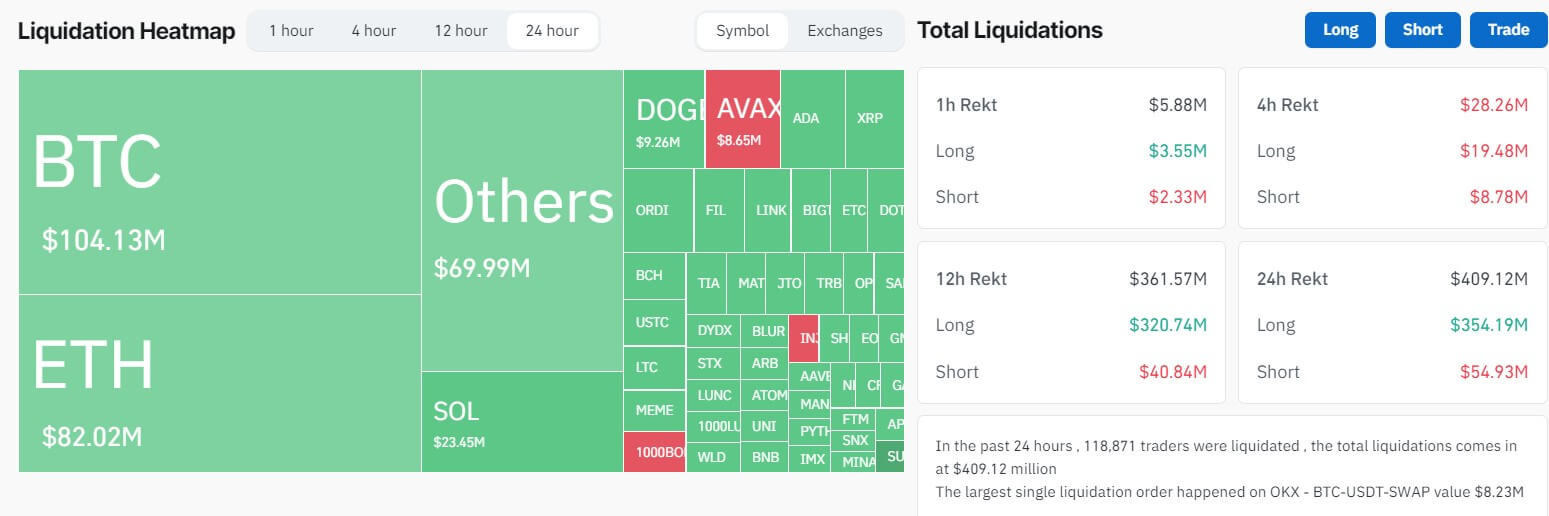

Almost 120,000 crypto merchants misplaced greater than $400 million previously 24 hours as digital asset costs plummeted in the course of the opening of Asia buying and selling hours on Dec. 11.

Coinglass knowledge signifies that roughly $356 million of those liquidations had been attributed to lengthy positions, marking essentially the most intensive single-day loss pushed by lengthy hypothesis within the final 4 months. Moreover, brief merchants confronted losses totaling $54.79 million.

Bitcoin merchants bore the brunt of those losses, accounting for about $104 million in whole liquidations. Lengthy positions in BTC contributed $90.9 million to this determine, whereas shorts accounted for $12.12 million.

Ethereum traders additionally confronted appreciable losses, with round $74.62 million liquidated in lengthy positions alongside $6.52 million from brief positions.

Different cryptocurrencies resembling Solana, XRP, Dogecoin, Avalanche, Cardano, and Litecoin noticed notable losses for merchants holding lengthy positions throughout this era.

Amongst exchanges, OKX and Binance witnessed essentially the most vital losses, tallying liquidations exceeding $171 million and $128 million, respectively. Notably, essentially the most substantial particular person loss recorded was an $8.2 million lengthy guess on Bitcoin’s worth on the OKX change.

Crypto market takes a breather.

Bitcoin, the biggest cryptocurrency by market capitalization, tumbled round 5% to a low of $41,649 earlier than recovering to its present worth of $42,155 as of press time, based on StarCrypto’s knowledge.

BTC’s fall ignited the value declines in different main cryptocurrencies like Ethereum, which slid by virtually 5%, adopted by different large-cap cryptocurrencies resembling Solana, XRP, Binance-backed BNB, and Cardano, enduring a few of their most appreciable losses in current weeks.

The worldwide crypto market capitalization fell by round 4% to $1.57 trillion.

The current drop comes after a three-month surge fueled by optimism concerning the potential approval of a Bitcoin Alternate-Traded Fund (ETF) in the US.

Though the approval hasn’t materialized but, consultants level to ongoing communications between the U.S. Securities and Alternate Fee (SEC) and the candidates as a constructive signal, hinting that the regulator may lastly give the inexperienced gentle to those funding merchandise.