- Altcoin Season Index at 35 confirms Bitcoin’s continued dominance within the crypto market.

- Gradual index rise hints at rising altcoin curiosity, but Bitcoin nonetheless leads the market.

- Ethereum progress and blockchain advances could sign a possible shift towards altcoin focus.

The CoinMarketCap (CMC) Altcoin Season Index registered a rating of 35, indicating Bitcoin dominance over the cryptocurrency market. Whereas, a more in-depth look exhibits there’s rising curiosity in altcoins with key matrices pointing to a shift in market dynamics. This evaluation delves into the Altcoin Season Index, its correlation with altcoin market capitalization, and the components that might contribute to a potential altcoin resurgence.

The metric tracks the efficiency of the highest 100 crypto belongings (excluding stablecoins and wrapped tokens) in opposition to Bitcoin over 90 days. It at the moment sits firmly in Bitcoin season territory.

The index defines Bitcoin season as a interval when 25% or fewer altcoins outperform Bitcoin. Altcoin season happens when 75% or extra altcoins outperform Bitcoin. The index, up to date day by day, ranges from 1 to 100, with the present rating falling barely from 37 the day past.

Bitcoin’s Dominance Continues Regardless of Rising Altcoin Curiosity

The Altcoin Season Index rose over the previous month, prompting elevated curiosity in altcoins regardless of Bitcoin sustaining its dominance. Historic information reveals that the index peaked at 32 per week in the past and 34 a month in the past.

Learn additionally: Altcoin Season Index Retreats, Signaling Bitcoin’s Rising Dominance

Nevertheless, it’s a far cry from the April 2024 excessive of fifty with the yearly low of 13 in September. Whereas the index stays beneath the edge for Altcoin Season, the current upward development hints at a possible shift in investor sentiment.

Market Actions and Altcoin Season Predictions

The 90-day chart of the Altcoin Season Index exhibits a correlation between altcoin market capitalization and the index. Though fluctuations within the altcoin market cap have been restricted, there are indicators of strengthening. The upward momentum within the index signifies a potential shift towards elevated curiosity in altcoins, although it has but to enter Altcoin Season territory.

Bitcoin’s value surge previous $90,000 has been a central focus out there, sustaining its dominant place. Nevertheless, rising exercise in key altcoins, corresponding to Ethereum, and the rising recognition of meme cash sign that altcoins are gaining consideration.

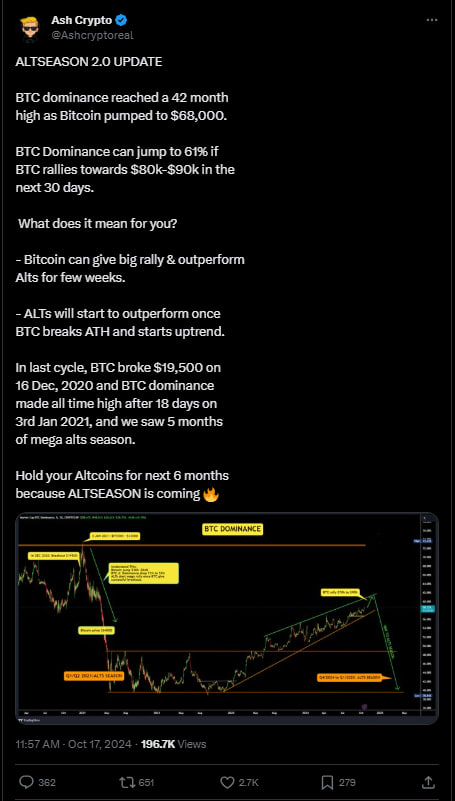

Historic patterns counsel {that a} decline in Bitcoin dominance usually precedes an altcoin rally. Ash Crypto, a market analyst, predicts that Altcoin Season might emerge inside six months based mostly on Bitcoin’s reducing dominance and the next rise in Ethereum resulting in this shift.

Disclaimer: The data introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any form. Coin Version is just not chargeable for any losses incurred because of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.