self-custody. That is usually a really constructive signal, and it was unsurprising that October opened with a 6-week worth excessive.”

Retracement Might Not Cease the Bulls

From the 4-hour BTC/USD chart, the drop beneath $28,000 was a results of profit-taking out there. As Santiment rightly identified, the surge in worth prompted one of many highest on-chain transactions in revenue within the final three months.

Subsequently, BTC’s preliminary rise to $28,432 might be termed a short-term native prime. The technical outlook additionally confirmed how consumers tried to push up the worth. However the endeavor ended with rejection at $27,680.

Nonetheless, there’s a probability that the retracement may solely final a brief interval. This was due to the Exponential Transferring Common (EMA) situation. On the time of writing, the 20 EMA (blue) had crossed over the 50 EMA (yellow), that means BTC had shaped a golden cross, and merchants had been bullish on the worth motion.

If the EMA holds the identical stance, then it’s solely a matter of time earlier than Bitcoin reclaims $28,000. It’s also doable that the coin blasts towards $30,000 if accumulation and the quantity rises.

However, Bitcoin’s bullish sentiment stays very current regardless of the drawdown. If the coin is ready to preserve its worth above the $27,000 psychological assist, then there may be room for a rise. Altcoin may additionally profit from the hike however merchants might have to be cautious.

Disclaimer: The views, opinions, and knowledge shared on this worth prediction are printed in good religion. Readers should do their analysis and due diligence. Any motion taken by the reader is strictly at their very own threat. Coin Version and its associates is not going to be accountable for direct or oblique harm or loss