- Binance’s spot quantity market share amongst centralized exchanges dropped 18% this yr.

- The drop got here after the CFTC and SEC stepped up regulatory actions towards the change.

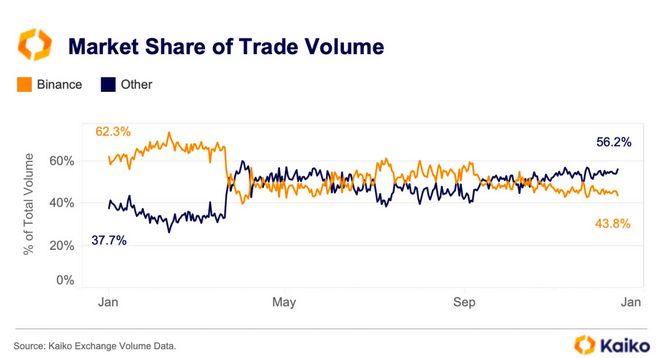

- Binance’s market share now stands at 43.8%, down from a peak of 62.3% in January.

The world’s largest cryptocurrency change, Binance, noticed its spot quantity market share amongst centralized exchanges decline considerably this yr, as per Kaiko Analysis report particulars. The decline got here following the change’s authorized troubles in the US.

The U.S. Commodity Futures Buying and selling Fee (CFTC) and the Securities and Change Fee (SEC) stepped up regulatory actions towards the change. Whereas the CFTC accused the change of making an attempt to maneuver Binance.US clients to its international platform, the SEC made comparable allegations alongside wash buying and selling accusations.

The FUD that adopted the allegations and the regulatory actions led to buyers shifting their belongings away from the change, on condition that the FTX collapse was nonetheless freshly ingrained. Kaiko wrote,

These costs did severe injury to Binance.US, inflicting huge outflows of liquidity and dropping its market share to almost 0.

Earlier than that, Kaiko famous that Binance’s spot quantity market share already dropped by 50% in March. The drop on the time got here after the change ended its buying and selling promotions and a number of other zero-fee pairs. At the beginning of the yr, the change held near 70% of the spot quantity market share amongst centralized exchanges.

Regardless of these authorized challenges, Kaiko famous that Binance has seen some restoration. Particularly, the change’s $4.3 billion advantageous settlement with the Division of Justice (DOJ) for violating anti-money laundering guidelines is handled by markets as bullish.

Moreover, the change’s cross to proceed working in the US can also be seen as a optimistic growth. At current, Binance’s share stands at 43.8%, towards 56.2% held by different centralized exchanges.

Going by the information, different centralized exchanges grew from 37.7% initially of the yr to the present determine of 56.2%. Moreover, the chart reveals that the takeover got here round September when authorized warmth towards Binance was rising. In the meantime, the SEC’s motion towards Binance.US, Binance, and former CEO Changpeng Zhao continues to be ongoing. As well as, Changpeng Zhao, who pleaded responsible to cash laundering violations in November, has his trial set for subsequent yr and will withstand 10 years in jail.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version isn’t answerable for any losses incurred because of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.