- Binance leads with 40% Bitcoin reserve share amid rising belief and market demand.

- Bitcoin nears $100K, boosting institutional adoption and Binance’s market management.

- Regulatory scrutiny fails to sluggish Binance’s progress as crypto adoption accelerates.

The crypto market has seen a shift in energy, with Binance rising as a dominant participant within the world trade community.

Regardless of challenges like regulatory scrutiny and market volatility, Binance has solidified its place, capturing an rising share of the Bitcoin reserve market amongst Proof-of-Reserve (PoR) exchanges.

Binance’s Bitcoin Reserve Market Share Grows Since 2017

Information from CryptoQuant founder Ki Younger Ju highlights Binance’s progress from mid-2017 to late 2024. Beginning with a small share in 2017, Binance expanded quickly, reaching about 10% of the market share by early 2018.

After a decline section from 2018 to 2020, the trade started to extend its dominance in 2021, coinciding with a surge in world crypto-asset adoption.

From mid-2021 onward, Binance’s market share steadily climbed, surpassing 40% in 2024. This progress displays its skill to draw customers by broad liquidity, an increasing person base, and aggressive companies.

Binance’s rise additionally occurred throughout intense market competitors and heightened demand for clear reserve administration.

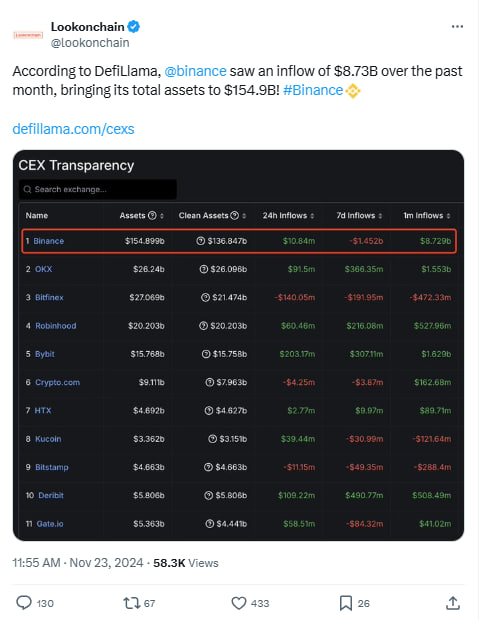

Binance Information $8.73 Billion Asset Inflows in 2024

In November 2024, Binance recorded an asset influx of $8.73 billion, elevating its complete holdings to $154.9 billion. Amid financial uncertainties, customers are shifting towards platforms that provide dependable options, with Binance reportedly attracting customers with companies like staking, crypto loans, and institutional asset administration.

Learn additionally: Bitcoin Surges, CZ is Launched, and Binance is Raking it in!

The corporate attributes its progress to a various product lineup tailor-made to crypto buyers’ wants. Regardless of dealing with regulatory scrutiny, Binance stays a number one selection for managing digital belongings.

In the meantime, analysts stay optimistic about Bitcoin’s efficiency, believing that Bitcoin might attain $500,000. This upward outlook has gained momentum from rising institutional adoption and Bitcoin’s popularity as a scarce asset in excessive demand.

As of press time, Bitcoin (BTC) was priced at $97,808.07, with a buying and selling quantity of $58.52 billion. Whereas its worth has dropped 0.47% prior to now 24 hours, it reveals a 7.93% enhance over the previous week, reflecting continued investor curiosity.

Disclaimer: The data offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version isn’t accountable for any losses incurred because of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.