- Bitcoin discovered assist at $25k (once more)

- YTD efficiency stays spectacular

- A dovish Fed might set off much more power

Cryptocurrency traders might have been upset by the dearth of volatility in the course of the summer time months—in spite of everything, Bitcoin, the main cryptocurrency, solely consolidated ranges.

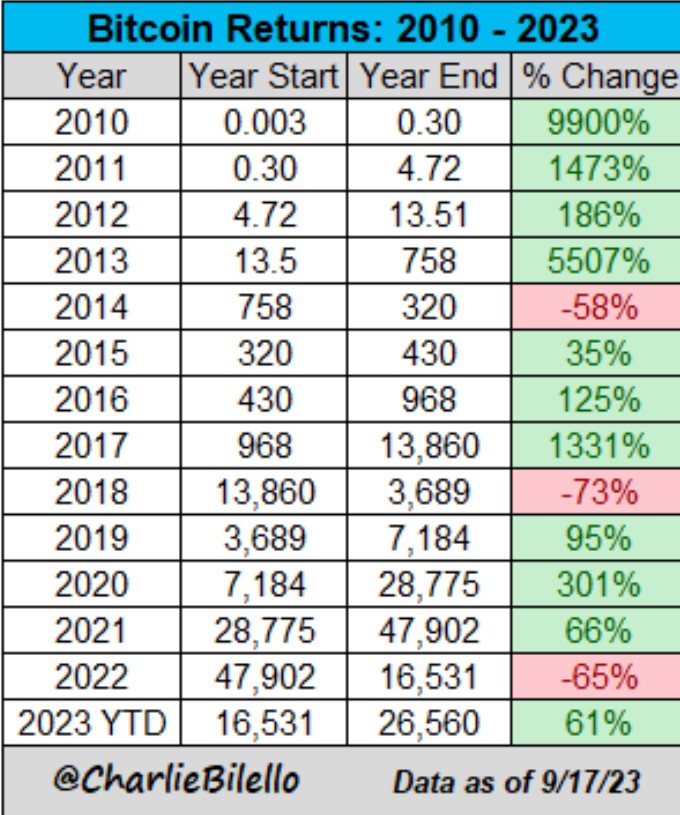

However one ought to remember the fact that Bitcoin rallied strongly in 2023. It returned over 61% within the buying and selling yr, and the bias stays bullish.

The bullish perspective is much more apparent if one appears to be like on the yearly returns of Bitcoin. Since 2010, solely in three years did Bitcoin ship detrimental returns.

Shopping for the dip appears to have labored each time, though the dips have been fairly scary.

Will the Fed’s resolution increase Bitcoin?

Tomorrow, the Federal Reserve of the US (Fed) is predicted to carry the funds price regular. As all the time, the small print within the FOMC Assertion and the press convention will transfer markets.

Greater inflation than the Fed’s goal was the principle reason for rising rates of interest. Now that inflation comes down from its highest ranges, the Fed might really feel snug that it’ll attain the goal in a well timed method.

Due to this fact, a dovish Fed would set off weak point within the US greenback and power for Bitcoin.

The technical image additionally favors extra Bitcoin power. The market bounced twice from $25k and now trades above $27k. A dovish Fed would ship Bitcoin again to the $30k resistance space with large probabilities to maneuver even larger.