- BNB’s worth decreased following withdrawal points with Binance in Europe.

- The 9-day EMA crossed beneath the 20-day EMA, indicating rising downward strain.

- BNB’s subsequent goal might be round $205 if demand continues to wane.

Latest developments and market sentiment have created an environment of uncertainty round Binance Coin (BNB), with mistrust for the alternate Binance, being the probably cause. Currently, Binance has been topic to regulatory scrutiny. Moreover, a few of its abrupt selections have left traders questioning if the alternate continues to be as stable because it claimed.

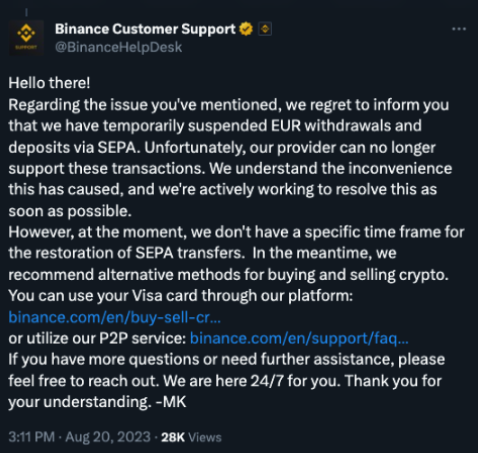

One subject that prompted the broader market to query Binance’s transparency was its choice to restrict withdrawals in Europe. Binance, in a now-deleted put up on X (previously Twitter), disclosed that it had paused deposits and withdrawals in Europe.

No Demand for BNB But

Explaining the explanations for its choice, the alternate mentioned it was having points with its cost supplier. Though Binance has now mentioned deposits and transactions had been again on, BNB has been severely affected by the sooner communiqué.

In keeping with CoinMarketCap, BNB’s worth was $209.98. The coin reached this worth as a result of promoting strain ensured that it misplaced 12.31% of its worth within the final seven days. From the 4-hour chart, BNB’s market construction has been bearish since August 14.

Additionally, the Exponential Transferring Common (EMA) revealed that BNB will not be far off from hitting $200. On the time of writing, the 9-day EMA (blue) was beneath the 20-day EMA (yellow). Every time the 20 EMA crosses above the 9 EMA, it means the worth motion is bearish.

So, if any type of market demand doesn’t seem for BNB, the worth might drop slowly from $205 to in all probability $195. Nevertheless, the Transferring Common Convergence Divergence (MACD) was 0.1. A optimistic MACD implies rising upward momentum.

However each the blue dynamic line of the MACD and the orange line had been beneath the zero mid-point. Mainly, it is a promote sign, and merchants might revenue from opening BNB brief positions.

Bears’ Season to Thrive?

Curiously, info from the derivatives portal Coinglass confirmed that BNB’s funding charge had dropped into the unfavorable space. Funding charges are funds made to both lengthy or brief merchants primarily based on the distinction between spot and perpetual costs.

When the funding charge is optimistic, it implies that longs are keen to pay shorts, and merchants’ sentiment is essentially bullish. However in BNB’s case, the unfavorable funding charge means that merchants are bearish on the BNB worth motion.

In conclusion, BNB hovering precariously across the $209 mark might not final lengthy. If the FUD round Binance continues, and promoting strain intensifies, BNB might drop beneath $200.

Disclaimer: The views, opinions, and knowledge shared on this worth prediction are revealed in good religion. Readers should do their analysis and due diligence. Any motion taken by the reader is strictly at their very own threat. Coin Version and its associates won’t be accountable for direct or oblique injury or loss.