Binance’s regulatory challenges in numerous jurisdictions in June seem to have resulted in a major decline in customers’ crypto belongings.

Binance customers withdraw belongings.

The trade’s newest proof of reserve snapshot, taken on July 1, confirmed that customers’ Bitcoin deposits fell by 3.5% to 592,450 BTC from 614.800 recorded on June 1. This meant that the platform customers withdrew round 22,000 BTC from the platform through the interval.

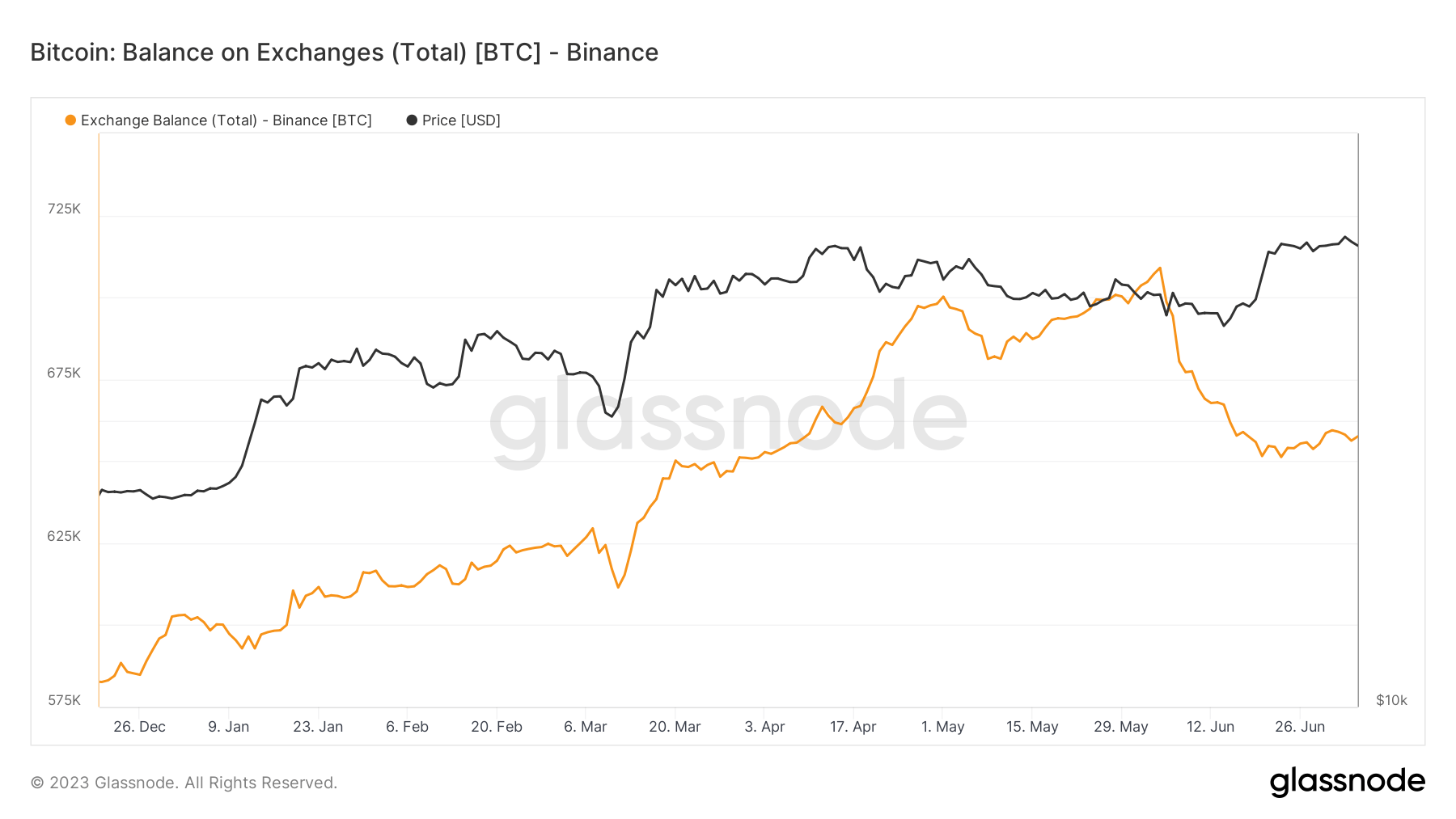

Knowledge from Glassnode corroborates that Binance’s BTC trade considerably decreased. Per the information aggregator, Binance’s BTC trade steadiness declined from a peak of 709,001 BTC on June 4 to as little as 651,275 BTC on June 23 earlier than rising to its present steadiness of 657,536 BTC as of July 6.

