Crypto alternate Binance introduced discontinuing buying and selling and subscription companies for its leveraged token choices, together with Bitcoin, Ethereum, and its BNB Coin, efficient Feb. 28.

In keeping with the Feb. 19 assertion, the alternate will delist these tokens and halt redemption by April 3. The affected leveraged tokens are BTCUP and BTCDOWN, ETHUP and ETHDOWN, and BNBUP and BNBDOWN.

Customers are urged to commerce their tokens earlier than the Feb. 28 deadline. Afterward, tokens can nonetheless be redeemed by way of the pockets operate or on its web site. These property can be mechanically transformed into USDT after the delisting interval.

Binance Leveraged Tokens are by-product merchandise representing a basket of perpetual contract positions that give customers leveraged publicity to the underlying asset. Like different tokens, these property may be traded by way of the spot market.

Thus, they permit the alternate customers to take part in by-product buying and selling with out tweaking their buying and selling methods. Nevertheless, these property additionally carry some inherent dangers.

Although Binance didn’t specify the rationale for discontinuing these companies, it acknowledged that it was targeted on delivering optimum worth to clients and sustaining competitiveness.

Binance silent resurgence continues

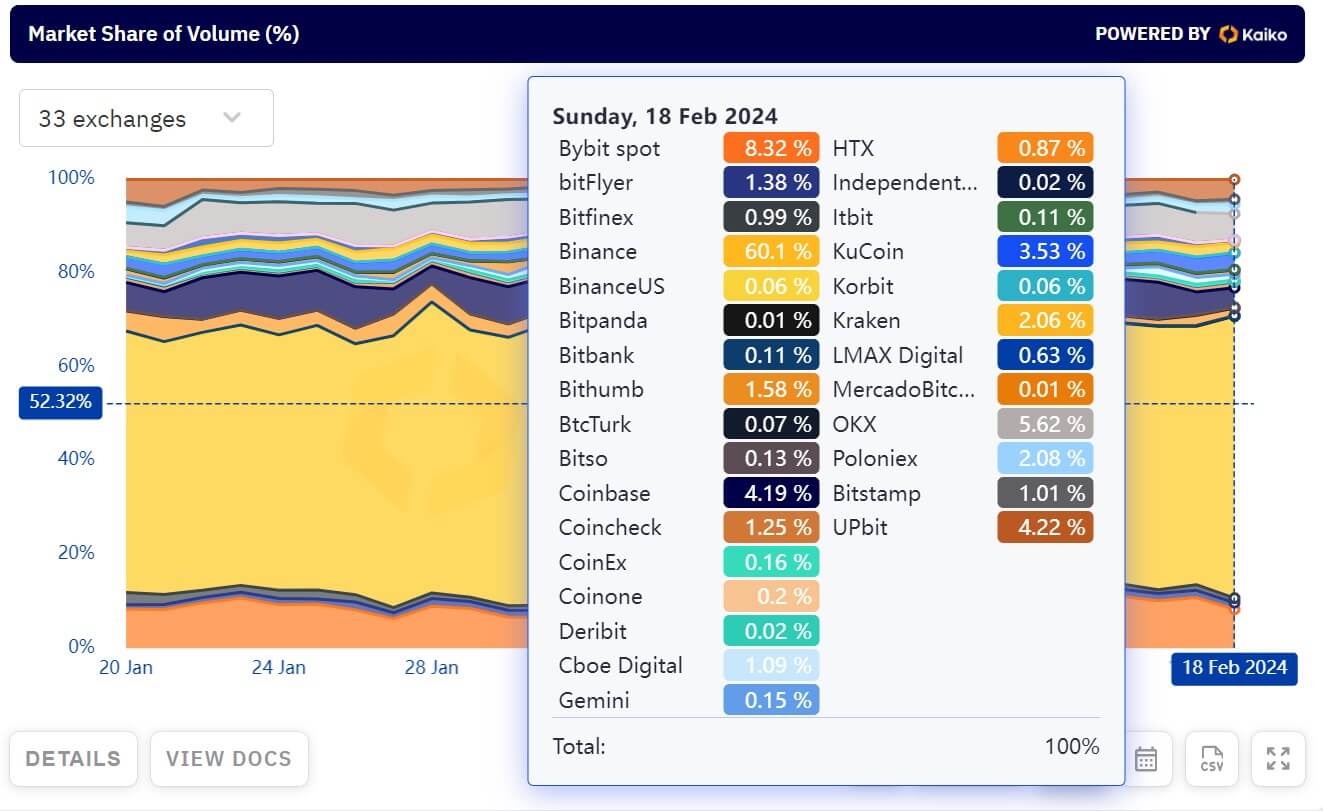

Additional, Binance’s market share is quietly rebounding to earlier peaks following regulatory challenges that affected its operations final yr.

The platform exited, or partially exited, a number of areas, together with Canada, the UK, and varied European international locations like Austria, Cyprus, and the Netherlands, as a consequence of these regulatory issues. Moreover, it settled with US authorities for $4.3 billion, inflicting its market share to drop to 44.5% by the top of the yr.

Nevertheless, Kaiko knowledge present that its numbers are bettering, with the alternate controlling greater than 60% of the market share quantity as of Feb. 18. Earlier within the month, StarCrypto Perception identified that the agency had overtaken CME because the main alternate by way of Bitcoin futures open curiosity.