Binance has cited lowered liquidity in Australian Greenback (AUD) pairs because the trigger for buying and selling reductions of Bitcoin (BTC) and different digital belongings on its Australian platform, in response to an emailed assertion to StarCrypto.

The change added:

“We shall be delisting [the] remaining AUD pairs according to the closure of fiat off-ramp providers. We stay centered on securing extra fiat relationships to service our customers.”

Bitcoin, others commerce at a reduction

In the meantime, a number of Australian crypto merchants have recognized the large arbitrage alternatives obtainable from the low cost.

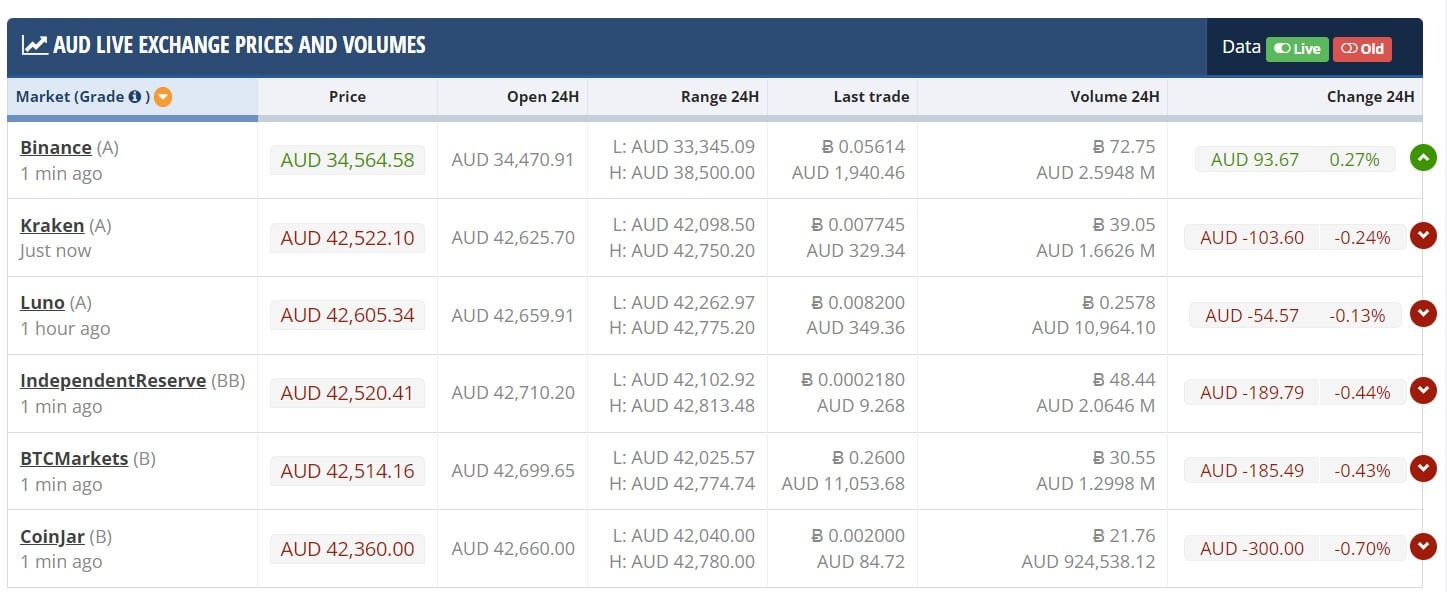

Knowledge from CryptoComapre exhibits that the flagship digital asset was buying and selling at AUD $34,250 (USD $22,345) on Binance Australia as of press time. That is considerably decrease than what it’s buying and selling on different exchanges like IndependentReserve, Luno, and Kraken, exchanging palms for over AUD $42,000 (USD $27,401).

The low cost can also be evident on different digital belongings like Ethereum (ETH). Ether is buying and selling at AUD $2,375 on Binance Australia, whereas it’s over AUD $2,900 on rival exchanges, in response to CryptoCompare information.

Binance Australia’s banking woes

On Could 18, Binance Australia stated it may not course of Australian Greenback (AUD) deposits for customers as a result of its third-party cost service supplier Cuscal stopped offering its providers to the agency. On the identical day, Australia’s oldest financial institution, Westpac, banned crypto transactions to unnamed exchanges.

In response to those points, Binance Australia began step by step limiting its customers from spot buying and selling actions with the AUD. On Could 26, the change introduced it could cease Bitcoin spot buying and selling actions with the fiat foreign money on June 1.

In the meantime, the change has maintained that customers can proceed buying and selling the affected belongings on different buying and selling pairs inside its platform.

The publish Binance Australia blames AUD liquidity drop for Bitcoin low cost appeared first on StarCrypto.