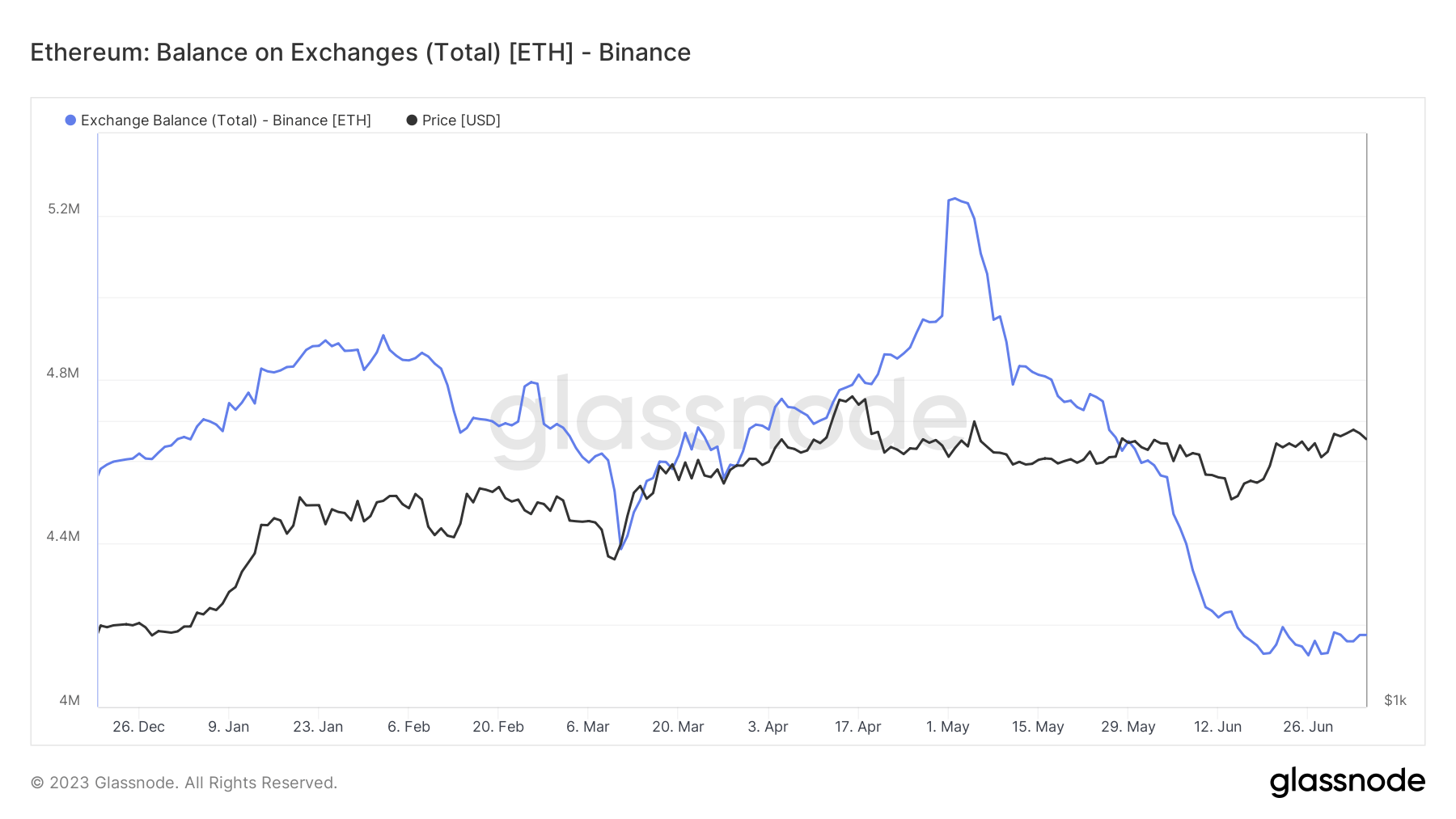

The trade customers’ Ethereum deposits declined by 4.4% to 4.16 million ETH as of July 1 from the 4.35 million ETH held for customers on June 1. This implies the trade customers withdrew almost 200,000 ETH from the platform over 30 days.

In the meantime, Glassnode knowledge reveals that Binance’s ETH steadiness has been on a downward pattern for the reason that starting of Could, coinciding with a interval when the entire variety of ETH held throughout all exchanges fell to a five-year low.

One other main crypto asset that noticed its deposits fall over the previous month is Tether’s USDT. The stablecoin steadiness on Binance declined by 1.61 billion to fifteen.47 billion, representing a 9.45% lower.

In the meantime, Binance’s BNB steadiness bucked the deposits decline pattern, rising by 6.6% to 29.7 million BNB as of July 1. Different belongings that recorded elevated deposits included Ripple’s XRP, USD Coin (USDC), and others.

Binance regulatory points

In June, Binance confronted vital regulatory hurdles in a number of jurisdictions. The U.S., numerous European nations, and Nigeria elevated their scrutiny of the trade’s actions.

The U.S. Securities and Alternate Fee (SEC) alleged that Binance violated federal securities legislation with its operation, including that the trade provided crypto securities tokens to People.

Whereas Binance has pledged to contest these allegations, CEO Changpeng ‘CZ’ Zhao has characterised the lawsuit as greater than a company authorized battle – he sees it as an assault on the broader crypto business.

The trade misplaced its Euro fee associate in Europe and exited a number of regional markets, together with Austria, the Netherlands, Cyprus, and Germany. Throughout these exits, French authorities raided the trade workplace in France, and a stop and desist order was issued towards it in Belgium.

Regardless of these points, a Binance spokesperson instructed StarCrypto that the agency’s focus was guaranteeing compliance with Europe’s forthcoming Markets in Crypto Property (MiCA) laws.