- BTC’s worth has dropped 3.83% over the past 24 hours.

- The market chief has entered right into a short-term bearish cycle.

- Bulls have stepped in right now to rescue BTC’s worth.

The crypto market chief skilled a 24-hour drop in worth because the crypto market shed 3.54% of its collective market cap. In accordance with CoinMarketCap, the value of Bitcoin (BTC) is down 3.83% over the past 24 hours. This unfavourable 24-hour worth efficiency has flipped BTC’s weekly efficiency into the pink, because it now stands at -1.36%.

BTC’s worth has entered right into a short-term bearish cycle because the 9 EMA line has crossed beneath the 20 EMA line on BTC’s 4-hour chart. Consequently, BTC’s worth dropped to the foremost assist stage at $22,524.29. BTC’s worth is now additionally buying and selling beneath the 4-hour 9 and 20 EMA traces.

Bulls appear to be attempting to raise BTC’s worth because the buying and selling quantity for the final 12-16 hours has been primarily purchase quantity. The RSI indicator on the 4-hour chart can be exhibiting some early bullish indicators, with the RSI line sloping positively towards the overbought territory.

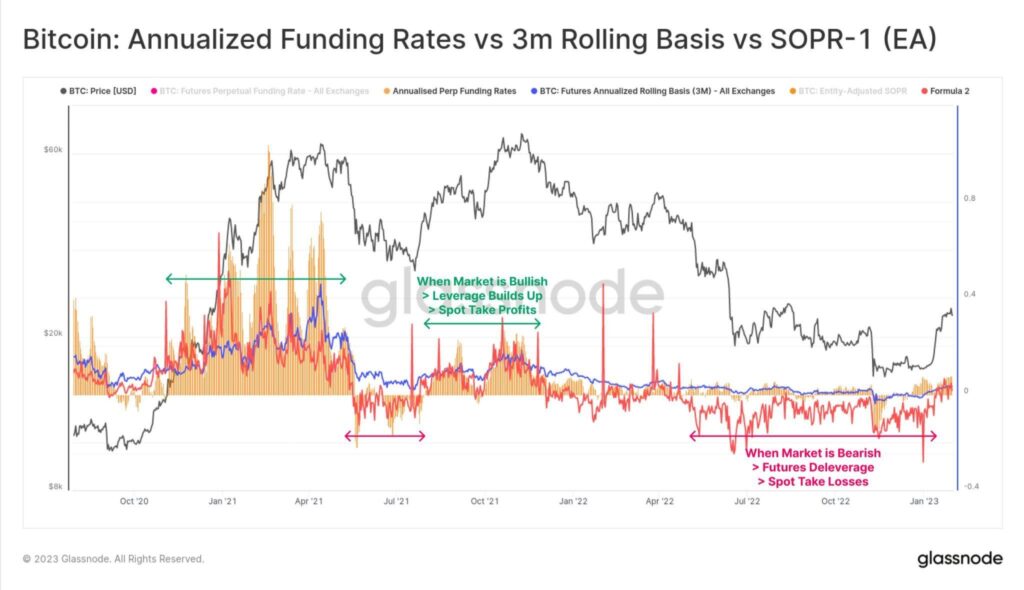

Crypto analyst _Checkmate (@_Checkmatey_) tweeted a thread relating to the connection between Bitcoin derivatives markets and spot/on-chain. Within the tweet, the Twitter consumer said that the 2 “converse the exact same language.” He additionally went on to state that “critics of on-chain knowledge are simply plain incorrect.”

The tweet included a chart from the blockchain evaluation agency, Glassnode. In accordance with the tweet, there may be an apparent visible relationship current within the chart, and that’s that when futures lever-up, spot is often realizing earnings. Conversely, spot is often realizing losses when futures de-lever.

Disclaimer: The views and opinions, in addition to all the data shared on this worth prediction, are revealed in good religion. Readers should do their analysis and due diligence. Any motion taken by the reader is strictly at their very own threat. Coin Version and its associates is not going to be held accountable for any direct or oblique harm or loss.