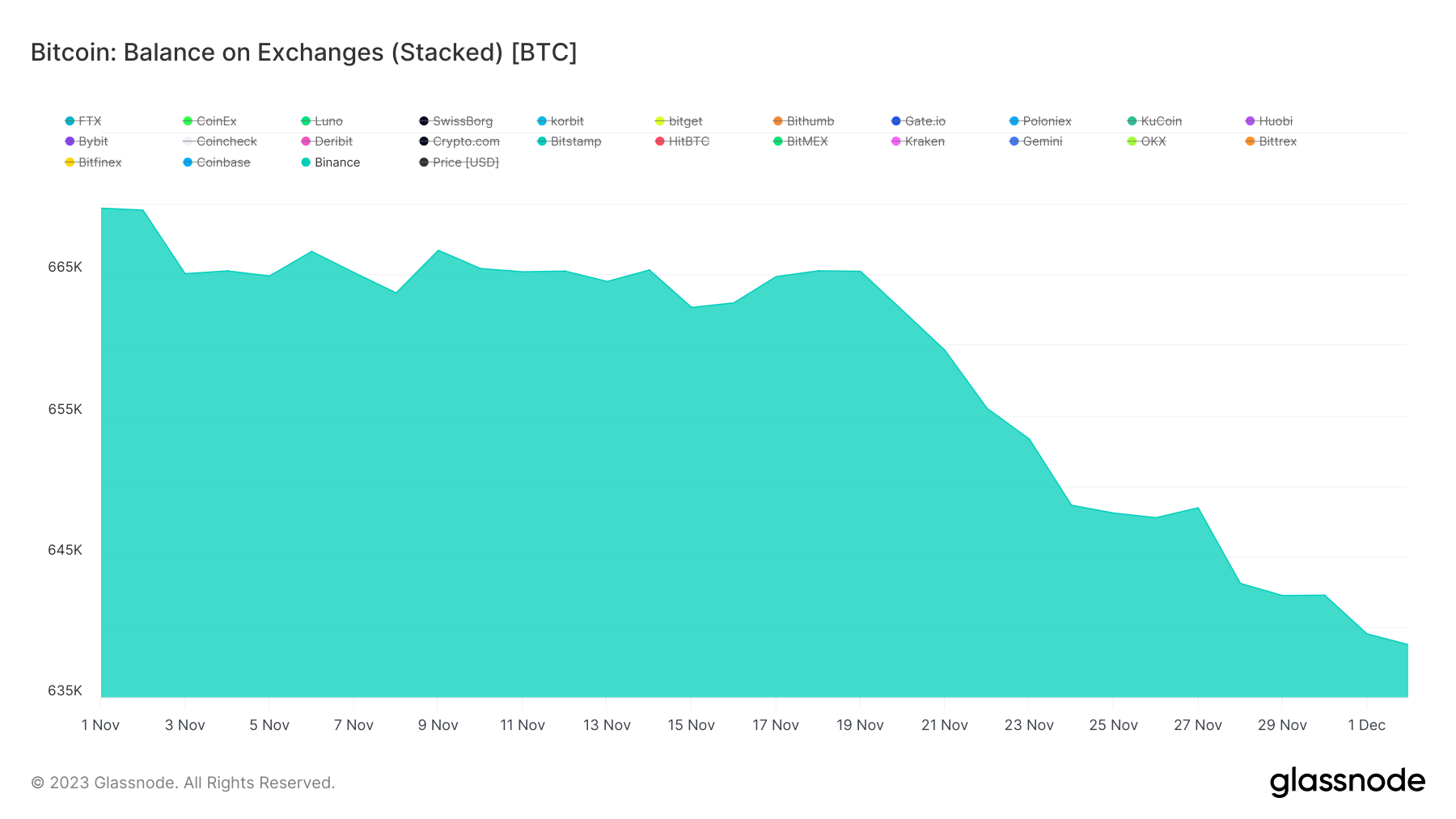

In accordance with its newest proof of reserves report, Binance skilled a major decline in its Bitcoin stability in November, dropping by over 23,000 BTC, or roughly 4%, coinciding with the alternate’s regulatory points with U.S. authorities.

In accordance with information from Binance’s web site, the entire BTC stability of its clients was 584,659 BTC firstly of November. Nonetheless, the stability had decreased to 561,003 BTC by the beginning of December. This means a considerable withdrawal of belongings from the platform in the course of the regulatory challenges it confronted.

A StarCrypto Perception evaluation highlighted a definite development amongst Binance customers throughout this era. The platform witnessed important BTC outflows from bigger holders, whereas incoming funds primarily originated from retail customers.

Supporting this remark, DeFillama’s information dashboard revealed that Binance encountered outflows surpassing $2 billion between Nov. 1 and Dec. 1.

This decline in Binance’s Bitcoin holdings occurred because the platform resolved to a settlement exceeding $4 billion with the U.S. authorities on points referring to a number of violations of a number of monetary legal guidelines. Moreover, the alternate’s founder, Changpeng ‘CZ’ Zhao, stepped down as CEO after pleading responsible to expenses associated to cash laundering.

Different asset balances

Binance’s web site additional exhibits that the platform balances on different main cryptocurrencies additionally recorded declines in the course of the interval.

For context, Ethereum holdings for Binance customers dropped by roughly 0.67%, transferring from 3.91 million to three.88 million as customers withdrew their belongings.

Related developments had been noticed in balances for different belongings similar to XRP, Litecoin, USDC, and Binance’s native BNB token.

In distinction, Binance noticed a greater than 5% surge within the stability of Tether’s USDT, reaching $15.2 billion. This improve coincided with over 860 million items of the stablecoin being despatched to the platform by customers throughout the identical interval.

Some analysts imagine that the upsurge in USDT’s stability on Binance is linked to the stablecoin’s rising market provide. As Binance maintains its place because the main cryptocurrency alternate by buying and selling quantity, crypto merchants more and more deposit their USDT on the platform for buying and selling functions.

Regardless of regulatory considerations, information on Binance’s web site signifies that the alternate’s belongings stay absolutely backed.