The value of Bitcoin surpassed $42,000 on Jan. 26 amidst important spot Bitcoin ETF flows and an improve to Coinbase’s inventory score.

Bitcoin (BTC) was valued at $42,040.36 with a market cap of $824.4 billion at 8:05 pm UTC on Friday. That marks 5.3% progress over 24 hours.

Bitcoin’s present value additionally represents a five-day excessive, as costs had been near $40,000 on Jan. 24 and 25 and as little as $38,678 on Jan. 23

The cryptocurrency market in its entirety was up 4.6% over 24 hours. Different prime ten belongings noticed comparable value positive factors at the moment: Avalanche (AVAX) was up 7.3%, Solana (SOL) was up 5.9%, XRP was up 3.7%, BNB was up 3.5%, Cardano (ADA) was up 3.3%, and Ethereum (ETH) was up 1.9%.

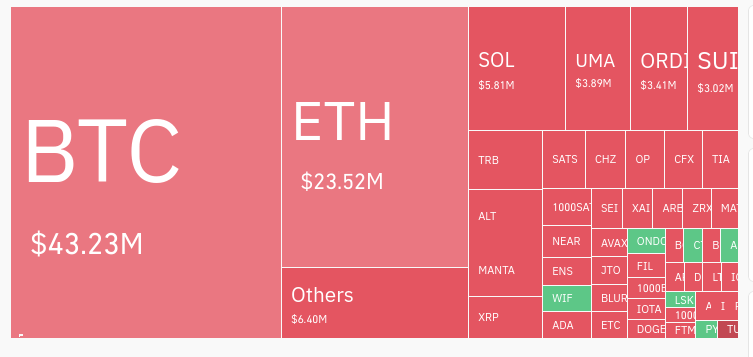

The market noticed $116 million in liquidations over 24 hours, in line with Coinglass knowledge, with Bitcoin (BTC) accounting for $43.23 million of liquidations and Ethereum (ETH) accounting for $23.52 million of liquidations.

Beneficial properties could also be resulting from ETF flows, Coinbase score

Although it’s not fully recognized why Bitcoin has gained worth at the moment, spot Bitcoin ETF inflows and outflows are one main affect available on the market.

Outflows from Grayscale’s GBTC ETF at the moment are slowing and will have largely concluded, in line with a report from JP Morgan on Jan. 25. Excessive GBTC outflows put extra Bitcoin (BTC) onto the market, offering a bigger provide compared to investor demand. Such outflows possible contributed to falling Bitcoin costs within the weeks following varied spot Bitcoin ETF approvals on Jan. 10.

Conversely, inflows into different funds have taken Bitcoin off the market and could also be serving to to lift costs. Though most spot Bitcoin ETFs have optimistic inflows, BlackRock’s iShares Bitcoin Belief (IBIT) notably crossed $2 billion in complete inflows on Jan. 26. Web inflows for all spot Bitcoin ETFs quantity to $744 million.

Different optimistic developments could have influenced crypto costs as effectively. Yahoo! Finance analysts famous that Coinbase (COIN)’s inventory score has been upgraded by Oppenheimer & Co. The value of COIN can also be up 3.40% at the moment.