- Changpeng Zhao stepped down as Binance CEO, pleading responsible to breaching anti-money laundering legal guidelines.

- Binance noticed a liquidity disaster and a serious outflow of property following Zhao’s transfer.

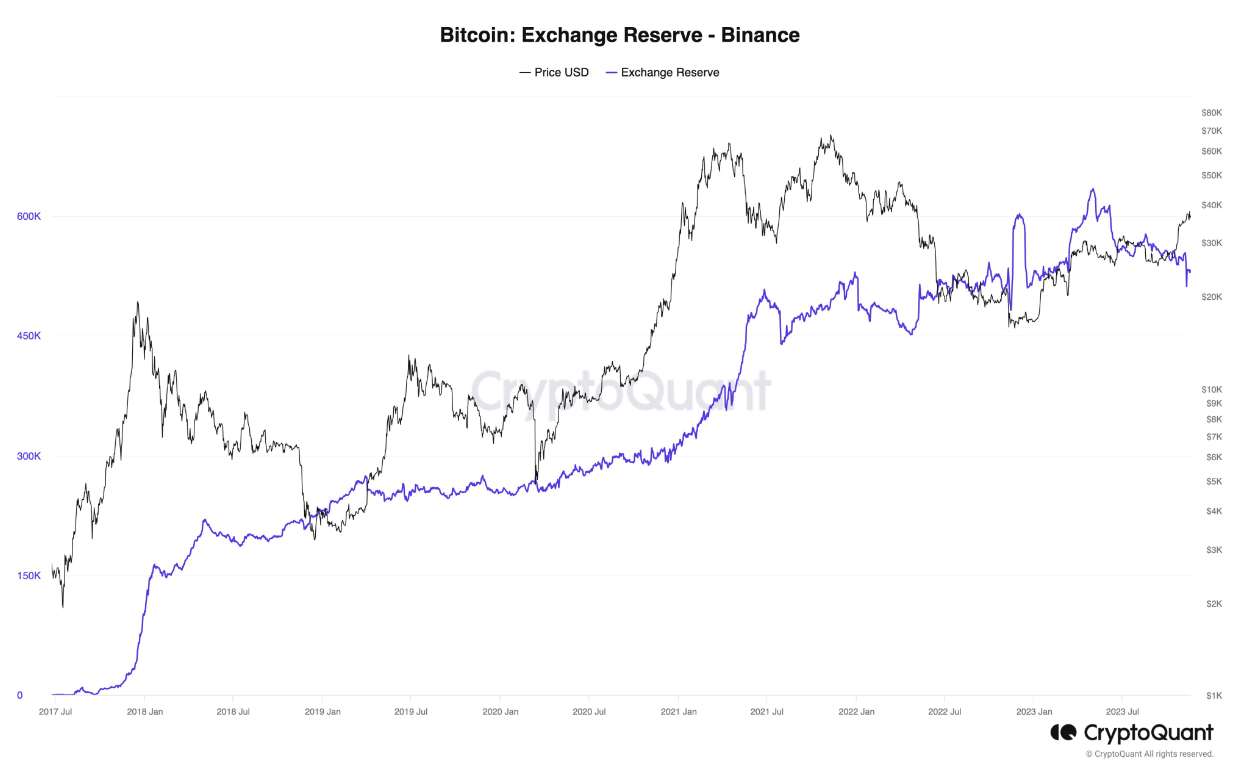

- Regardless of these challenges, Binance leads as non-US customers are much less concerned within the asset outflow.

Binance continues to linger on the forefront of the blockchain trade regardless of the continued regulatory pressures and Changpeng Zhao’s resignation. In accordance with a latest CryptoQuant report, non-US customers of Binance are much less more likely to withdraw their holdings on the platform.

Over the previous few months, Binance and its CEO, Changpeng Zhao, have been sued by the US Securities and Trade Fee (SEC), alleging that the platform breached federal securities legal guidelines. In a lawsuit filed by the SEC in June 2023, Binance was accused of working unregistered exchanges, broker-dealers, and clearing companies. As well as, the regulators accused Zhao of “misrepresenting buying and selling controls and oversight on the Binance US platform,” together with facilitating the unregistered sale of securities.

In a latest flip of occasions, Zhao declared his departure from the agency, pleading responsible to breaching the anti-money laundering legal guidelines as a part of a $4.3 billion settlement. Subsequently, Binance might be led by the previous World Head of Regional Markets, Richard Teng, who will take cost as the brand new CEO of the platform.

Whereas Zhao admitted his errors by way of an X (previously Twitter) thread, he additionally agreed with the court docket to pay $50 million from his private holdings. Lawyer Common Merrick B. Garland shared his feedback on the matter, asserting,

Binance grew to become the world’s largest cryptocurrency trade partially due to the crimes it dedicated; now it’s paying one of many largest company penalties in U.S. historical past.

Consequently, as per a Bloomberg report, Binance witnessed a considerable outflow of its native token, BNB, and different cryptocurrencies. AltTab Capital’s Co-Founder Greg Moritz, cited, “The market has responded negatively within the quick time period to the Binance information.”

Regardless of these prevailing dilemmas, Binance maintains its lead with rising trade reserves. When it comes to liquidity, Binance reveals resilience; as Kaiko analyst identified, “There was an preliminary response to the information the place liquidity dropped 40%, however prior to now hour, liquidity has proven indicators of returning to regular.”

Disclaimer: The data introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any type. Coin Version isn’t chargeable for any losses incurred because of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.